Visa (V) Unusual Cashtag Chatter Cashtag Mentions for the multinational […]

Visa (V) Earnings Deep Dive

Visa is one of the largest and most beloved brands globally -- slotting itself in the top 10 value list between Nvidia and Facebook -- that's a pretty nice place to be! The next peer on the list is Mastercard, coming in at #11.

For reference, brand value is calculated by multiplying the brand's financial value (that can be attributed to the brand specifically in question) by its ability to increase purchase volume and charge a premium for its products/services.

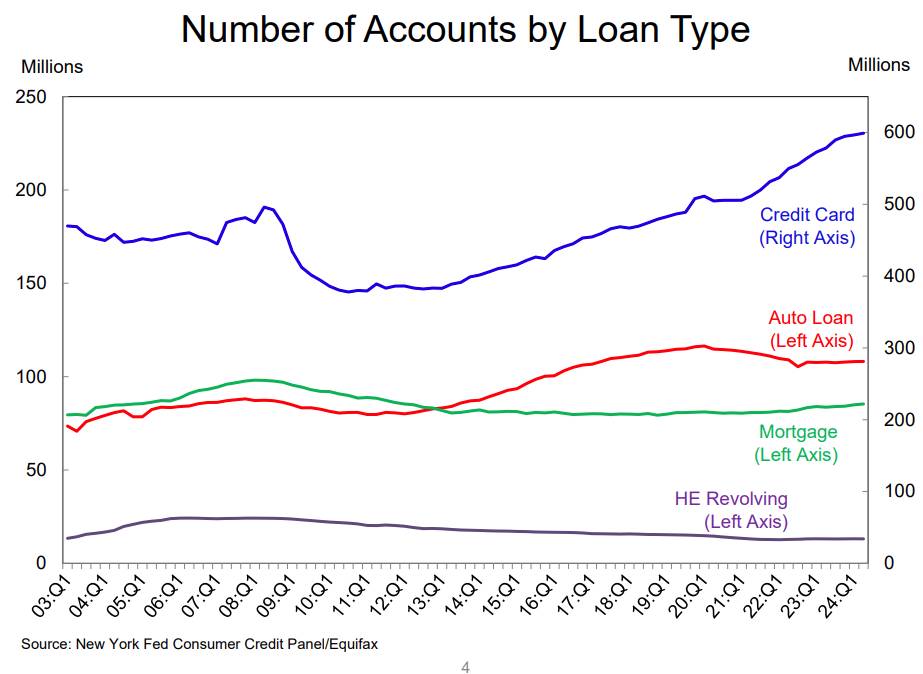

Credit card financing in the U.S. has surged over the past two years, with varying reasons driving consumers to rely on credit.

Inflation has forced many middle- and lower-income consumers to spend more reluctantly, while wealthier cardholders have enjoyed increased disposable income from rising real estate and stock portfolios. This combination has fueled greater credit card usage, prompting financial services brands to address a widening spectrum of client perspectives.

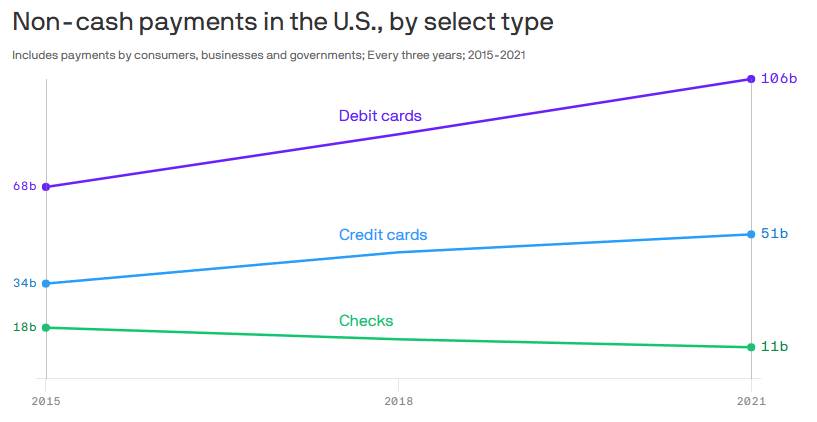

Visa, in particular has also carved a niche in another core payment market: debit.

Each year, Visa processes over 60% of the 100 billion debit card transactions in the U.S. This dominance allows it to charge a premium for those transactions -- contributing to its high brand value we talked about earlier -- and also a major contributor for its ongoing DOJ antitrust lawsuit.

Thanks to agreements that favor Visa with numerous banks, some merchants may pay a high "rack rate" if they don't route all or the majority of debit transactions to Visa. Essentially, if merchants do not comply with Visa's routing preferences, they incur higher transaction fees—similar to how a hotel rack rate is the full, non-discounted price for a room.

Complaints allege: "Visa charges over $7 billion in network fees on U.S. debit volume annually, earning Visa $5.6 billion in net revenue."

Earlier this month, a new class action lawsuit was filed from US merchants over Visa's payments network, that accuses Visa of paying potential rivals not to develop competitive networks.

Visa stocks appears to show no signs of investor fear, approaching all-time high levels ahead of its next report.

Here's what we're watching...

This section is restricted to LikeFolio Pro Members only.