Spotify (SPOT) purchase intent surging Spotify Purchase Intent was the […]

We’re Adding Chewy to our Nice List…will the Street do the same?

Chewy has been on our nice list for a while now. With a happiness rating of 81% positive (+4 points higher than last year), they are obviously doing something right. Just look at the holiday card one of our very own research analysts and dog-lover, Emily, just received from the pet supply retailer.

Adding to this high consumer happiness rating, data shows signs of customer retention, namely through Chewy’s subscription program Autoship.

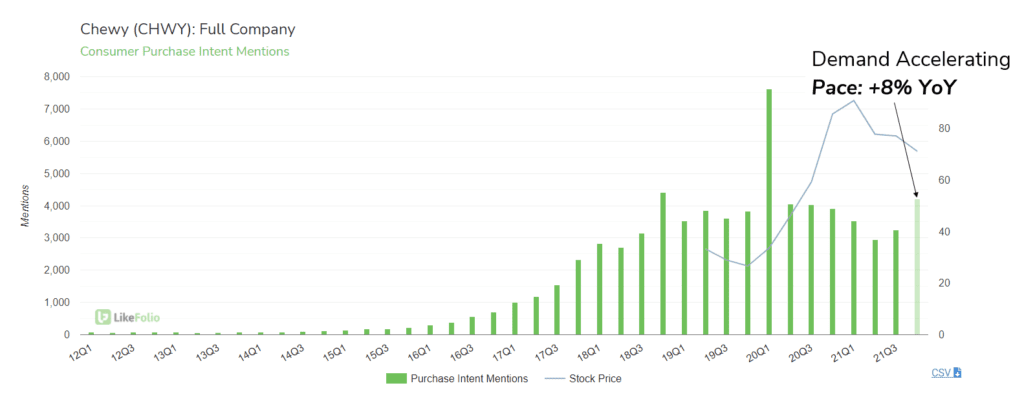

Consumer mentions of signing up for or using Chewy’s Autoship service have increased +54% on a YoY basis. Comprehensive demand (any mention from a consumer completing a purchase with Chewy) is also showing signs of acceleration. CHWY Purchase Intent Mentions are on pace to rise about +8% YoY in the current quarter, a positive sign for guidance.

At the end of the day, Chewy separates itself by how it treats its consumers – pets and their human owners, alike. The company has been physically sending condolences to customers that have lost their animals.

Chewy is setting the bar high. Really high. And so is the market. Chewy shares have shed nearly 20% in value in the last month as investors anticipate challenges mounting from reopened economies and supply chain disruptions. The company reports earnings on Dec. 9 after the bell.