Despite recent market volatility and some arguing for a bear […]

What To Know Ahead of Uber (UBER) Earnings

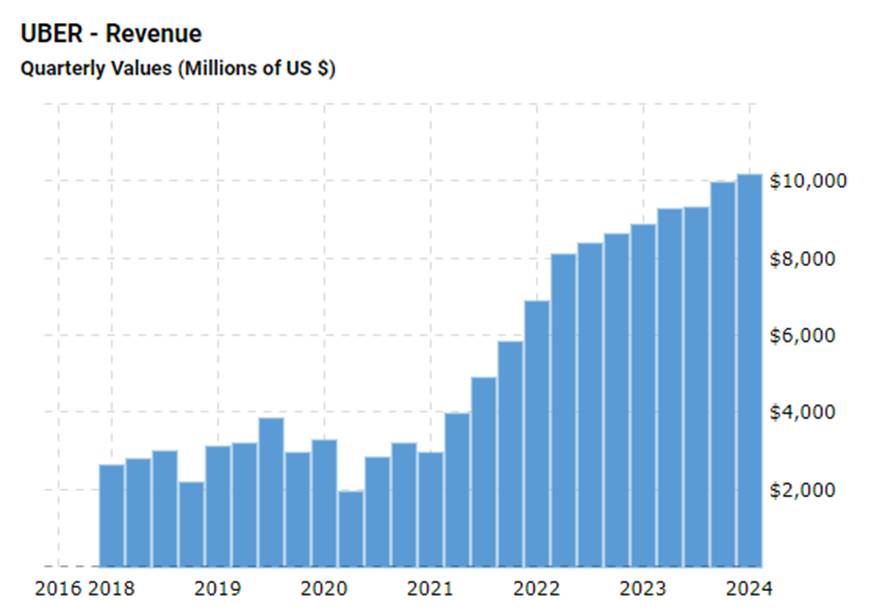

Uber (UBER) is set to release its second-quarter earnings early next month, with strong financial performance indicators both quarterly and annually. In the past quarter, Uber's revenue grew by 15% compared to the previous year’s first quarter, and the company has seen a year-over-year (YoY) revenue increase of 17%.

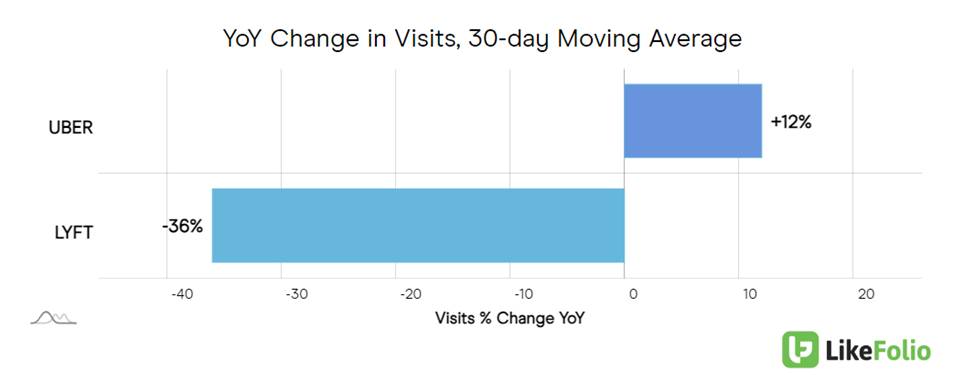

Web Traffic and User Engagement

Uber's web traffic has shown significant growth, particularly in the last quarter, according to LikeFolio data. In contrast, Lyft (LYFT), a primary competitor, has experienced a notable decline in web traffic.

Additionally, Uber's monthly active users have increased by 15% over the past year, reaching 149 million.

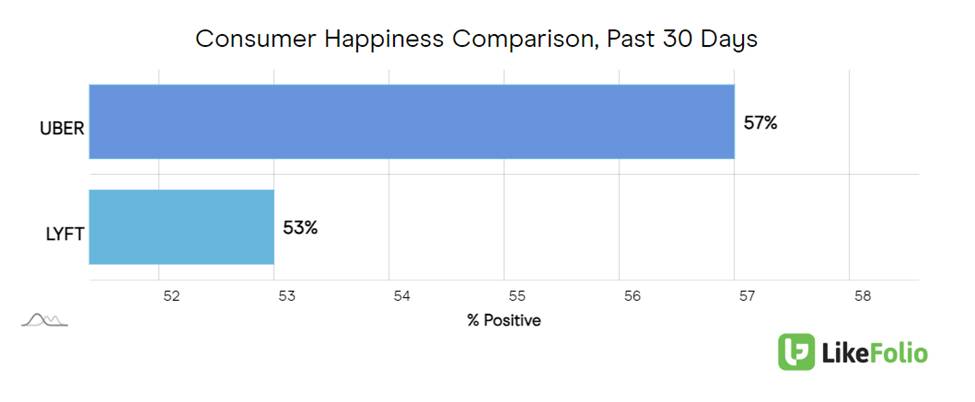

Customer Satisfaction and Market Interest

Uber continues to outperform Lyft in terms of customer happiness, with a satisfaction level of 57%, which is 4% higher than Lyft.

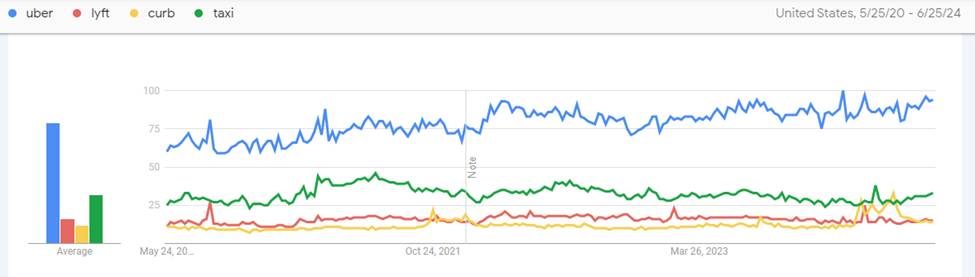

Google Trends data also indicates that Uber is more popular than its alternatives, including Lyft, Curb, and traditional taxi services. Uber's search interest has gradually increased compared to its competitors.

Autonomous Vehicles (AV) and Diversification

Uber is strategically positioned to manage risks associated with autonomous vehicles (AV). While Tesla (TSLA) and Waymo (GOOG) are key players in the AV space, Uber’s marketplace model could allow it to host AVs or potentially acquire its own fleet.

Rides have also decreased in how much of the overall company revenue they make up, from 70% to 56% over the past four years, reflecting UBER's expansion into other segments such as Uber Eats. Recent partnerships bolstering Uber's strategy include:

- A long-term partnership with Aurora (AUR) for driverless trucks.

- A collaboration with Bango to attract more customers through subscription bundles.

- A recent deal with grocer Save A Lot, adding 150 locations for Uber Eats access.

Regulatory Challenges

Despite its market dominance, Uber has faced regulatory scrutiny and criticism. Recent issues include accusations of blocking drivers to avoid minimum wage requirements in NYC and a lawsuit alleging racial bias in driver terminations, though the latter was dismissed.

Financial Outlook

The global rideshare market is projected to grow by 30% by 2028, positioning Uber as a strong competitor in this expanding market.

In the first quarter of 2024, Uber reported a net income loss of $654 million, primarily due to a decrease in the value of equity investments. However, this loss is considered a one-time event, and earnings per share (EPS) are expected to improve from -$0.32 to +$0.31.

Uber’s upcoming earnings report is anticipated with great interest, as the company continues to demonstrate robust growth and strategic positioning in a competitive and evolving market.