Despite recent market volatility and some arguing for a bear […]

Rideshare Recovery? Uber vs. Lyft

March 12, 2021

Rideshare Recovery? Uber vs. Lyft

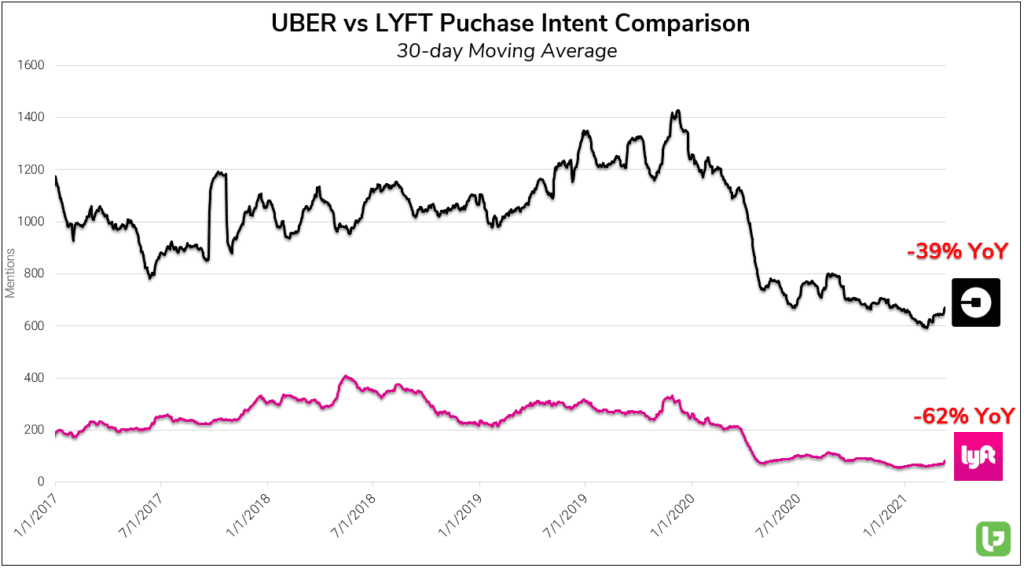

Throughout the past year we’ve seen a staggering decline in mentions for the rideshare companies, namely Uber (UBER) and (LYFT)… So, how are they doing now that the country is slowly starting to re-open?

- UBER has maintained higher demand volume, with a less pronounced slowdown: -39% YoY on the 30 day moving average.

- LYFT is struggling, with only 1/10th of Uber’s PI volume and average -62% YoY for the past 30 days.

The downtrend in mention volume seen in recent quarters has accurately reflected a significant slump in reported revenues for both companies. However, vaccine-fueled market optimism has both of these stocks up more than +150% from last March. UBER is still the clear candidate for a long-term re-opening bet, but we’re not rushing to short LYFT until things are truly “back to normal.”