Sprott is Squeezing the Uranium Market $URA, $SRUUF Over the […]

What’s happening with the Uranium Squeeze? ($SRUUF)

What’s happening with the Uranium Squeeze? ($SRUUF)

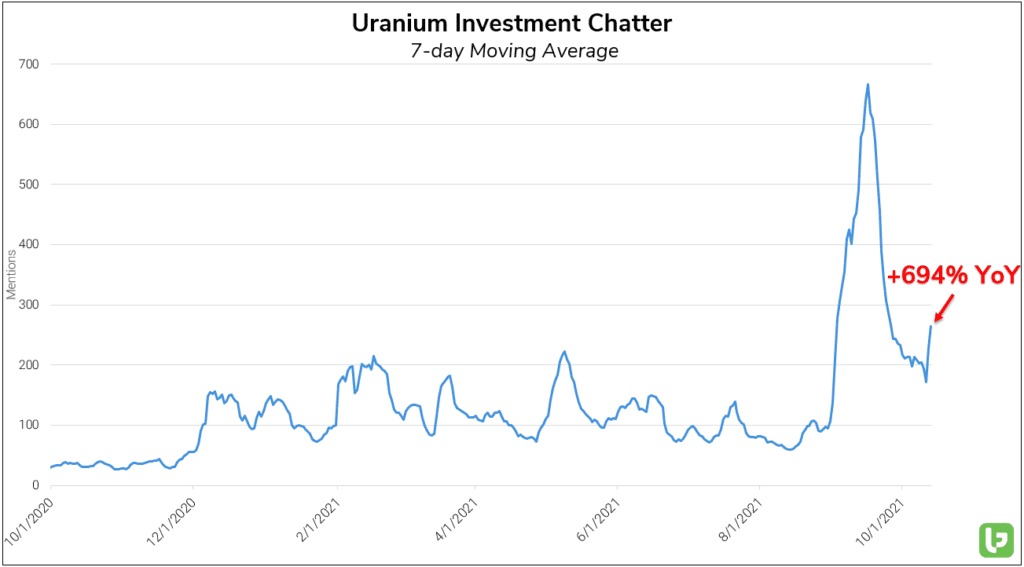

Last month, the Sprott Physical Uranium Trust ($SRUUF) made a huge splash in the Uranium market, with aggressive spot purchases driving a significant price increase in the underlying commodity. Our data showed that the promise of a squeeze in the uranium market attracted a swarm of new investors…Many abandoned the cause after a disappointing lull in the action, but not all of them. Uranium-specific Investment chatter (mentions of investing in uranium, uranium miners, and relevant ETFs) is surging again, currently up +694% YoY on a 7-day moving average.

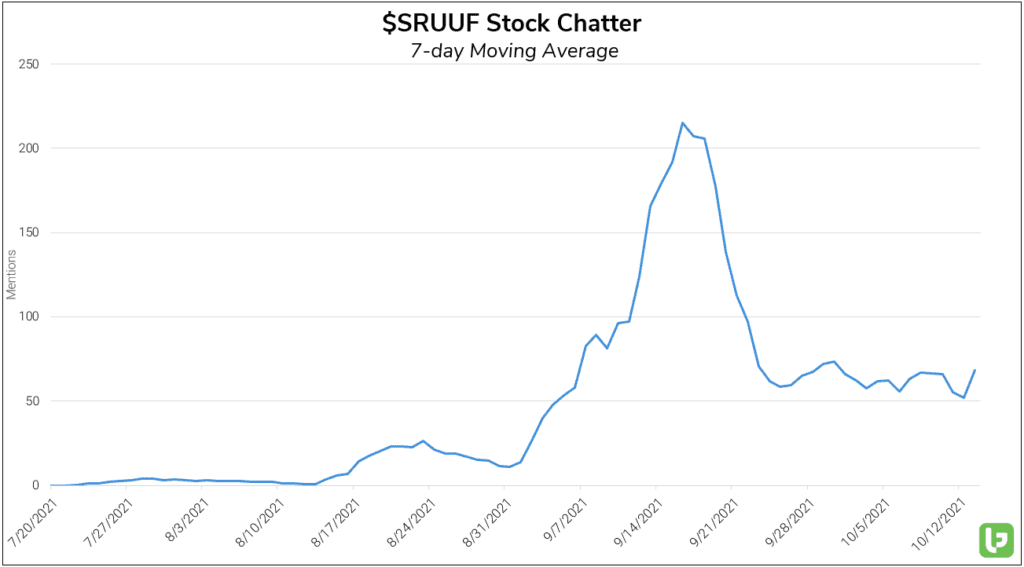

Sprott resumed buying last week, but underlying chatter for SRUUF has yet to show signs of a breakout on its 7-day MA trendline.

This could be due to the US OTC markets placing trading restrictions on the ticker. Regardless, elevated mentions confirm that “SPUT” has established a solid base of support amongst U.S. investors.

The "uranium squeeze" is alive and well, and investors are positioning themselves accordingly.