The company formerly known as Facebook (FB) shocked the world […]

Why META is up +400% since 2022

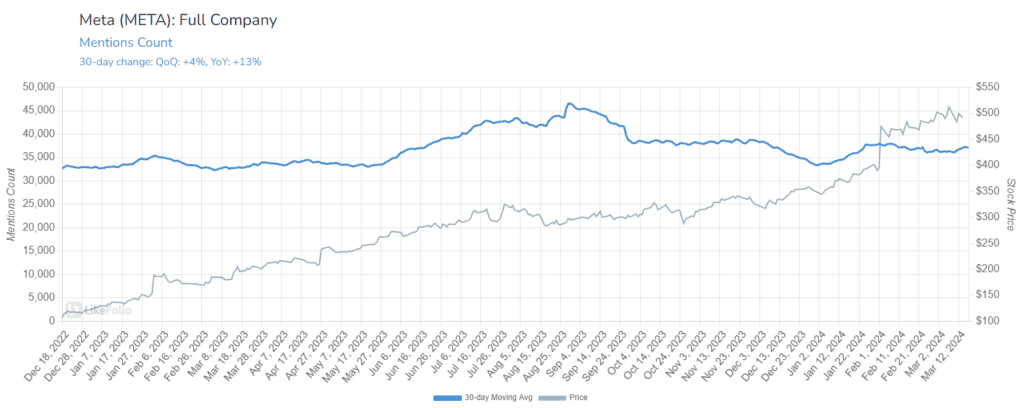

Shares of META have ridden a tech-resurgence wave higher from 2022 lows (+400%!), and are up nearly +40% YTD.

LikeFolio data corroborates these gains, and even paints a Bullish story from here.

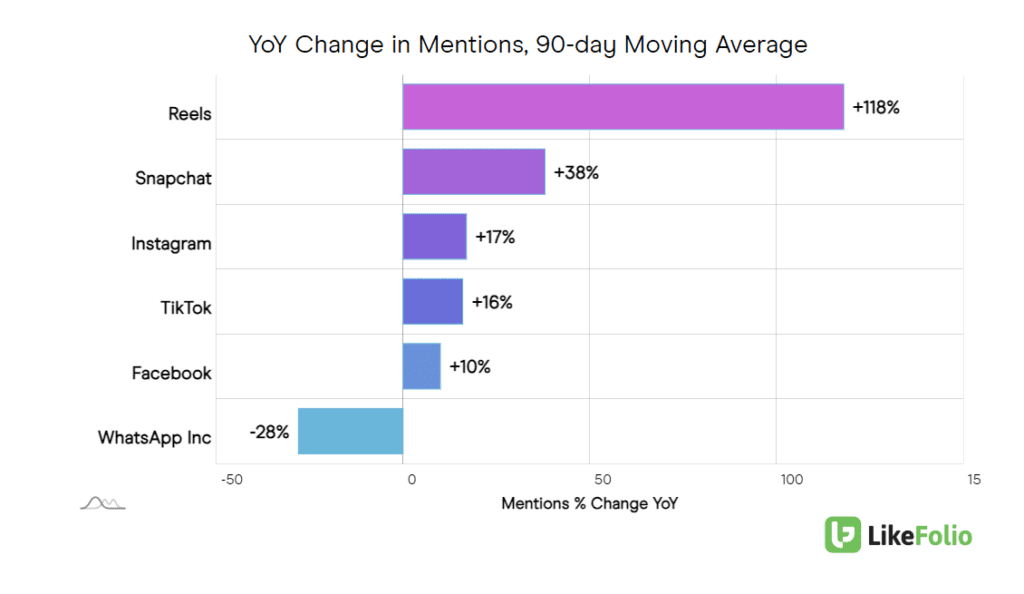

Mention buzz is accelerating, up +13% on a YoY basis. Much of this is being by consumer adoption of Reels, Meta's answer to TikTok.

Last week the U.S. House passed legislation that could lead to TikTok being sold or banned, addressing national security concerns over data privacy. However, a sale wouldn't completely solve data security issues, and the proposal faces significant challenges, including ownership and antitrust concerns.

TikTok might have lost that battle, but data suggests META is already winning the war for consumer eyeballs, regardless of TikTok's availability in the U.S.

Reels mentions are up by triple digits YoY, besting TikTok growth and continuing to chip away at market share.

If there's anything Meta is good at, it's copying app designs and pushing it through to its billions of users who are already on one of its social platforms – it had 3.07 billion monthly active users last quarter alone.

The battle for eyeballs is really a proxy for advertising spend.

Last quarter much of this spend came from overseas, with China-based advertisers like Temu and Shein accounting for 10% of sales as they try to break into the US market. META will benefit as the ad market at large recovers.

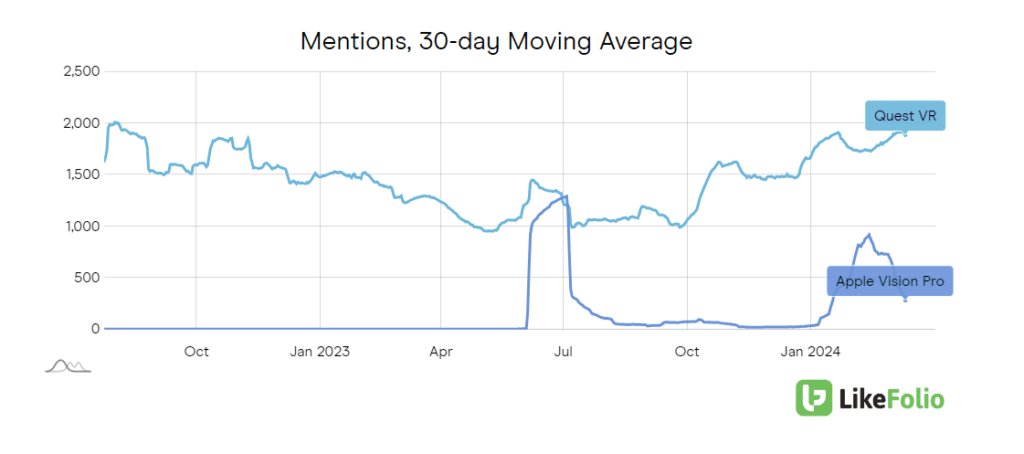

Aside from advertising, META may prove the near-term winner when it comes to AI headsets.

Though Apple's Vision Pro was impressive, the world wasn't quite ready for it...yet. You can see on the chart the drop of the Vision Pro actually served as a catalyst for META's Quest VR headset, which has wider immediate use cases/applications right now. Quest mentions are up +48% YoY after 2 years of decline.

Lastly, it looks like META has expenses under control.

The company laid off 22% of its workforce in 2023 and decreased its expenses by -8% in the fourth quarter. These moves, coupled with stronger ad spend more than doubled its operating margin.

Bottom line: META is finally proving competent at battling competition from giants like TikTok and even AAPL. If the company can continue make improvements on the AI front and rake in ad dollars, it likely still has gas in the tank.