DG & FIVE: The Past and the Future of Discount […]

Is Five Below set to follow DLTR lower?

Five Below* (and above, now) is like the love child of Dollar Tree and Target: a discount retailer specializing in brick-and-mortar discovery and affordable goods, increasingly loved by trendy consumers.

The market had a very different response to recent DLTR and TGT reports.

Target shares surged on operational improvements and recovering foot traffic.

Dollar Tree shares slumped on a weak holiday performance, hampered by difficulties in restocking stores to meet consumer demand, a faltering Family Dollar banner (it plans to close 970 locations), and shifts in consumers spending at large away from discretionary items to low-margin essentials.

So – is FIVE more like DLTR or TGT?

LikeFolio data says somewhere in between. Check it out:

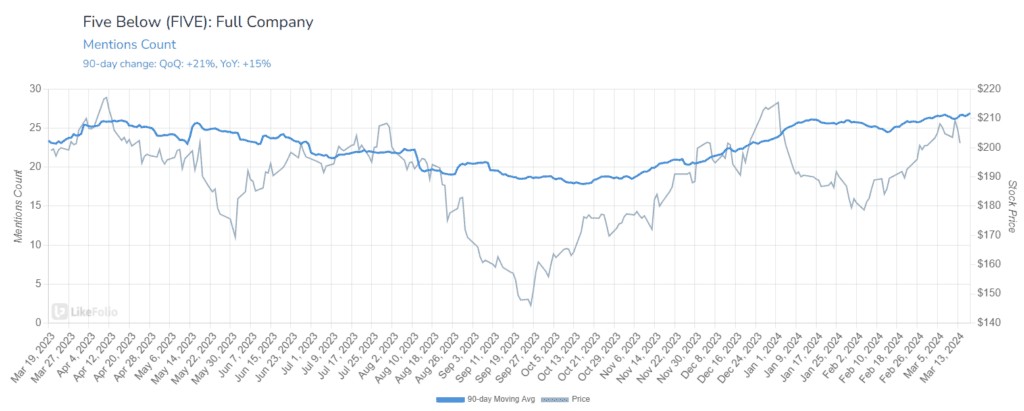

- Five Below mention buzz is building, up +15% YoY and rebounding from its 2023 low.

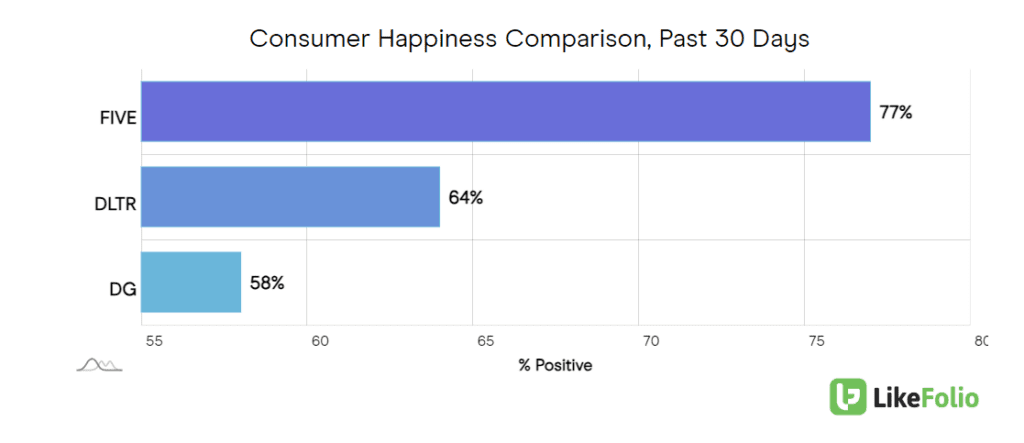

- Five Below has higher happiness -- and higher quality items -- vs. other discount retailers Dollar Tree and Dollar General. Sentiment sits at 77% positive, 13 points above its next closest peer.

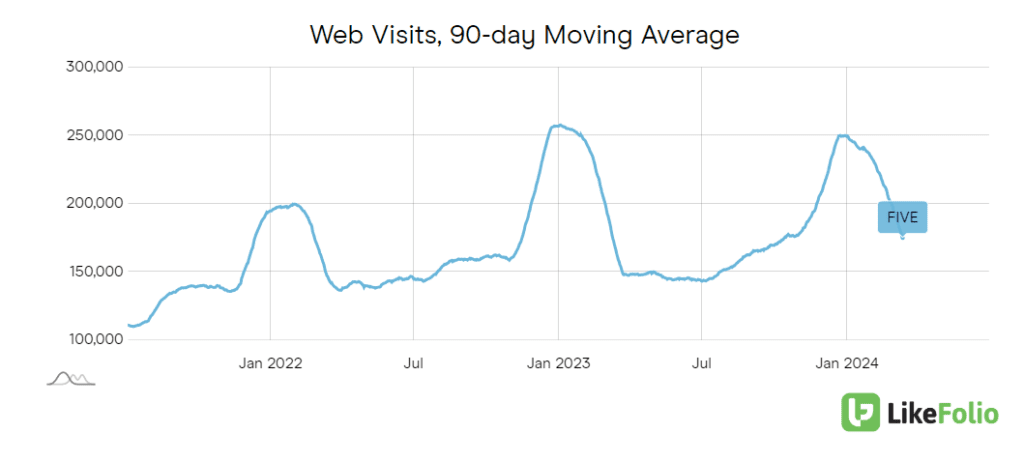

- Five Below is starting to leverage its eCommerce channel. Web visits are up +4% YoY on a 90-day Moving Average and +13% YoY on a 30-day Moving Average. But it still has a LOT of room to grow here.

Other growth drivers:

- The company is expanding significantly, adding 74 new stores across 31 states in the third quarter and it remained on track to open 200 new stores by the end of 2023.

- Five Below also has what Dollar Tree doesn't have: pricing power. It's Five Beyond store concept is overperforming its original format. The company noted: "These stores are driving traffic, they're attracting new customers, and they're retaining more current customers." It plans to convert additional stores to this higher-margin, higher-price format, noting 50% of its store count was already Five Beyond at the end of the third quarter.

- FIVE has the "it" factor when it comes to discretionary items. Though it is vulnerable to the same headwinds of essential-focused spending, it has proven its ability to get consumers to fork out funds. Take for example, its Halloween inflatables and decor that helped to drive sales last quarter, and its viral 'Charlie Brown Tree' that garnered millions of views on TikTok.

Our score is neutral, but we are buyers of any dips. The discretionary spend warning we heard from Dollar Tree tempers our outlook, as does rising online competition from Chinese eCommerce player, Temu.

But data does lean more bullish ahead of this event for traders who wish to play this to the upside or are approaching from a long-term lens.