Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Dollar General (DG), Dollar Tree (DLTR) EPS Preview

May 26, 2021

Dollar General (DG), Dollar Tree (DLTR) EPS Preview

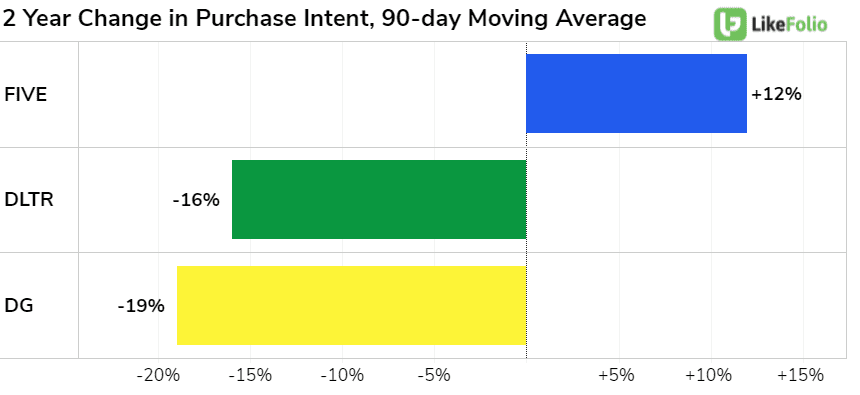

Dollar General and Dollar Tree report earnings May 27 BMO. We checked out the Discount Retail space, and this is what we're watching:

Demand Growth vs. 2019

- FIVE has effectively capitalized on returning demand for novelty items and "trendy" products, including electronics, gaming supplies, and "squishmallows" -- trust us on this, squishmallows are a thing...essentially this generation's collectible beanie baby.

- DLTR should be benefitting alongside FIVE in regard to novelty as consumers seek event-based products like Easter Egg basket stuffers, party decorations, etc. But we aren't seeing this move the needle in demand mentions. Dollar Tree does boast a discovery element, and the company is more popular vs. DG with younger generations, but FIVE is clearly superior.

- DG previously benefitted from COVID stockpiling and accessibility, but this growth has stalled. The retail footprint is enormous: +18,000 stores, and nearly 1 in 3 U.S. store openings is a Dollar General. This presence partially insulates Dollar General, because for some consumers, it's the only option in town.

Consumer Happiness

In addition, Dollar General and Dollar Tree boast significantly lower Consumer Happiness levels vs. Five Below, due to the in-store experience:

- FIVE: 72% Positive

- DLTR: 63% Positive

- DG: 60% Positive

We'll be listening to see if store expansion and reopening localities can move the needle in the positive direction for DG and DLTR, but the data doesn't suggest significant traction.