Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Can Five Below (FIVE) Rise Above Expectations?

Can Five Below (FIVE) Rise Above Expectations?

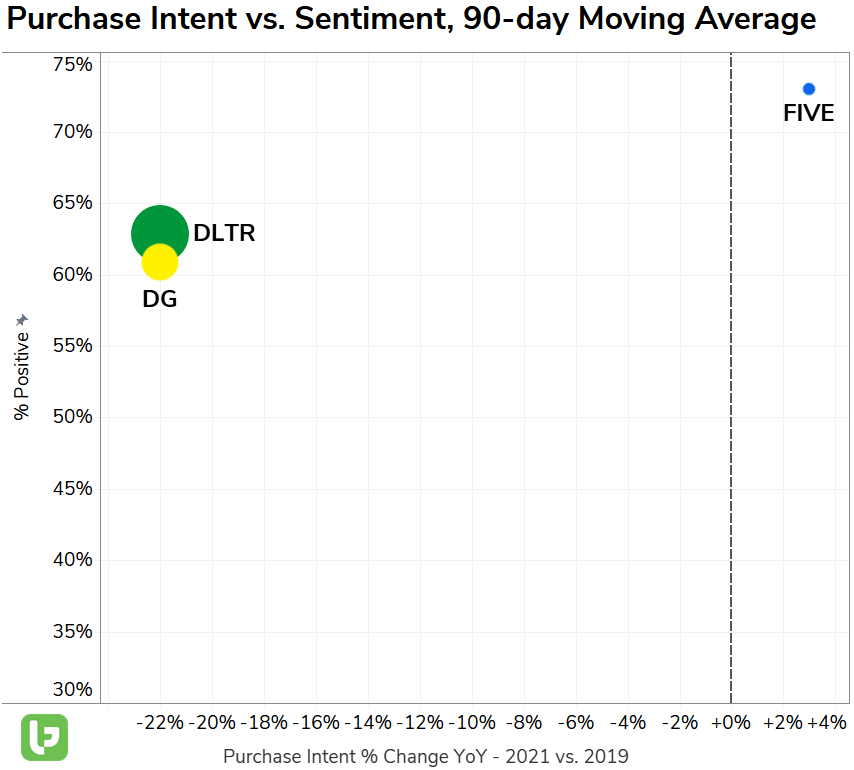

Consumer behavior is shifting as reopening continues in the US, and Five Below is outperforming its peers in the discount retail space.

Mentions of shopping at Five Below are continuing an upward trajectory. After a strong Holiday Season, Demand Mentions remain elevated: +3% vs. pre-COVID levels. This is a promising sign, considering the company's 3-pronged growth strategy:

- Leveraging its small stores (typically located in shopping centers) to rapidly grow its retail footprint -- FIVE management predicts 180 new store openings in FY21.

- Expanding its digital presence through strategic partnerships (Instacart) and rolling out curbside pickup.

- Incorporating higher-priced items by adding "Five Beyond" sections to more locations going forward.

Despite reporting a -1.8% YoY decrease in comp. transactions, FIVE posted record comp. sales growth last quarter: +13.8% YoY -- This is indicative of the company's shift towards higher-priced items.

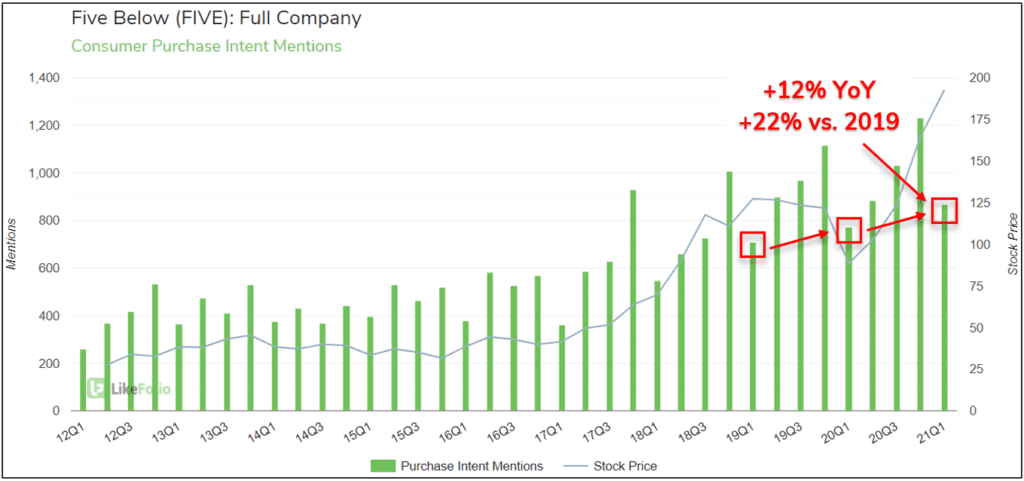

FIVE Purchase Intent Mentions rose +12% YoY and +22% vs. 2019 in the reporting quarter.

Five Below has surpassed top and bottom-line expectations in the past 3 quarters. Wall St. expectations for the upcoming report have been raised accordingly.

We've seen rivals Dollar Tree (DLTR) & Dollar General (DG) move lower on “good” numbers...FIVE shares have traded lower in sympathy.