Can Darden Restaurants Continue on its Recovery Trajectory? ($DRI) Since […]

Can Steakhouses Lift Darden (DRI)?

Darden – the parent company of almost every restaurant your parents or grandparents might recommend after church on Sunday – is gaining favor among consumers.

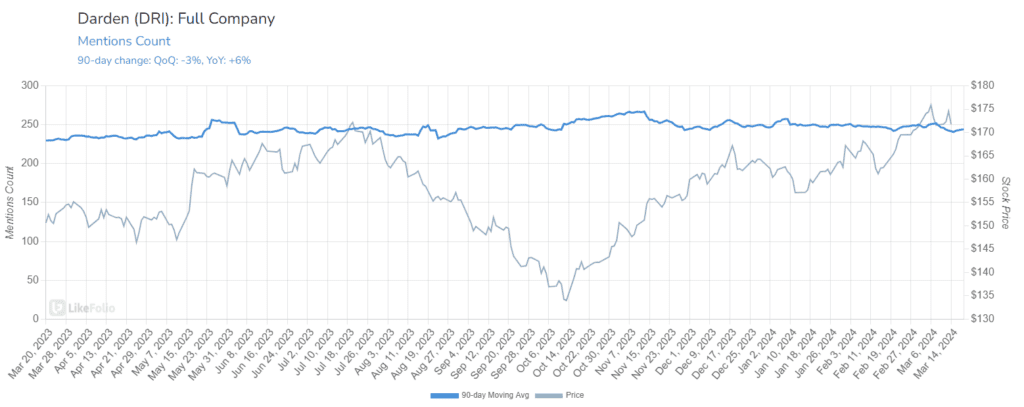

Mention buzz growth is steadily inching higher, up +6% YoY.

What’s driving this uptick?

The company’s investment in BEEF.

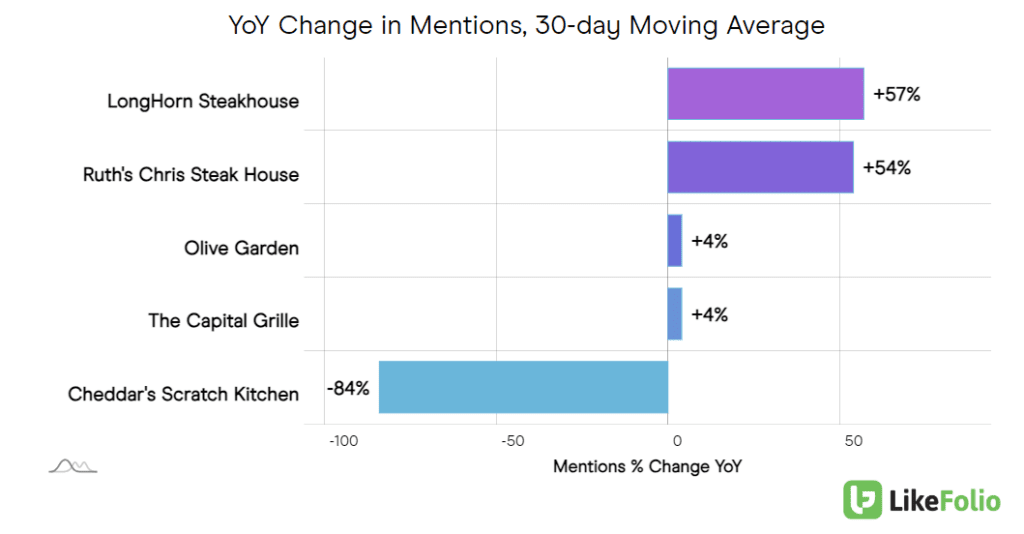

LongHorn Steakhouse and newly-acquired Ruth’s Chris Steakhouse are logging buzz growth of more than +50% YoY.

Olive Garden, which makes up the bulk of the company’s revenue, is also charting growth: +4% YoY.

These banners are benefiting from a picky yet still experience-oriented consumer.

But will this strength be enough to offset weakness in its fine dining segment?

Maybe not. Though Capital Grille is showing promise, consumer interest in other fine dining names like Eddie V’s and Seasons 52 remains lower YoY.

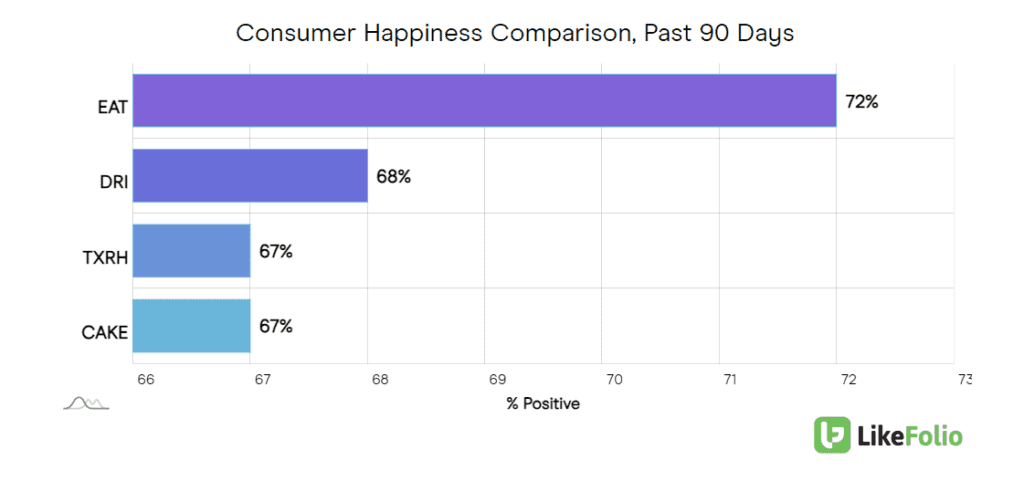

And happiness isn’t quite high enough to push us over the bullish edge for this event. While high, it's not the industry leader.

Long-term: we're watching the integration of Ruth's Chris. At a first glance, it looks like DRI is doing really well here and this could be a nice driver of future growth.

Short-term: our data is pretty neutral. If we could be bullish on steak alone, we would.