LikeFolio's Consumer Happiness data on Papa John's has been incredible […]

Dine-In Restaurant Demand is Building...

I don’t know about where you live, but in Louisville, it’s finally patio season.

Couple this warming weather with loads of consumers who have been couped up inside and it’s no surprise that dine-in restaurant demand is popping.

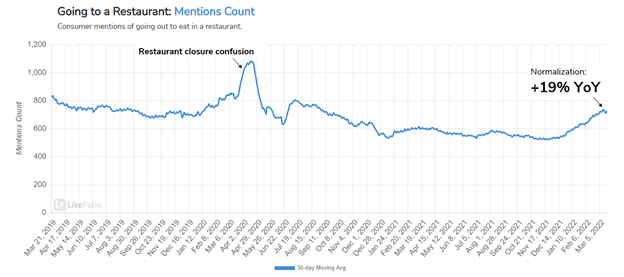

Mentions of going out to eat in a restaurant have increased by +19% YoY, and have completely normalized to pre-pandemic levels.

This is great news if you’re a restaurant owner.

And it’s helping to elevate demand momentum for these dine-in restaurants above that of fast-food providers, who did see demand return sooner.

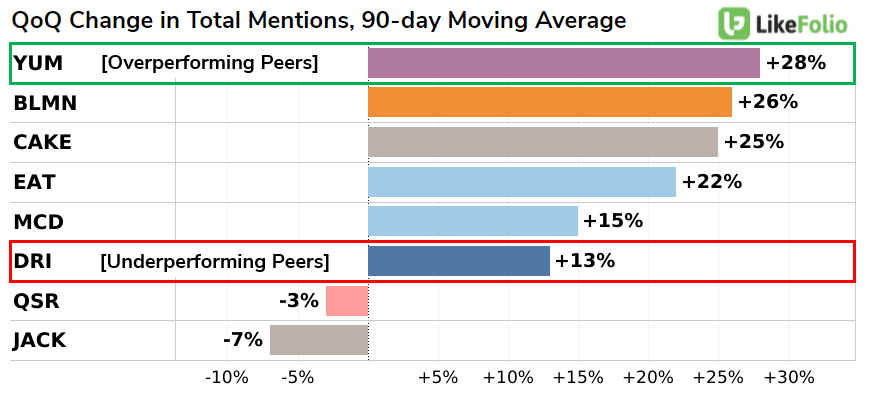

This all makes sense. But LikeFolio data analyzing these segments revealed an interesting takeaway: not all companies in each segment are performing equally.

There’s one fast-food company that is significantly overperforming peers, and one dine-in group falling behind.

1. YUM Brands! Demand is booming alongside new menu item releases.

Yum! Brands owns a handful of popular fast-food chains like Taco Bell, KFC, and Pizza Hut. And Taco Bell's wings and the return of the beloved nacho fries have driven demand for the company.

2. Darden Restaurants, owner of restaurant chains including Olive Garden, Longhorn Steakhouse, Cheddar’s and Yard House, is falling behind its sit-down peers.

What’s going on?

Even though some brands in Darden’s portfolio are doing well, like Cheddar’s whose mentions have increased by +5% YoY – other brands aren’t faring as well. Olive Garden, which comprises ~half of Darden’s revenue, is exhibiting brand weakness, with mentions declining YoY.

Moral of the story: even though Darden is reporting earnings this week, we are sidelined. Data suggests a more clear directional signal is brewing in names, like YUM, who are gaining favor with consumers.