Trend Watch -- Looking Ahead We knew this day would […]

Will Back to Work and School Doom Zoom (ZM)?

June 1, 2021

Will Back to Work and School Doom Zoom (ZM)?

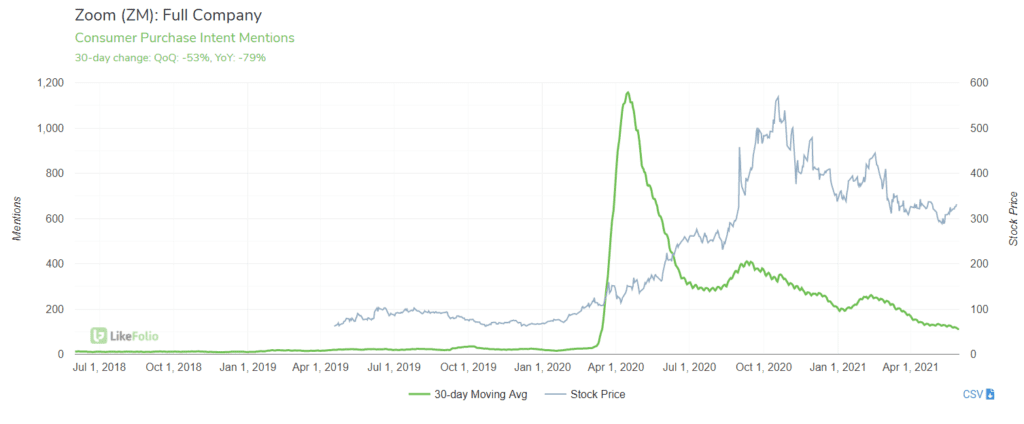

Last quarter ZM shares popped +11% after beating expectations (revenue +369% YoY) and projecting +42% revenue growth for the upcoming fiscal year. Demand for video conferencing software rocketed as workforces worked from home, and now Zoom wants to leverage what it considers to be a future that embraces the "work from anywhere" mantra. LikeFolio data shows a sharp decline in Zoom user growth, as well as normalization in consumer behaviors that drove Zoom adoption.

- Zoom Purchase Intent mentions (signing up, opening an account, renewing, using) have fallen -53% QoQ. While this decline is substantial, these mentions DO remain higher vs. pre-pandemic levels.

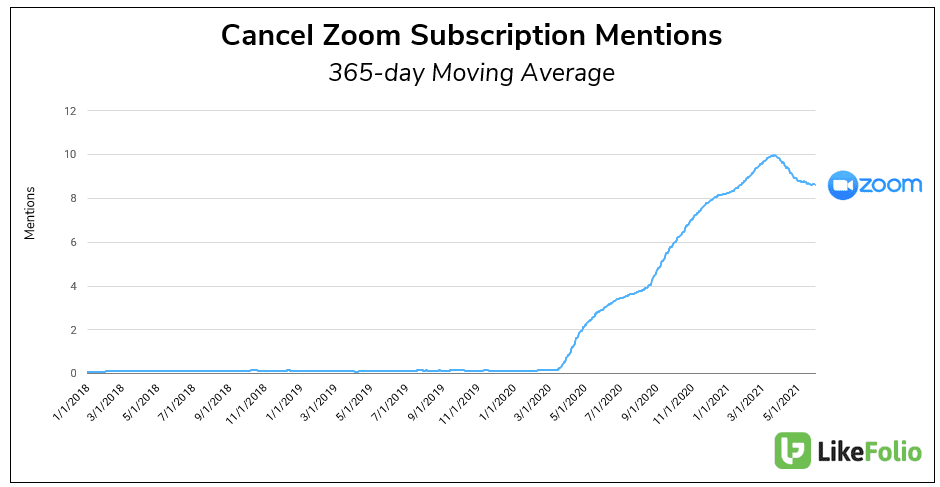

- Zoom cancellation mentions confirm churn remains elevated. Last quarter the company reported that churn rates were higher vs. pre-pandemic levels but were stabilizing. We recorded a spike to kick off the new year, and now cancellation mentions are holding higher.

- Consumer mentions of working from home have fallen -9% vs. last quarter (-51% YoY) as this trend slowly tapers down. There is some stickiness here, but it's definitely not growing.

- Mentions of attending a digital work conference are showing even more drastic signs of normalization: -64% YoY, while in-person conferences resume: +22% QoQ

Perhaps JPMorgan's CEO expressed it best: “I'm about to cancel all my Zoom meetings... I'm done with that." We'll be listening to see if Zoom can continue to meet investor expectations when it releases 22Q1 results June 1 after market close.