Roku makes streaming devices that allow its customers to stream […]

Will ROKU follow NFLX to the downside?

As we approach Roku's (ROKU) earnings report tonight, LikeFolio is taking a neutral, but concerned, stance.

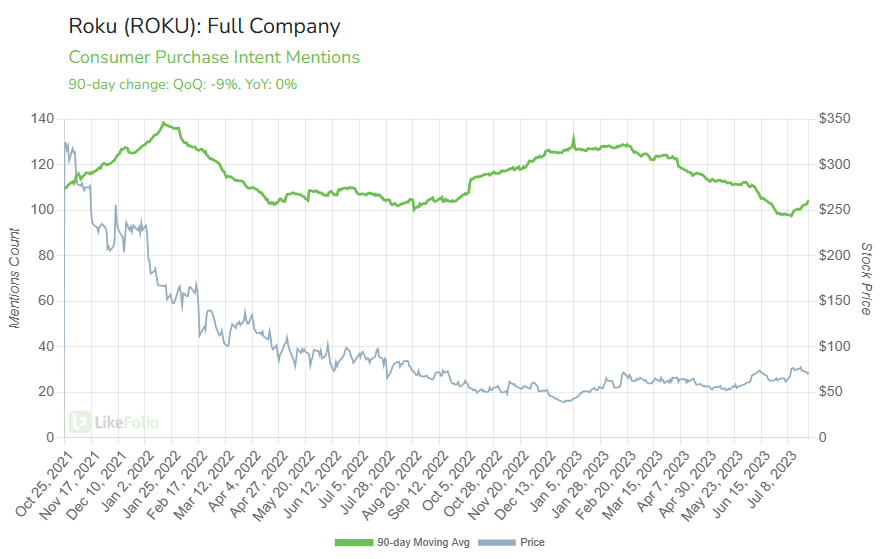

We've noticed a slight increase in consumer purchase intent mentions year over year, but nothing that screams “rapid growth”…

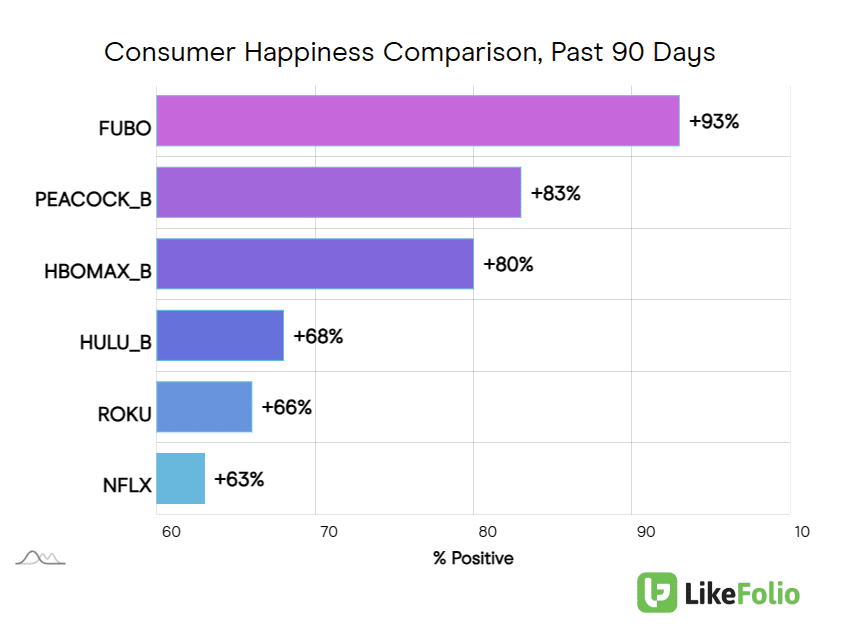

On top of that, consumer happiness is sitting at just 66%. Not great when compared to competitors like FUBO at 93%, HBO Max at 80%, HULU at 68%, and topping only Netflix (NFLX) at 63%.

Heading into tonight’s earnings there are three big questions on our mind:

- How is the current advertising climate impacting ROKU’s revenues?

While companies like Meta Platforms (META) and Alphabet's Google (GOOGL) have turned their ad-targeting capabilities into upbeat revenue performance, others are struggling. Roku could potentially benefit from Netflix's traction with its ad-supported tier of service, but Hollywood strikes could limit new content on streaming services.

- Can ROKU justify the recent stock move with a more optimistic outlook?

Roku's stock has been a big winner in 2023, up 77% year to date. However, the company's guidance for the upcoming quarter has been conservative, predicting a net loss of $175 million and less than 1% year-over-year growth in revenue. - Are partnerships paying off…yet?

The company's partnership with Shopify (SHOP) is another development to watch. This allows third-party merchants to place interactive ads on the streaming hub.

While it's too early for this partnership to impact the second-quarter results, it could potentially be a significant revenue driver in the future.

Bottom line: Netflix’s big drop post-earnings, combined with the recent outperformance of ROKU stock, gives us reason to believe the risk going into ROKU’s earnings is clearly to the downside.

We hope to see reasons to resume our bullish stance that served us so well a few years ago. However, we remain cautiously neutral.

The streaming landscape is ever-changing, and Roku's ability to navigate these changes will be critical in the coming quarters.