LikeFolio's Consumer Happiness data on Papa John's has been incredible […]

YUM’s digital transformation is working

In the midst of the Great Depression, right down the street from where I’m at now in Louisville, Kentucky, a tireless entrepreneur embarked on a culinary adventure that would forever change the landscape of fast food.

Colonel Harland Sanders, armed with a unique blend of herbs and spices, founded the iconic brand known today as Kentucky Fried Chicken. Col. Sanders once remarked, "I've only had two rules: Do all you can and do it the best you can. It's the only way you ever get that feeling of accomplishing something."

This ethos laid the foundation for what would become YUM Brands (YUM), the conglomerate that not only includes KFC but also Taco Bell and Pizza Hut. Just as Col. Sanders created a lasting legacy in Louisville, YUM continues to innovate and adapt in a changing market.

Here's why the data suggests it's a mouthwatering opportunity:

Key Point: Looking beyond last quarter

YUM shares traded mostly flat following its earnings release last week — the neutral reaction our LikeFolio Sunday Earnings Sheet predicted.

However, LikeFolio data is beginning to see room for optimism.

Our earnings score has increased by +10 points from last week alone to +23 — landing firmly in the Bullish camp.

Let's explore why:

Digital Sales Domination

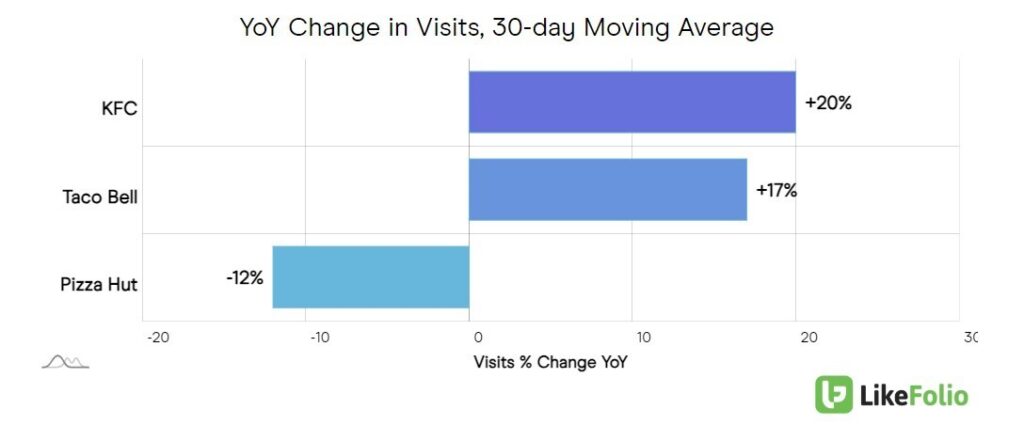

Last quarter, the company's digital sales surged by almost +30% in the quarter, making up nearly half of all orders. Web visits for KFC and Taco Bell have increased by double digits YoY.

Consumer mentions of ordering KFC, Taco Bell, or Pizza Hut via third party delivery apps have increased collectively by +5% YoY — impressive considering Pizza Hut's relative weakness.

In fact, only Pizza Hut saw a year over year decline in web visits according to LikeFolio data:

Unexpected Cultural Publicity

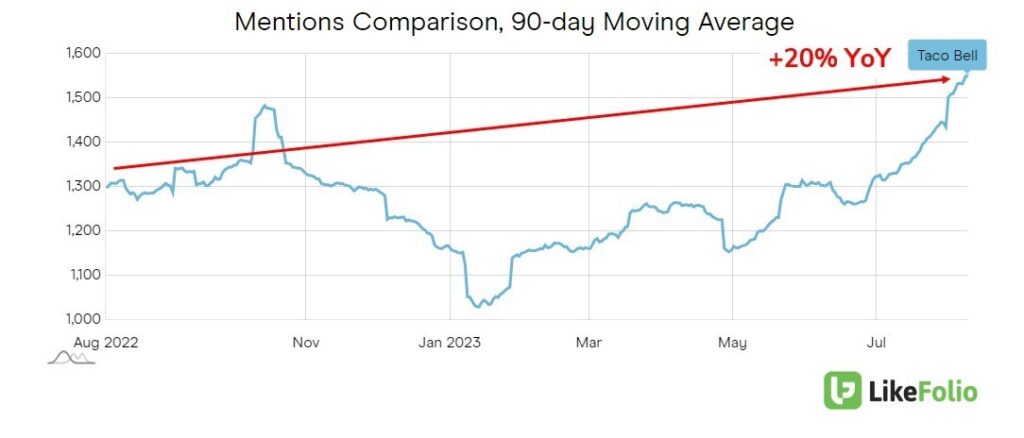

Taco Bell's battle to "liberate" Taco Tuesday for the masses generated more publicity for the brand than its own Mexican Pizza, according to company leadership.

This has translated in LikeFolio data — Taco Bell mentions are +20% higher on a YoY basis, greatly outperforming its other brands KFC (+6% YoY) and laggard Pizza Hut (-31% YoY).

Cooling Inflation may support more splurges

Yum executives mentioned during the company's conference call that inflation has peaked in most developed markets and is starting to slow down. This may bode well for consumers who are ready to splurge on fast food or upgrade menu options. However, emerging markets continue to experience rising inflation.

Conclusion

YUM Brands continues to embody the entrepreneurial spirit and dedication that Colonel Sanders infused into KFC nearly a century ago.

The company’s embrace of digital sales, strategic victories in legal battles, and insights into economic trends demonstrate an innovative and resilient approach to the industry.

In a world where fast food preferences ebb and flow, YUM stands strong, offering flavors that resonate with consumers across generations.

It may not be the secret recipe that Col. Sanders crafted in Louisville, but the strategic blend YUM employs today promises a rich taste of success for investors hungry for opportunity.