Costco Demand & Renewal Mentions Show Retention We've been officially Bullish […]

🛒 Costco Earnings: A Sneak Peek into Today’s Report!

It’s mum season in our neck of the woods, and around here that means a trip to Costco.

The company is set to report earnings today (Sept. 26) after the bell. So, what’s the scoop on the Costco’s performance and what does LikeFolio’s real-time data suggest is in store for its report tomorrow? Let’s dive in…

Monthly Performance Updates:

Costco steals our thunder when it releases sales updates every month. This also gives investors a sneak peek into core company trends.

- August Sales: Costco's net sales in August saw a +5% YoY increase, building on a strong July. The strength was primarily driven by grocery and "staple" food items, with fresh foods like bakery and meat leading the way. However, non-foods and ancillary business sales saw a dip.

- eCommerce: After a solid performance in July (+4.1% YoY), Costco's eCommerce comp sales slipped by -2.5% YoY in August. This reflects a decline in sales of large-ticket items like electronics and home furnishings.

LikeFolio's Take:

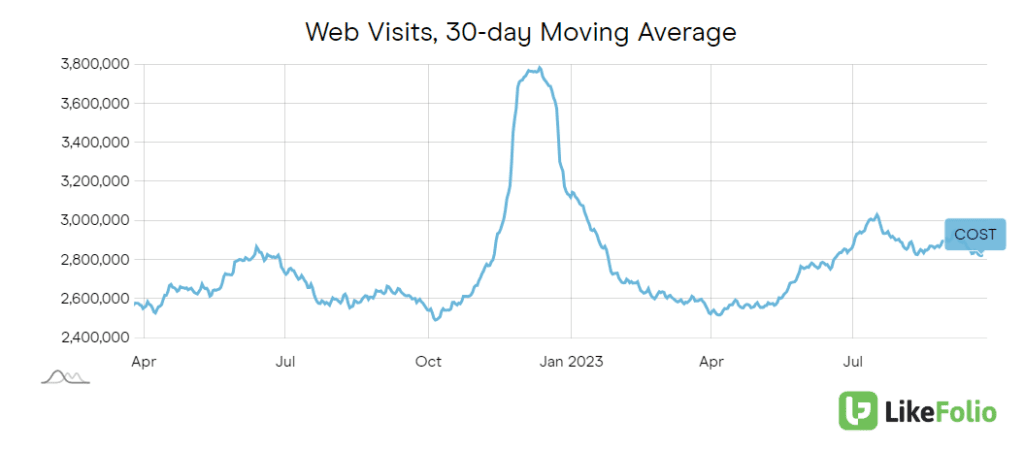

- eCommerce and Consumer Happiness: Our data suggests a continued tempering in Costco's eCommerce sales. Web visits have slipped by a point over the last month.

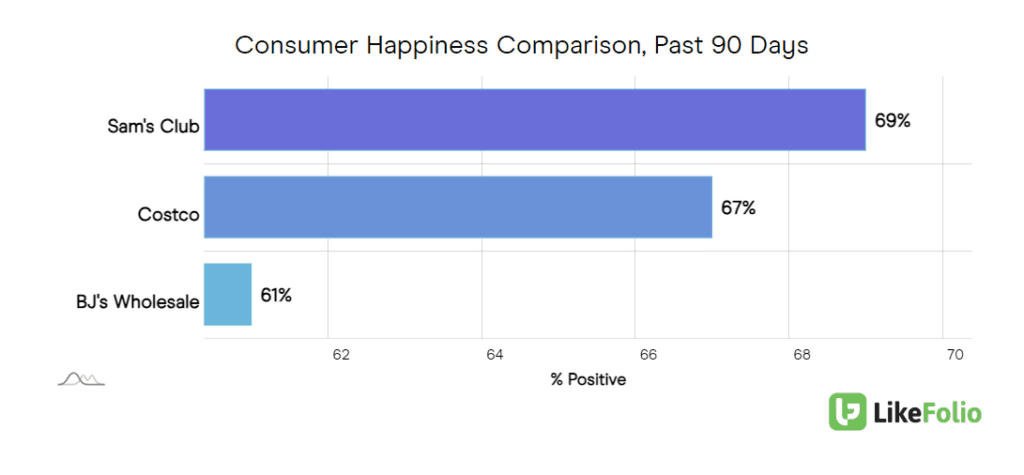

Additionally, Costco's consumer happiness stands at 67% positive, slightly behind Walmart's Sam's Club at 69% positive. The perceived savings at Sam's Club seem to be resonating more with consumers.

- Mind Share and Expansion: Costco is a clear leader in consumer mindshare, holding a whopping 94% of mention volume. The company is also venturing into new territories, partnering with Sesame to offer online health checkups, aligning with the trend of retailers diving into the healthcare sector.

- Membership Growth: Costco's membership base is solid and growing. With a renewal rate of 92.6% in the U.S. and Canada, the company reported a 6.1% increase in membership fee income last quarter. Interestingly, Costco hasn't raised its membership fees since 2017, even as competitors like Amazon and Sam's Club have. Any news of a fee increase could send shares higher.

- Bonus Insight: Costco's recent crackdown on sharing membership cards might be contributing to its growth. The company has started checking licenses to confirm membership identity at self-checkout lanes, a move that's likely pushing more consumers to get their own memberships. You can see this in real time on the chart below in June.

Bottom Line:

As we approach earnings, our stance on Costco is neutral (-11). While the company is showing some signs of weakness, especially in eCommerce, its dominant position in bulk purchases and expanded innovative offerings (like low-cost lab work) make it a compelling long-term play. Given that Costco reports monthly, much of its earnings move might already be factored in. But as always, we'll be watching closely to see how things unfold.