Used-Vehicle Demand is Surging A worsening chip shortage and corresponding production drop are expected to […]

UAW Strike: CarMax's Consumer Edge Amidst Auto Chaos

The automotive industry is currently navigating the choppy waters of the UAW (United Auto Workers) strike, which threatens to tighten the already scarce supply of popular car models.

With over 18,000 workers walking out from major automakers like Ford, Stellantis, and General Motors, the ripple effects are palpable.

For example, dealerships might soon face longer wait times for car services, given the UAW's targeting of parts-distribution centers across 20 states.

However, amidst this turmoil, CarMax stands out as a potential long-term bet. Here’s what we’re watching…

Growing Digital Engagement

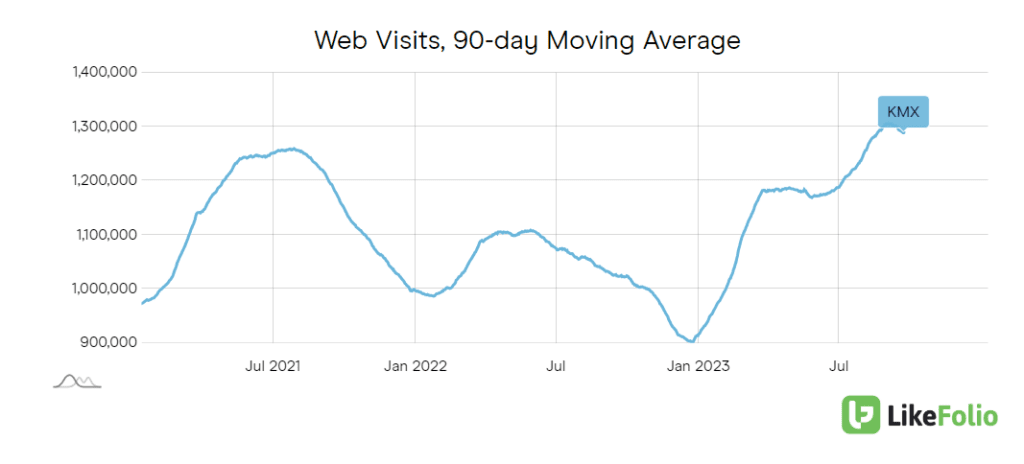

LikeFolio's web traffic data reveals a significant +26% YoY surge in CarMax web visits.

This uptick is a testament to the company's strategic lean into its omnichannel offerings, allowing consumers a seamless blend of online and in-store shopping experiences.

Last quarter, approximately 14% of CarMax's retail unit sales were conducted online, marking an increase from 11% the previous year. Additionally, around 54% of retail unit sales were omni sales, consistent with the prior year's figures.

Industry-Leading Consumer Sentiment

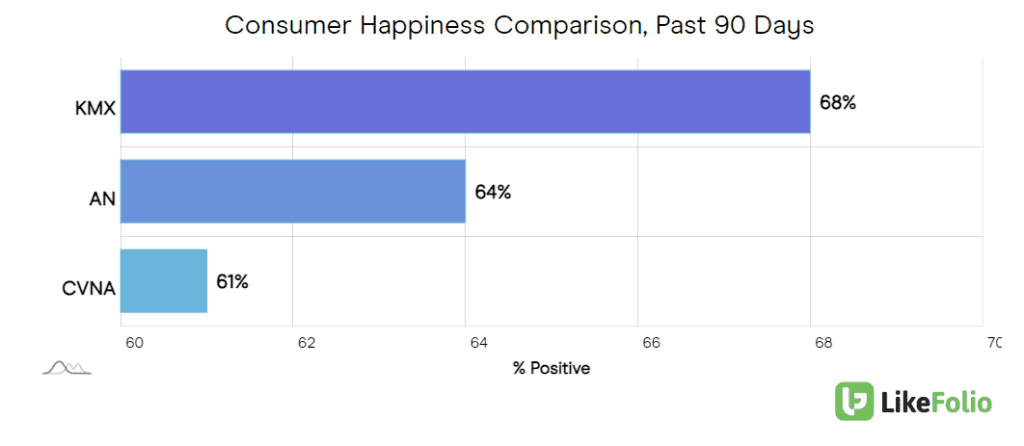

Moreover, when it comes to consumer sentiment, CarMax is outpacing its competitors.

consumer sentiment levels are robust at 68% positive, placing it ahead of peers like AutoNation and Carvana.

This positive sentiment, despite industry challenges, underscores CarMax's ability to maintain consumer trust and satisfaction.

Prices Rising Soon

While manufacturers typically refrain from hiking retail prices during strikes, dealers might soon find themselves with fewer incentives, potentially charging above sticker prices for high-demand models. If the 40-day GM strike in 2019 is a historical lesson, investors can expect potential inventory and sales challenges for dealerships.

And remember what happened last time the car industry faced a major slowdown?

The COVID-induced supply chain and manufacturing hurdles translated to an uptick in demand for used cars. With new vehicle production intermittently halted, consumers flocked to the used car market, driving up prices.

Bottom Line

The UAW strike could lead to tightened vehicle supplies, longer wait times for services, potential price hikes, and significant disruptions in the automotive retail and service sectors. Businesses like CarMax could face challenges related to inventory, pricing, and customer service.

While this event poses challenges for the automotive industry at large, CarMax's strong consumer sentiment and improved omnichannel offerings highlight its resilience and adaptability.

In addition, if the UAW strike leads to a broader increase in demand for used vehicles, CarMax could potentially benefit given its position as a major player in the used car market.

We’re officially neutral ahead of CarMax earnings, mostly due to pending uncertainty related to the new and used vehicle market at large. But we like this name long-term, especially vs. peers like CVNA.