In regard to trading volume, Coinbase is the largest cryptocurrency […]

3 sectors ready to boom no matter who is elected

We’ve broken down several stocks set to benefit from a Trump or Harris win over the last week.

We’ve also tackled what the stock and betting markets are already pricing in.

To cap off our election series, we’re diving into 3 sectors that are ripe for growth regardless of who ends up in office.

The macro tailwinds for each of these sectors are undeniable – let’s get to it.

Nuclear Energy

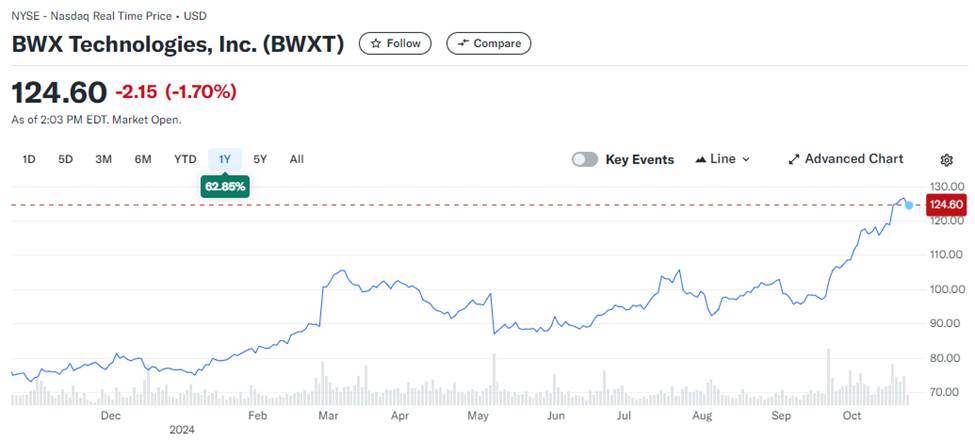

With rising energy demands fueled by AI and data centers, nuclear power is becoming increasingly important. Companies like BWX Technologies (BWXT), which focuses on nuclear components and reactors, could benefit from increased nuclear infrastructure spending.

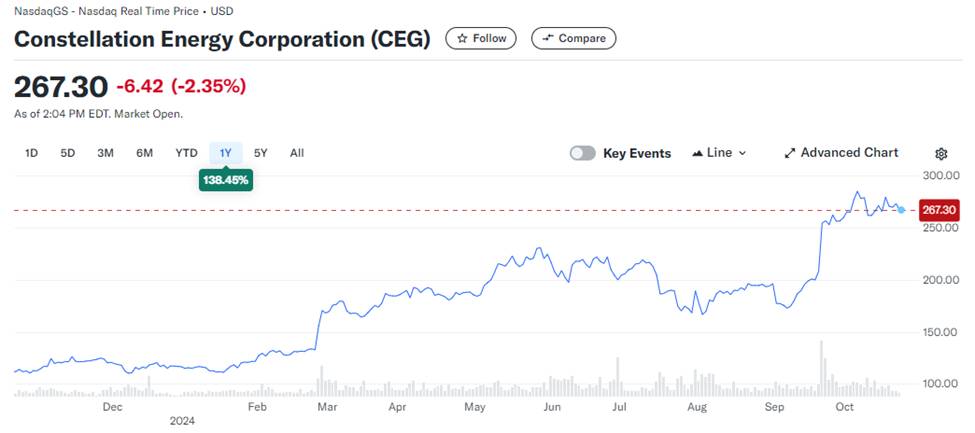

Constellation Energy (CEG), a leading provider of carbon-free energy and nuclear power generation in the U.S., might push even higher.

Constellation operates one of the largest fleets of nuclear power plants, with more than 20 nuclear reactors, contributing nearly 10,000 megawatts of zero-carbon electricity. The company is well-positioned to play a key role in the country’s transition to clean energy, especially as the push for carbon-neutral power sources accelerates.

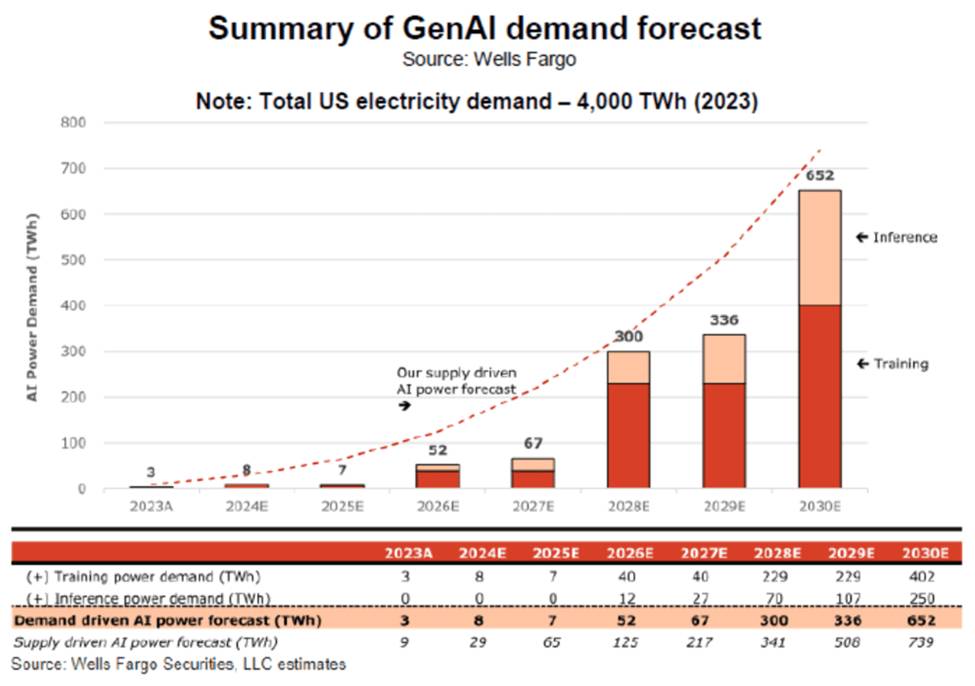

Projections from Wells Fargo estimates that AI's power demand, driven by both training and inference, will grow dramatically from 3 TWh (terawatt-hours) in 2023 to 652 TWh by 2030. This also translates to ~74,452 MW.

To put this into context, 1 MW of power is enough to supply energy to about 200 American homes.

Cryptocurrency

A Trump win could lead to more lax regulation in the cryptocurrency sector, benefiting companies like Coinbase (COIN) and Marathon Digital Holdings (MARA), both of which are heavily involved in Bitcoin trading and mining. This would likely encourage further investments in Bitcoin, as reduced regulatory scrutiny might promote greater adoption and market activity.

Bitcoin itself could experience massively increased demand as a store of value and as a speculative asset under a less regulated environment.

Under a Harris administration, stricter regulations might be imposed on cryptocurrency exchanges and mining operations. Companies focusing on ESG-friendly blockchain solutions, such as HIVE Digital Technologies (HIVE), could find a favorable niche as Harris places more emphasis on sustainability and responsible energy use.

Despite increased regulatory scrutiny under a potential Harris administration, many analysts believe Bitcoin and other cryptocurrencies are primed for continued growth. The primary driver isn't tied to political leadership but to broader macroeconomic factors that favor crypto’s rise.

Here's what we mean...

This section is restricted to LikeFolio Pro Members only.