Planet Fitness ($PLNT) reports earnings tonight, and analysts are expecting […]

4 Opportunities in Fitness

It’s officially pool-season.

And time to check-in to see how those exercise habits that many consumers jump-started at the start of the New Year are holding up.

LikeFolio data reveals 3 critical trends in the fitness industry that are helpful bellwethers for companies operating in the fitness space.

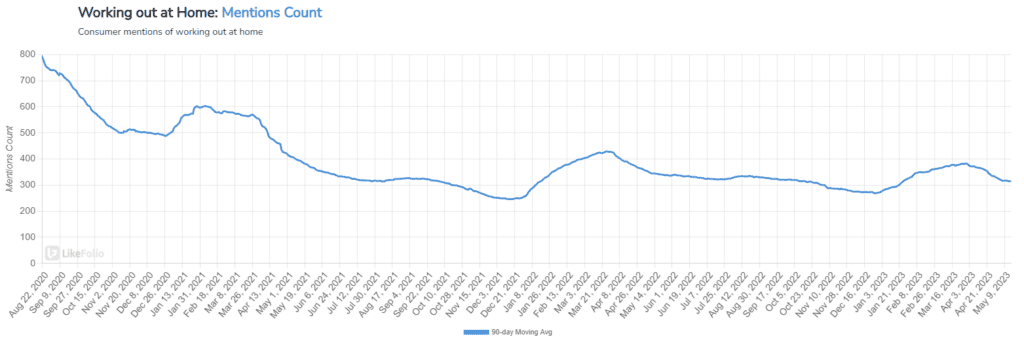

First: The Home Gym is Losing is Luster: -8% YoY

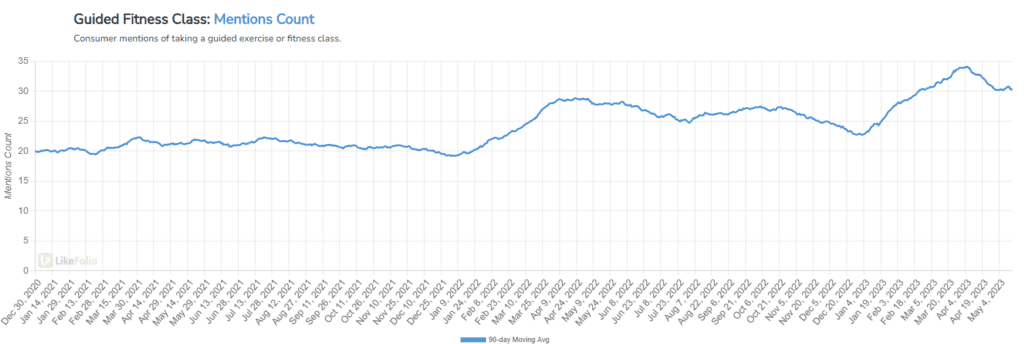

Second: Guided Fitness Classes are Growing in Popularity: +9% YoY

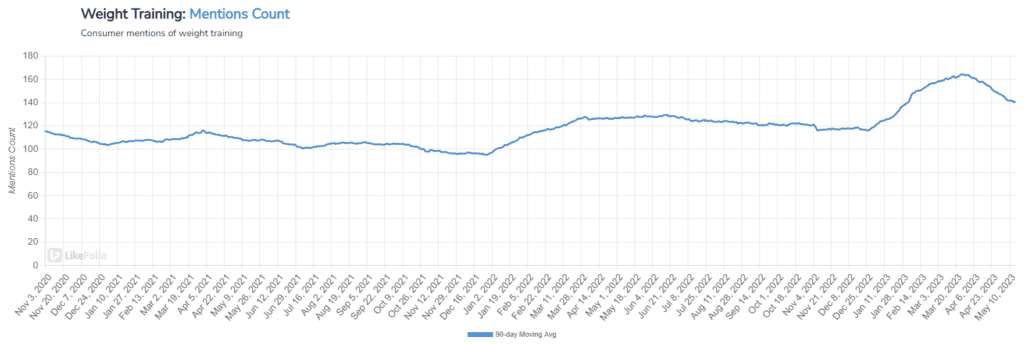

Third: Consumers are Re-Focusing on Weight Training: +11% YoY

These trends spell continued trouble for at-home fitness players, and opportunity for boutique class providers.

Check out how four major players stack up below…

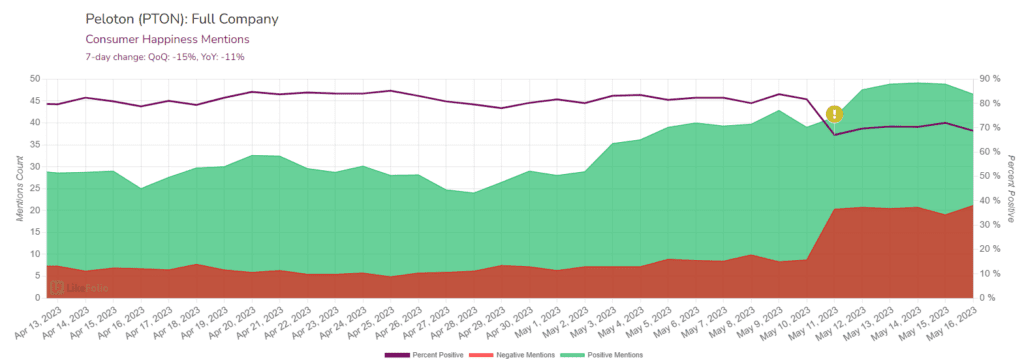

Peloton (PTON) – Downhill from here?

Peloton’s stock has been on a downhill ride for the last 2 years, shedding more than -90% in value as it coasts off covid-induced highs.

Last week, it announced some bad news – for users and investors: a seat recall.

This news is minor compared to early 2021 when the company recalled all of its Tread+ and Tread treadmills after a child’s death and multiple injuries, but it still sent sentiment -11% lower on a YoY basis.

Key Takeaway: Recalls haven’t proven to be a nail in the coffin in the past, but it’s not a good vote of confidence for Peloton’s struggling brand image. More concerning for long-term investors: consumer demand volume is cratering below 2018 levels, even amid product launched like the rower. Data doesn’t support a bet to the upside just yet.

Xponential Fitness (XPOF) - Winner

Xponential Fitness is the parent company of some of the trendiest names in boutique fitness classes.

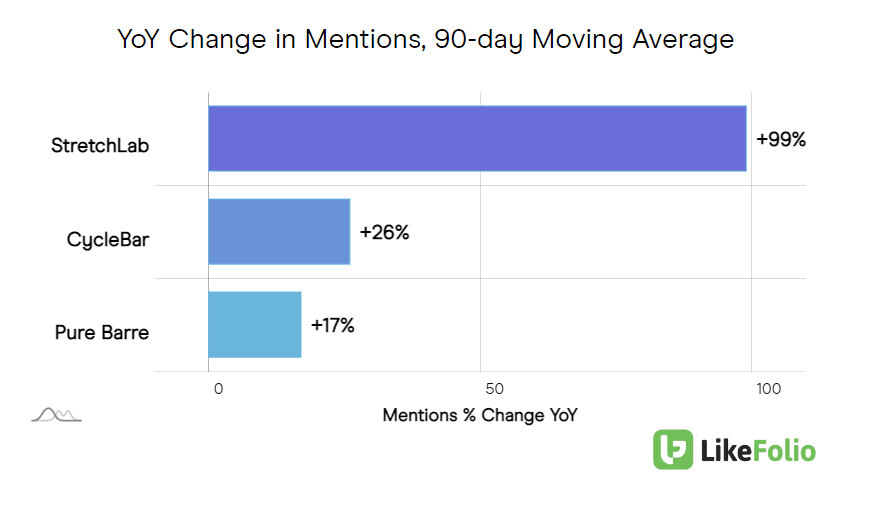

CycleBar, Pure Barre and StretchLab make up the lions share of mention volume and growth:

Consumer mentions of taking one of XPOF’s fitness classes have risen by +37% YoY across the board. While demand is tempering from its seasonal peak, this remains an impressive growth rate.

Last quarter, XPOF posted a surprising loss (analysts were expecting positive earnings) alongside a +40% YoY jump in revenue. The loss was attributed partially to $6.2 million in Rumble-related acquisition expenses.

Other key highlights:

- Growing userbase: North American memberships topped 665,000, +31% YoY

- Rising engagement: Studio visits increased by +38% YoY

- Low churn: membership freezes were at their lowest level since prior to the pandemic

Key Takeaway: LikeFolio issued a Bullish alert for XPOF more than a year ago and members have raked in nearly +50% in gains since then. However, the recent pull-back may prove to be overstated. Underlying consumer demand remains strong and boutique fitness continues to be insulated from churn vs. virtual fitness memberships and even some gyms.

Planet Fitness (PLNT) – Double-Down Opportunity

The long-term pandemic ripple effects have proven to be tailwinds for Planet Fitness – namely, a renewed consumer interest in health and fitness, the bankruptcy of competitors, and increased real estate opportunities allowing for lower-cost expansion.

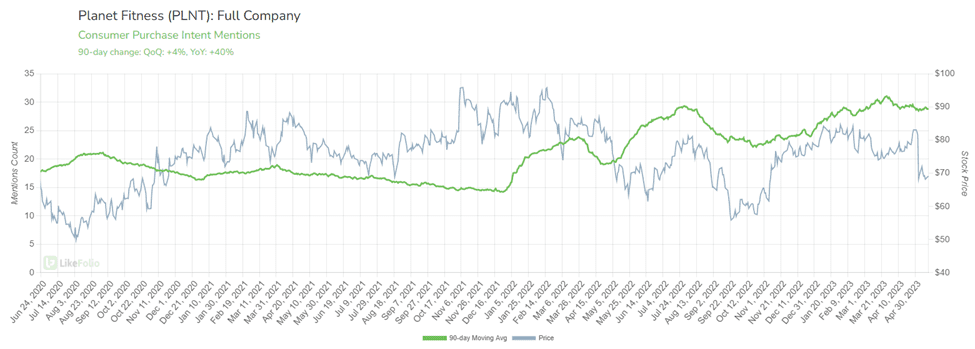

LikeFolio data confirms Planet Fitness is effectively attracting new members into its low-priced model:

Purchase Intent mentions, including new sign-ups and membership usage mentions, have risen by +40% YoY after a strong New Year season. At the end of last quarter, the judgment-free gym boasted more than +18 million members.

Unfortunately for PLNT stockholders, the bar was high ahead of the company’s last report. Planet Fitness posted revenue and adjusted earnings growth of +19% and +28% YoY respectively but failed to clear Street expectations, sparking a sell-off post-report.

LikeFolio data suggests this may prove to be an ideal entry point for long-term investors. The company has its eyes set on international expansion and demand growth is holding strong through a typical down-season.

PLNT is also benefitting from deal-seekers hunting a cheap gym membership and a renewed consumer interest in weight training.

Key Takeaway: LikeFolio featured PLNT as a bullish play on our February MegaTrends report. Though the stock has gained as much as ~7% since then, the recent pullback has us in the red. We’re re-iterating our Bullish stance and doubling-down on our Bullish outlook at an even lower price.

F45 Training Holdings (FXLV) – Still a Moonshot Bet

Sometimes at LikeFolio, we take moonshot bets.

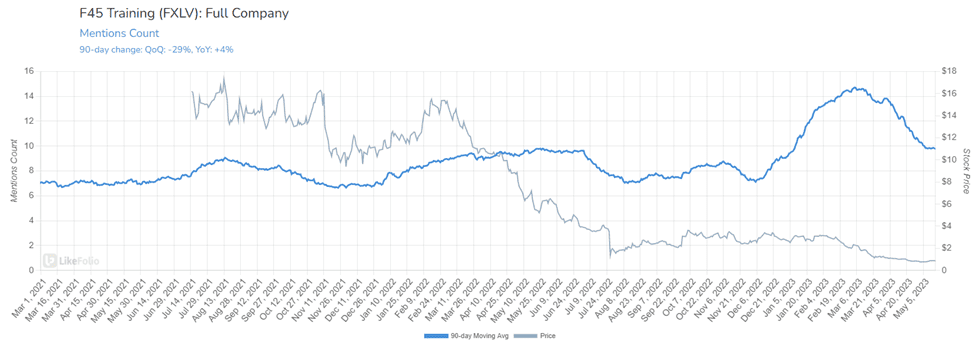

Our Bullish opportunity alert for FXLV, known for its cardio and strength training classes (some of which are designed by Mark Wahlberg), is certainly a shoot-for-the-moon play.

The underlying premise of this opportunity remains: consumers have reported a rising interest in guided fitness classes and weight training, specifically.

FXLV class mentions remain higher on a YoY basis, though have shown some signs of tempering:

The company delayed its 23Q1 and ’22 annual report, so investors are still waiting for confirmation of a potential turnaround.

Key Takeaway: FXLV is trading under $1 and still has much to prove. However, data suggests consumer trends are serving as near-term tailwinds. Mark Wahlberg’s increased involvement is also helping to attract new eyeballs to the struggling brand. It’s still early in our moonshot bullish play, and data hasn’t changed significantly since our initial alert – however, it’s important to reiterate elevated volatility in the near-term as the company gains its footing (or ultimately fails to do so). Stay risk defined.