Spotify (SPOT) purchase intent surging Spotify Purchase Intent was the […]

5 Stocks to Watch This Week (CHWY, BBW, BBBY, LEVI, RBLX)

August 29, 2022

| Here are some names that LikeFolio is keeping an eye on this week: Chewy (CHWY) |

- Chewy reports earnings Tuesday evening.

- Options are currently pricing in a move of over $5/share (13%) in either direction, making this one of the week’s highest risk/reward earnings plays on our Sunday Earnings Sheet.

- Short interest is 25%, one of the most heavily shorted names among large-cap stocks. If the company posts a good quarter and outlook, a short-squeeze is possible and could lead to an extended move higher.

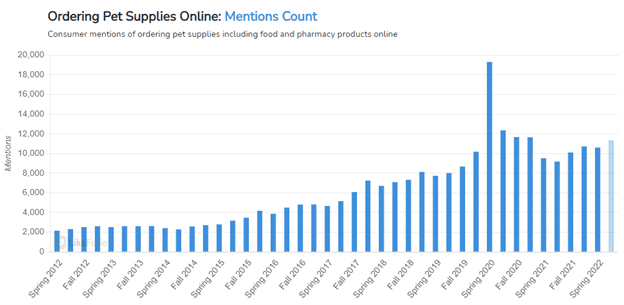

- Online pet supply ordering is up 24% year-over-year, providing a macro tailwind for the company.

- LikeFolio data suggests CHWY’s recent decline of more than 50% year-over-year is likely overdone.

- We’ll be betting to the upside on this earnings report, utilizing an options strategy designed to strictly limit risk to $100 or less, while providing profit potential of 300% or more during the 5-day period.

Build-A-Bear (BBW)

- Build-A-Bear reports earnings before the market opens on Thursday.

- LikeFolio data is showing a slowdown in consumer demand for BBW products, even with Disney and Pokemon collaborations in play.

- BBW stock faces significant, long-term resistance around $19/share… difficult to break through.

- Options pricing in a 13% move in either direction… consider using option spreads to limit risk on any downside bet.

| Bed Bath & Beyond (BBBY) |

- Bed Bath & Beyond is setting up for another potential short-squeeze.

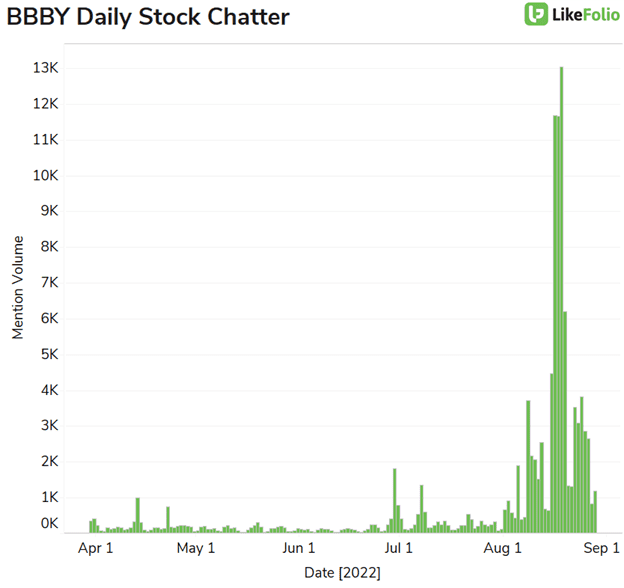

- Stock is frequently featured in our STOCK CHATTER ALERTS due to high investor interest, especially among “meme stock” enthusiasts… chatter increases typically precede short-squeeze attempts (the last spike seen below coincided with a stock move from $10 to $30 in days.)

- Near-term resistance at $12.30-12.50…. a break above this level could lead to a short-covering rally into the upper teens.

- Company update scheduled for 8/31/2022 is hotly anticipated… bulls desperately hoping for the company to announce a spin-off of its lucrative buybuy BABY brand, bears say the announcement of store closings is more likely.

- We believe the stock could run sharply in anticipation of the 8/31/22 company event, but the likelihood of disappointment from the meeting is high.

- Extremely high volatility in this name… traders playing for a short-squeeze could be rewarded handsomely but must take the extremely high risk (50%+ losses this week possible) to do so.

| Roblox (RBLX) |

- Gaming is cooling off across the board as the pandemic behaviors normalize. Mention volume for each trend LikeFolio tracks (generic gaming, online gaming, mobile gaming, and new gamers) remains lower vs. 2020 levels.

- RBLX shares are currently trading near $40, more than 70% below November ’21 highs. Investor sentiment surged last year alongside Metaverse hype and subsequently plunged alongside tech market weakness.

- Roblox players are getting older, on average. Through 2021, Roblox touted more players 13 and under vs. 13+. However, in 22Q2 Roblox reported the widest gap between daily active users +/- 13, with more than 53% of players over the age of 13. This is a positive sign for potential in-game spending via the game’s currency, Robux.

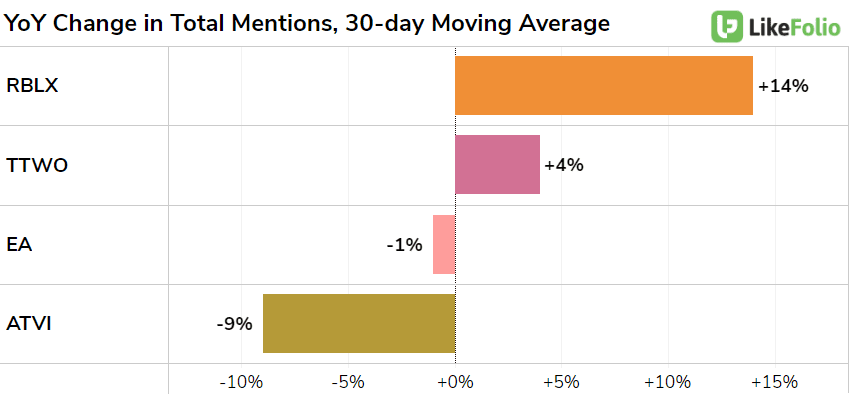

- In addition, Roblox is outperforming peers when it comes to overall mention buzz. Mentions of playing Roblox are rising in the current quarter, currently pacing +11% higher QoQ and +8% higher YoY. Has the Street written this name off too soon?

- Roblox won’t report 22Q3 results until November, but the initial data looks strong. We’ve got a close eye on this one into earnings. It could be setting up for a major surprise.

| Levi Strauss & Co. (LEVI) |

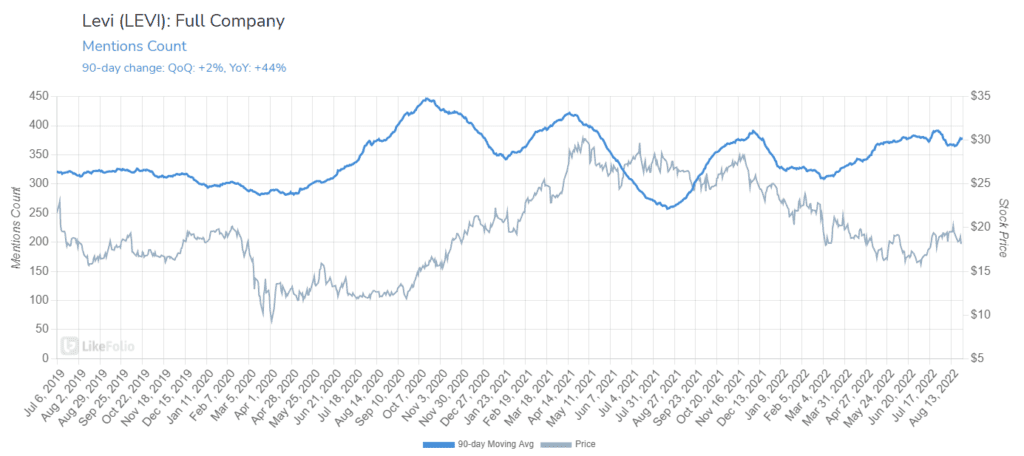

- Levi Strauss & Co. got its groove back in 2021. Shares surged above pre-pandemic highs thanks to strong sales and an optimistic outlook.

- Now, Levi mention buzz is rising as shares trade lower YoY. Is a divergence opportunity unfolding?

- In 22Q2, LEVI reported revenue growth of +15% YoY, driven by strong brand reception, “global casualization” and consumer adoption of direct-to-consumer channels.

- Levi is also successfully leveraging its “vintage” status on social sites like TikTok. Leadership noted: “This past quarter, we dug into our archives, releasing Levi's Fresh collection, which was inspired by our product collection from the 1970s, featuring a range of sustainably dyed pieces for men and women, including 501 jeans, sweats, accessories and more at premium price points. The innovative collection saw particular success with women's and tops, in addition to younger consumers with whom we are gaining share and seeing record engagement on our industry-leading TikTok.”

- LEVI will report 22Q3 earnings in October, and LikeFolio data suggests previous strength is holding despite investor fears in the apparel sector.

Want deeper insights? Get Free Access to The Vault.

Tags:

$BBBY, $CHWY, BBW, Bed Bath & Beyond, Build-A-Bear, chewy, LEVI, Levi's, RBLX, Roblox