United Parcel Service (UPS) After two quarters of explosive demand […]

UPS: Near-term Struggles, Long-term Opportunity

"In the middle of difficulty lies opportunity." - Albert Einstein

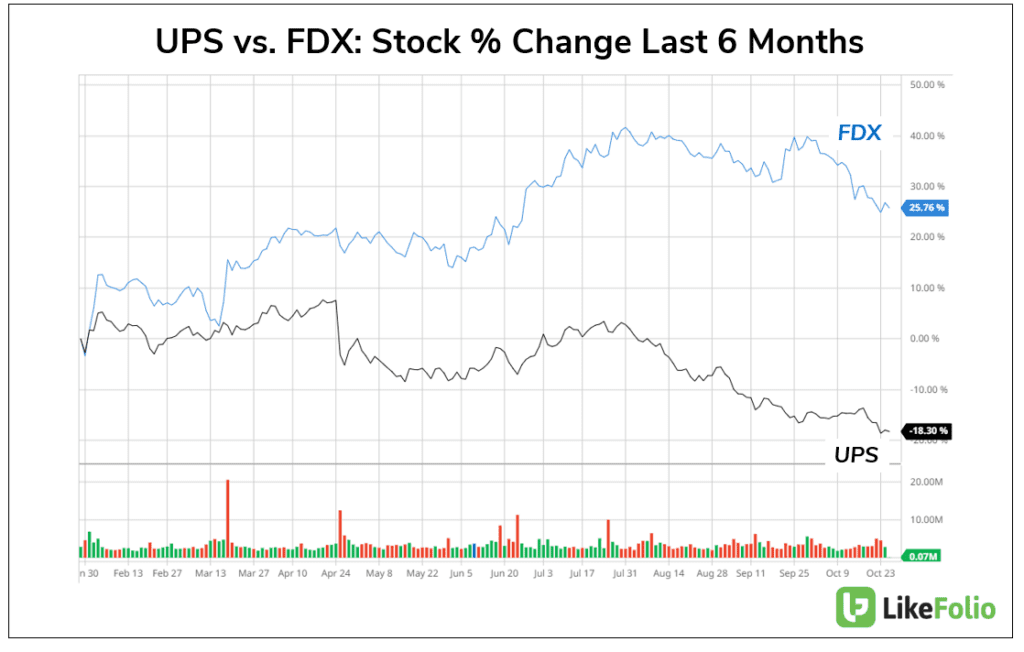

United Parcel Service (UPS) has recently been a hot topic in the investment world, not just for its headline-grabbing union negotiations and significant wage increases, but also for its stock's dismal performance compared to its peer, FedEx.

Over the last nine months, UPS shares have dipped by -18%, while FedEx has enjoyed a +25% rise.

However, LikeFolio's data paints a different picture for UPS's future, one that savvy investors should not overlook.

Union Negotiations and Market Response

The recent agreement between UPS and the Teamsters union, marking a substantial 9-10% labor cost increase in the first year, has been the steepest in the contract's duration.

This move, aimed at satisfying union demands and keeping a competitive edge in workforce quality, initially rattled investors.

But here's where it gets interesting: LikeFolio's analysis indicates that this should not deter long-term investors. In fact, the current pullback in UPS's stock price might just be the golden opportunity for accumulation.

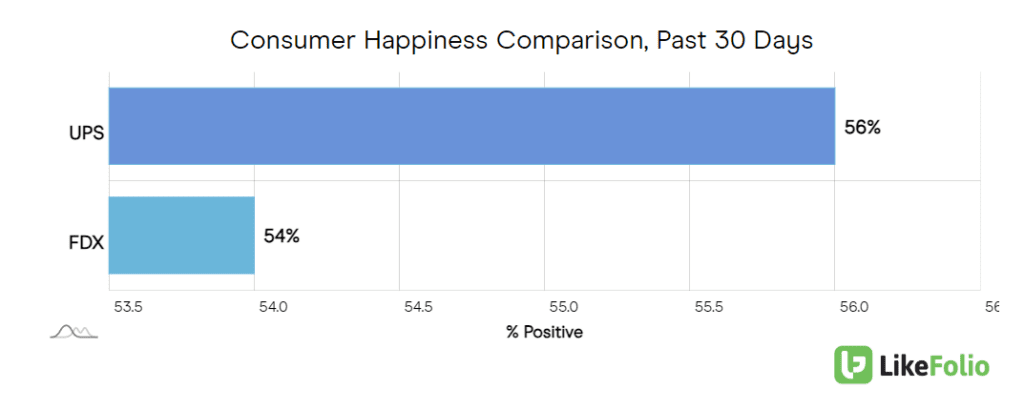

Happiness Edge

At the end of the day, consumers care about cost and speed when it comes to shipping. And UPS understands. Its focus on rates and customer experience are evident in its happiness metrics, 2 points higher vs. rival FedEx.

This makes sense…

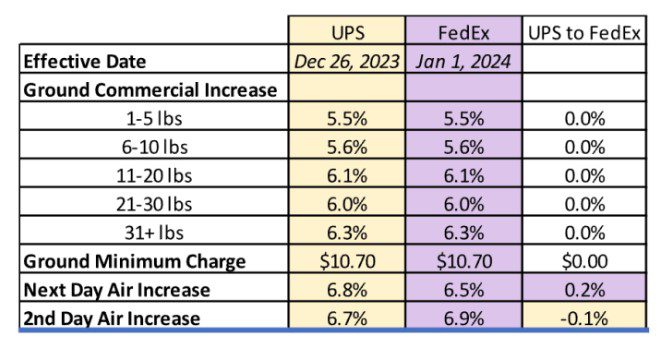

Competitive Rates Despite Wage Hikes

Despite the wage bumps, UPS's 2024 rate hikes are strategically aligned to stay competitive, mirroring those of FedEx. This includes identical rate increases for ground commercial shipments and minimum charges per shipment.

It's a delicate balance between enhancing yields and maintaining customer loyalty, especially with the looming presence of regional carriers and giants like Amazon.com Inc. UPS's rate strategy, inclusive of surcharges, shows a keen focus on sustaining market competitiveness while managing operational costs.

Rebate Strategy and Market Share Recovery

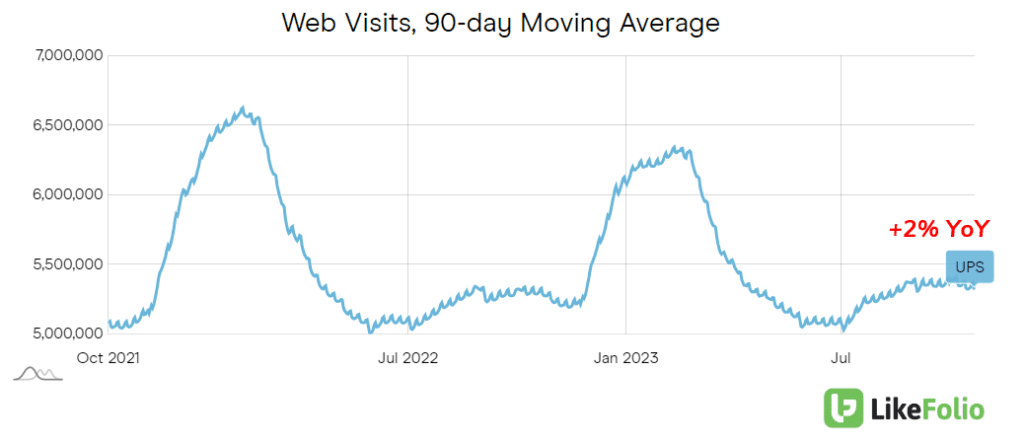

In a bold move to reclaim the approximately 1.2 million daily parcels diverted to competitors during the tumultuous labor negotiations (ouch), UPS is offering rebates to customers breaking contracts with other carriers to return. LikeFolio's data suggests this tactic is gaining traction.

UPS's share of consumer web traffic has risen to 56%, overtaking FedEx's 54%. This marks a significant recovery, considering these figures were reversed just a quarter ago.

Additionally, UPS's web traffic has seen a +2% year-over-year increase.

Automation and Cost-Saving Measures

Facing increased costs from the new union contract, UPS is turning to automation and technology. The company plans to reduce its 140,000 part-time unionized workforce in sort centers, potentially saving billions. UPS is also exploring advanced technologies like robotics, drones, and driverless vehicles, indicating a future-leaning approach to operational efficiency.

Navigating Holiday Headwinds

The upcoming holiday season looks challenging, with signs of a weaker peak season emerging across the supply chain. A decline in demand for products like apparel and electronics is evident as consumers shift their spending towards services and travel.

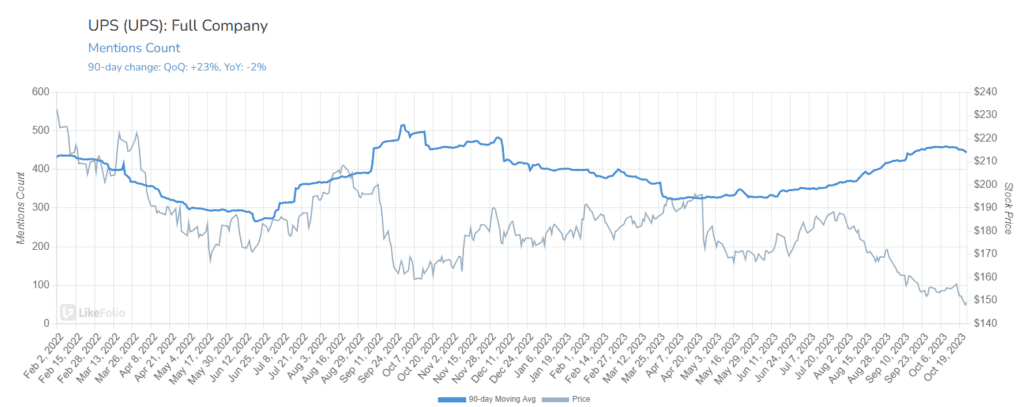

LikeFolio's comprehensive mentions of UPS show a slight downtrend, confirming some near-term macroeconomic challenges.

The Bottom Line

Despite facing near-term hurdles, UPS's long-term outlook remains promising.

With a robust strategy and a 4% dividend yield, UPS stands out as an attractive investment for those willing to navigate through current market uncertainties, eyeing substantial future gains.

We’re sidelines for this earnings event but view pullbacks in the stock as accumulation opportunities.