Chipotle has been one of LikeFolio's biggest winners over the […]

The Future is Now and It's Automated

"Adapt or fall behind," seems to be the mantra driving Chipotle Mexican Grill (CMG) as it gears up for its earnings announcement this afternoon (Oct. 26).

LikeFolio’s earnings score for Chipotle is flashing bullish at +32.

Here’s what is driving success for this burrito giant…

LikeFolio Data Looks Solid

Key Metrics Indicating Growth for Chipotle include:

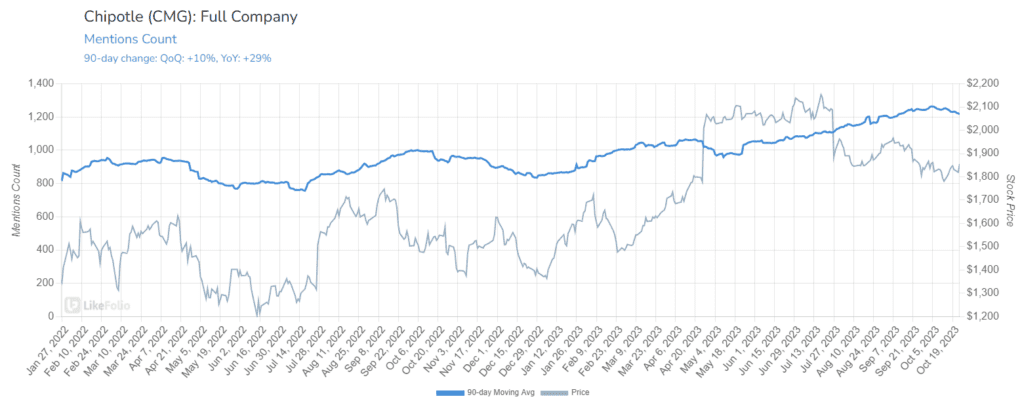

- Mentions: Up by 29% year-over-year.

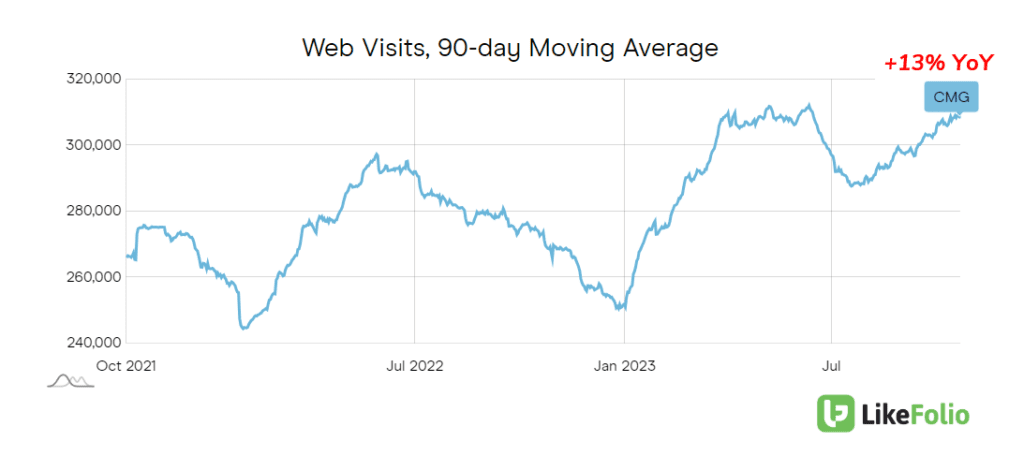

- Web Visits: Showing a healthy 13% increase year-over-year.

- Sentiment: Holding steady at 64% positive, despite a slight dip following the recent price adjustments.

Leadership decisions also bode well for margin improvement. Consider the following:

A Tech-Forward Approach

A few weeks back, we delved into Chipotle's ambitious foray into automation. (read here)

In a significant move towards modernization, Chipotle, in partnership with Hyphen, is testing a new robotic system.

This technology is designed to efficiently assemble burrito bowls and salads, primarily catering to the booming trend of digital orders.

In addition to automation, Chipotle is upgrading its equipment to cook food faster. On its last report, its CEO revealed the company is introducing a dual-sided grill capable of cooking chicken threefold quicker and steak fourfold faster. This new equipment has been installed in 10 of Chipotle's busiest restaurants.

Smart.

Strategic Price Increases Amid Economic Shifts

Despite implementing its fourth price hike in two years just a week ago, Chipotle's market appeal hasn't waned.

The increase, though modest, has been noticeable — protein options are up by 30 cents, and many drinks now exceed $3.

Yet, LikeFolio's data paints a picture of resilience, with Chipotle's demand soaring to new heights and daily web traffic crossing the 300K threshold.

Mixed Outcomes in Recent Earnings

Chipotle's Q2 report was a blend of triumphs and challenges. The company outperformed EPS estimates with $12.65, yet slightly missed the revenue mark with $2.51 billion against an expected $2.53 billion.

This led to a 9% drop in stock prices post-announcement, even though net income rose impressively to $341.8 million from $259.9 million the previous year.

Bottom Line

As we look towards the earnings announcement, one thing is clear: Chipotle is not just serving up burritos; it's dishing out a masterclass in navigating a tech-centric, consumer-driven market. We’re bullish as Chipotle flexes its pricing power and leans into automation.