Here are some key stats and data points on stocks […]

Mattel: More Than a Barbie Blip

Barbie Fever

Mattel reported a 16% jump in Barbie sales in the third quarter, attributing this surge largely to the success of the "Barbie" film released in July.

The movie, which became a global cultural phenomenon, is the highest-grossing film of the year, earning over $1.4 billion worldwide.

LikeFolio data saw this jump in consumer demand coming from a mile away. Just check out the brand buzz chart below: +734% YoY.

Overall Revenue Growth

Unsurprisingly, the popularity of the Barbie movie significantly contributed to Mattel's overall revenue, which rose 9% to $1.92 billion.

This performance exceeded Wall Street's expectations, with earnings per share at $1.08 (adjusted), compared to the expected 86 cents.

Disappointing Forecast Despite Strong Results

But Mattel's stock experienced a significant drop due to a forecast that failed to impress analysts.

Despite reporting strong quarterly results that exceeded expectations, the company's revised guidance, particularly leaving its revenue projection unchanged and flat on the year, led to investor disappointment.

The company's CEO, Ynon Kreiz, noted a year-to-date decline in overall toy industry sales. This observation, coupled with Mattel's cautious stance towards the upcoming holiday season and broader industry challenges, contributed to the stock's decline.

Analysts highlighted this "near-term cautiousness" and broader industry weakness as key factors affecting investor sentiment.

But we think the Street got it dead wrong.

Here are 3 reasons why we’re Bullish MAT ahead of the holiday season:

- Broader Strategy Impact

The success of the "Barbie" movie marks Mattel's first major move in leveraging its intellectual property to create other potential blockbuster movies. This strategy not only boosted Barbie sales but also positively influenced other Mattel brands, like Hot Wheels, which saw a 22% sales increase.

With a handful of other classic brands under its umbrella, the sky is the limit for Mattel to turn the lever in a similar fashion across its portfolio.

2. Barbie Fever isn’t Over Yet

In fact, it may just be heating up.

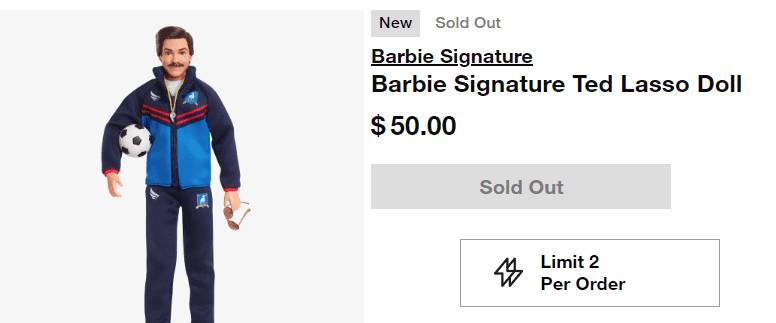

After earnings Mattel launched its Barbie Signature Ted Lasso Collection.

The $50 Lasso figurine is already sold out on Mattel’s site:

…And going for double the initial asking price on Amazon.

This is the Ken we all need, to be frank.

But it also shows that Mattel knows, once again, how to turn up the heat on a good thing.

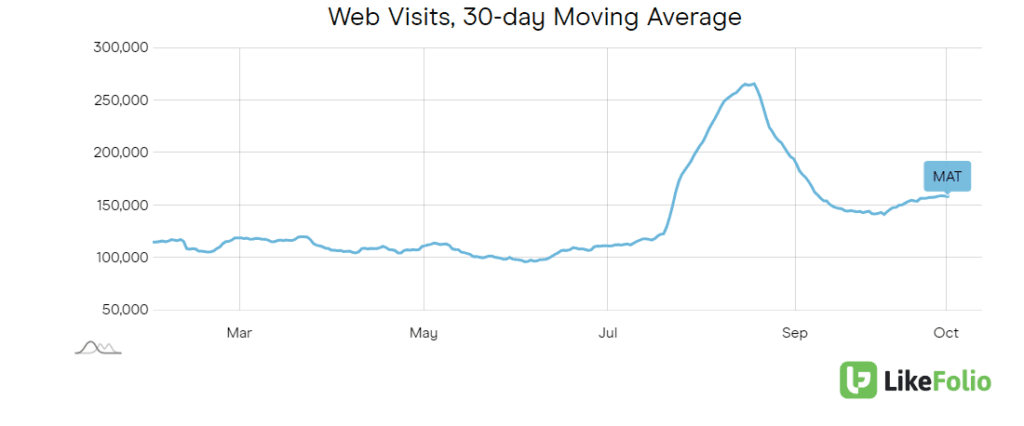

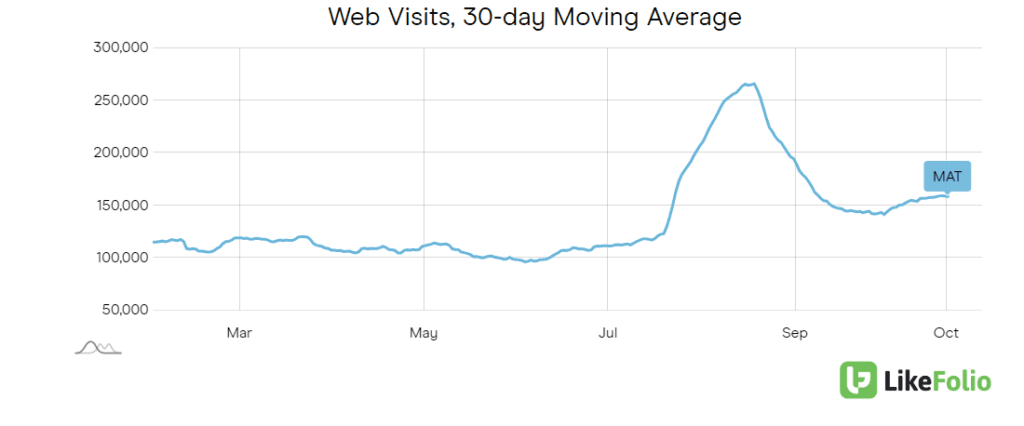

Just check out web visits, which include those to its online shopping site:

Note that bump on the far right side of the chart.

After coming off the initial Barbie high, visits are ticking back up again.

This suggests the muted outlook the company provided may have been too overly cautious.

- “Weak” Holiday Sales Already Priced In

The potential slowdown in the toy industry, particularly heading into the critical holiday shopping season, is being driven by concerns over inflation and a pullback in consumer spending.

This apprehension is reflected in the drop in consumer confidence and worries about prolonged high interest rates, leading to fears that consumers may spend less on toys such as dolls and board games.

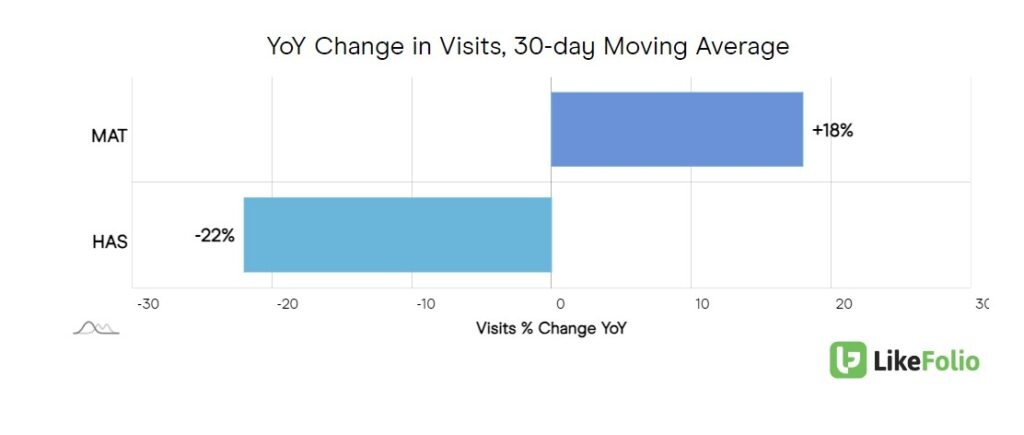

Both Hasbro and Mattel's shares have been negatively impacted by these industry concerns. Hasbro's third-quarter revenue fell short of Wall Street expectations, leading the company to cut its full-year revenue outlook significantly, from an initial decline of 3-6% to a now anticipated 13-15% drop. This revision, along with the overall softer toy outlook, caused Hasbro's shares to slide more than 12% before market opening.

Similarly, despite Mattel's better performance in the third quarter, its stock also dropped by over 12% in premarket trading, influenced by broader industry sales concerns and a forecasted mid single-digit decline in global toy sales for the full year.

However, LikeFolio data suggests not all toy companies are created equally.

And right now, Mattel is pulling ahead.

We’ll be keeping an eye on both of these companies into the holiday season. But right now, Mattel has a leg up and we like the long-term trajectory.