Despite recent market volatility and some arguing for a bear […]

Is this tech stock about to turnaround?

Pinterest's journey from a humble digital mood board to a pandemic-era sensation has been nothing short of a rollercoaster ride.

Thriving as a haven for creativity and inspiration during lockdowns, it connected millions to a world of ideas when they needed it most.

However, as life resumed its usual pace, Pinterest faced a stark reality with waning user interest and financial challenges.

Now the platform appears poised for a potential turnaround, fueled by strategic AI investments and key partnerships, signaling a new, transformative chapter in its story.

While we aren't pounding the table for Pinterest (PINS) like during the pandemic, LikeFolio emerging data gives room for optimism, backed by strong web and Google Trends data and a recent earnings beat by Snap Inc. that might hint at a similar outcome for Pinterest.

Recent Performance and Challenges Set a Low Bar

Over the last three months, PINS shares have dipped nearly -15%. This decline followed the company's Q2 earnings, which revealed a concerning trend: expenses growing faster than revenue. Sales increased by 6% year-over-year, but total costs and expenses jumped by 11%. A key factor driving these expenses were Pinterest's significant investment in AI, aimed at enhancing user experience and ad performance.

LikeFolio Data Turning Green

Despite these challenges, LikeFolio data indicates improvement for Pinterest:

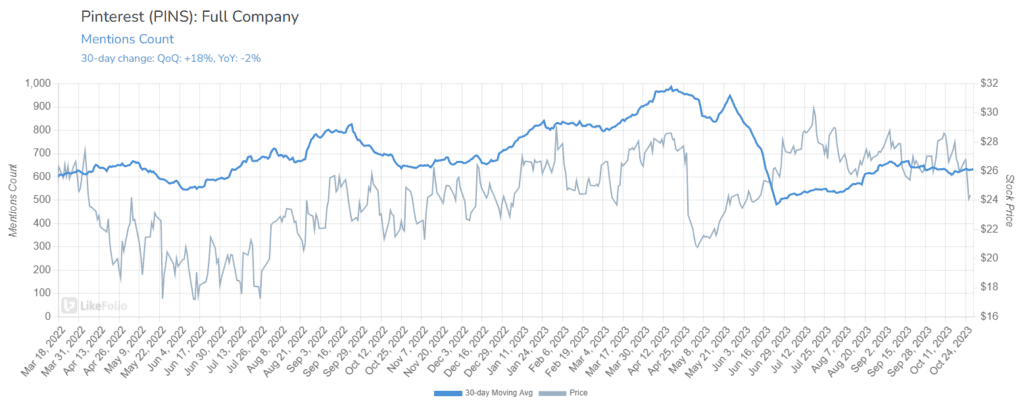

- Mentions: PINS mentions are up +18% quarter-over-quarter (down -2% YoY), showing a notable recovery from a -21% year-over-year drop last quarter.

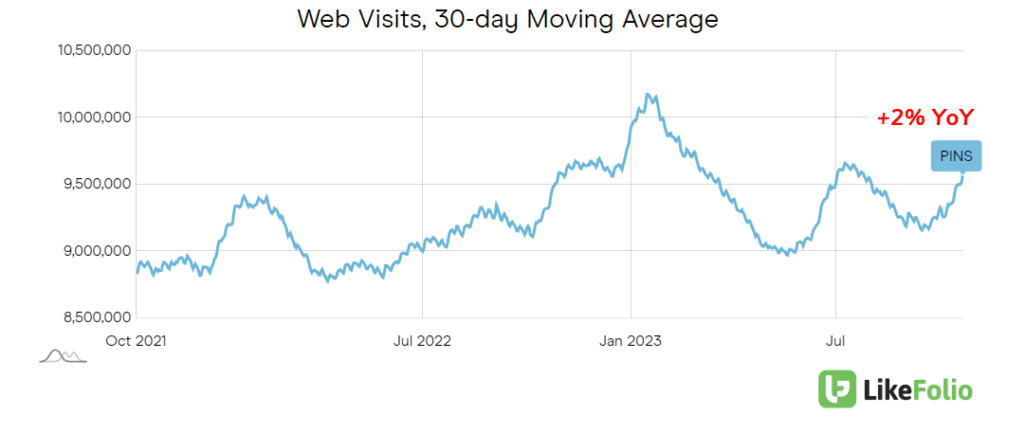

- Web Traffic: U.S. web visits have increased by +2% year-over-year and +8% on a two-year stack. Given the higher ARPU in the U.S. compared to global averages, this uptick is crucial.

- Global Interest: Pinterest's global searches are climbing, signaling growing international interest.

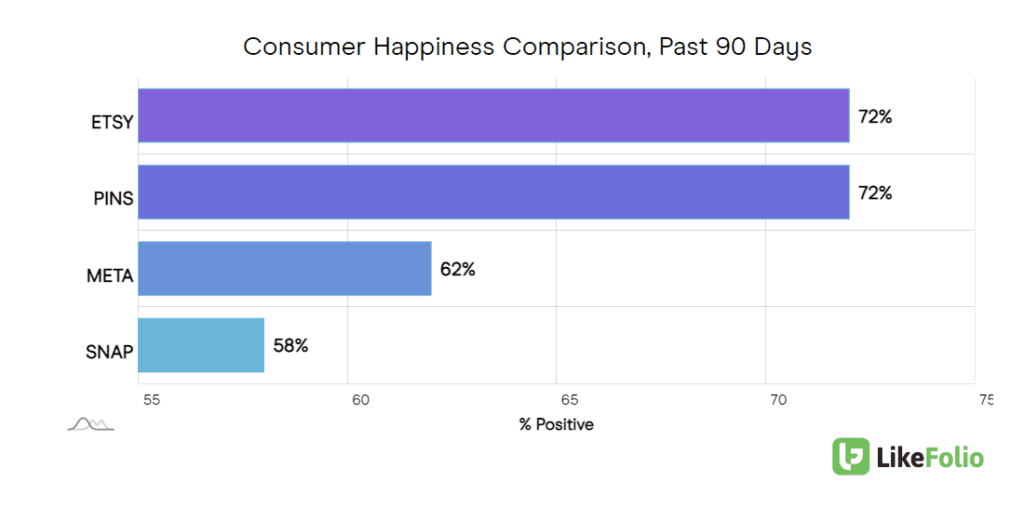

- Advertising and User Happiness: Pinterest's advertising potential is underscored by a high happiness rating (+72% positive), comparable to platforms like Etsy and outperforming Meta and Snap. This positive sentiment is crucial for attracting and retaining advertisers.

What is driving this turnaround in user metrics?

Five Reasons for Optimism

- AI Investments: Pinterest's strategic AI investments are paying off, with recommender models now 100 times larger than before. Enhanced AI-driven content personalization, including ads, is improving user engagement and ad performance.

- CEO's Vision: The CEO's recent comments highlight a surge in shopping-related engagement and ad revenue growth, outpacing overall revenue increases. Innovations in ad products and measurement tools are attracting more advertisers.

- International Monetization Potential: With 80% of monthly active users globally but only 20% of revenue from these markets, there's a massive opportunity for international revenue growth.

- Amazon Partnership: A Game Changer Pinterest's partnership with Amazon introduces third-party ads to its platform, significantly boosting Pinterest's ad inventory and potential revenue. This collaboration, leveraging Amazon's vast advertising segment, is expected to enhance Pinterest's ad rates and relevance, while also improving profit margins by reducing sales and marketing expenses. The success of this partnership could lead to further third-party ad collaborations, amplifying Pinterest's long-term growth and profitability.