Call it narcissism, or call it knowing exactly what you […]

Wayfair (W) is Winning in a Tough Market

When Wayfair rose to popularity at the peak of the pandemic, the bullish thesis was clear.

Here was an eCommerce home improvement retailer ready to send the latest and greatest trends in décor directly into consumer living rooms.

And goodness knows consumers were spending a lot to revamp living spaces where they were suddenly spending all of their time.

Now, Wayfair’s growth prospects are a bit more nuanced, as fears about macro headwinds in the home improvement sector and higher interest rates weigh on investors.

But investors with access to real-time consumer data can look below the surface.

Here's why we at LikeFolio are bullish on Wayfair ahead of its earnings report:

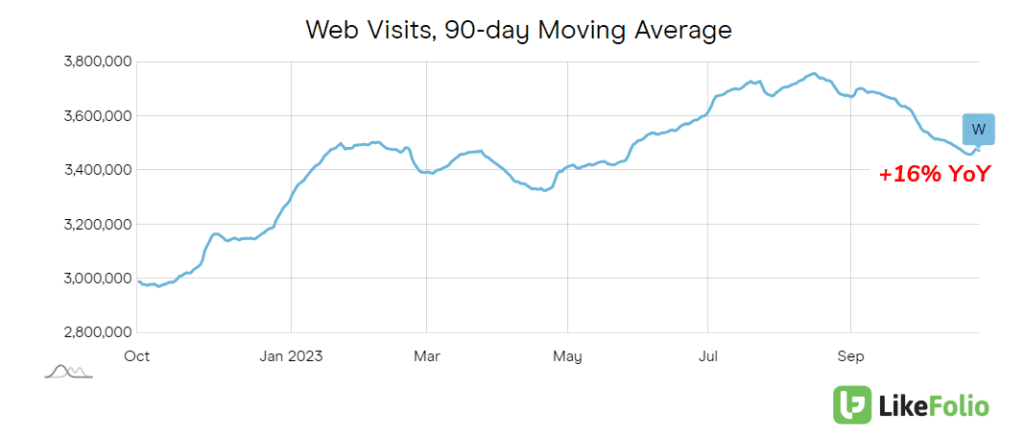

1. Strong Consumer Demand and Web Traffic: LikeFolio's earnings score for Wayfair stands at a bullish +59. This positive sentiment is driven by notable improvements in consumer demand and a surge in web traffic. Despite a low volume selloff since August 3rd, our data suggests that the market might have been too hasty in its judgment.

2. Impressive Q2 Earnings: Wayfair's stock witnessed a surge post its Q2 earnings, which notably exceeded market expectations. The company reported an adjusted earnings of 21 cents per share, in stark contrast to Wall Street's anticipated 73-cent loss. Furthermore, the total net revenue of $3.17 billion surpassed the expected $3.10 billion. This robust financial performance propelled Wayfair's stock price by 18%, reaching its highest level since May 2022.

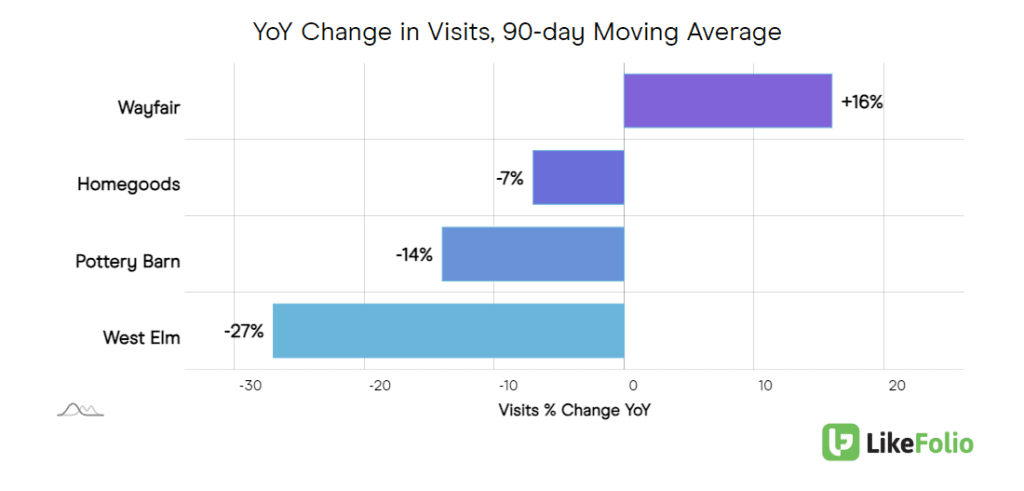

3. Digital Dominance: In the realm of digital traffic, Wayfair is outshining its peers. With a 16% YoY growth in web visits, it stands as a beacon of green amidst a sea of red, outperforming other home improvement giants like TJX's Homegoods, WSM's West Elm, and Pottery Barn.

4. Capitalizing on Market Shifts: The closure of Bed Bath & Beyond presents a golden opportunity for Wayfair. With Bed Bath & Beyond's annual revenue still exceeding a billion dollars, despite a significant drop, Wayfair, with its vast online presence, is poised to capture a significant portion of this market.

5. Consumer-Centric Events: Wayfair's recent "Way Day" event, held on October 25-26, showcased the company's commitment to offering value to its customers. The event featured substantial discounts on a plethora of products, leading to a 7% YoY increase in buzz.

6. Back-to-School Boost: The back-to-school shopping season, which witnessed record-breaking spending, likely provided a significant boost to Wayfair's sales. With college students and their families spending an average of $1,367 per person, Wayfair had a prime opportunity to expand its market share in this retail sector.

Bottom Line

It’s important to acknowledge the broader challenges facing Wayfair and its peers. The U.S. home improvement market, valued at around $1 trillion, has been experiencing a slowdown in spending growth. This deceleration, influenced by softening home prices, slowing wage growth, and potential recession fears, poses challenges for the industry.

But Wayfair's unique positioning in the market, combined with its digital dominance and consumer-centric approach, makes it a strong contender for a positive earnings surprise. The market might have priced in the headwinds, but we at LikeFolio see potential for an upside. Wayfair might just be the underdog story we've all been waiting for.