Airbnb (ABNB) AirbnB is set to report earnings for the […]

Airbnb's Troubling Trends: A Deep Dive

When sifting through tweets and headlines about Airbnb, one often encounters horror stories.

These range from women finding a bat-infested castle house in Michigan to travelers driving cross-country, only to have their reservations cancelled, leaving them stranded and financially burdened. Heck, Hollywood even produced a movie inspired by such incidents.

As an Airbnb user, I've noticed two key things:

1) Airbnb's pricing can be significantly higher than direct bookings — a personal comparison for a 3-night stay revealed a $600 difference.

2) This markup, once widely recognized by users and property managers, could lead to a loss in sales for Airbnb. My own booking decision (hint: not through Airbnb) reflects this sentiment.

However, these stories and my experience aren't just isolated incidents but indicators of a deeper issue with Airbnb's business model, as evidenced by LikeFolio data.

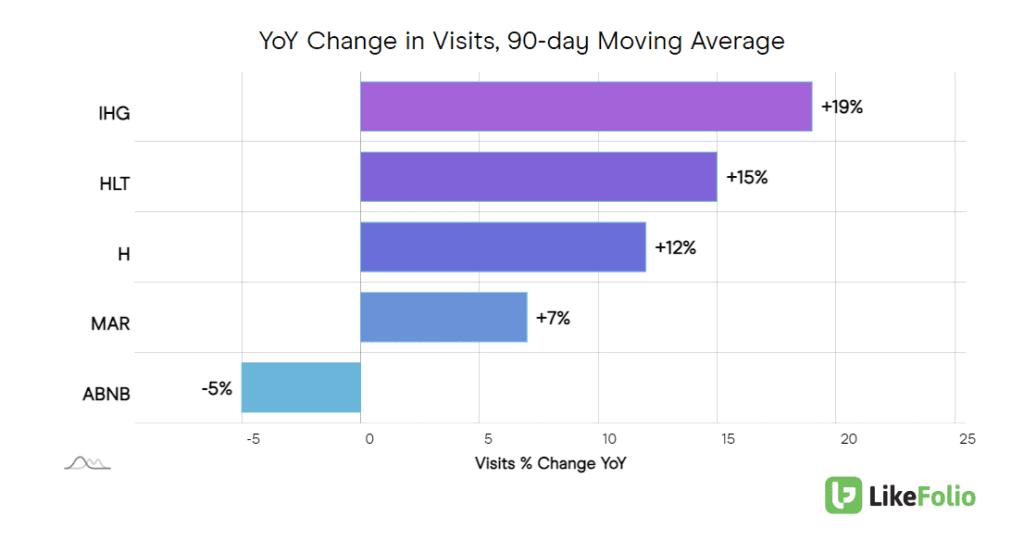

Web visits have plummeted to their lowest since October 2022, showing a 5% year-over-year decline after a lackluster summer, and are significantly lower compared to traditional lodging options.

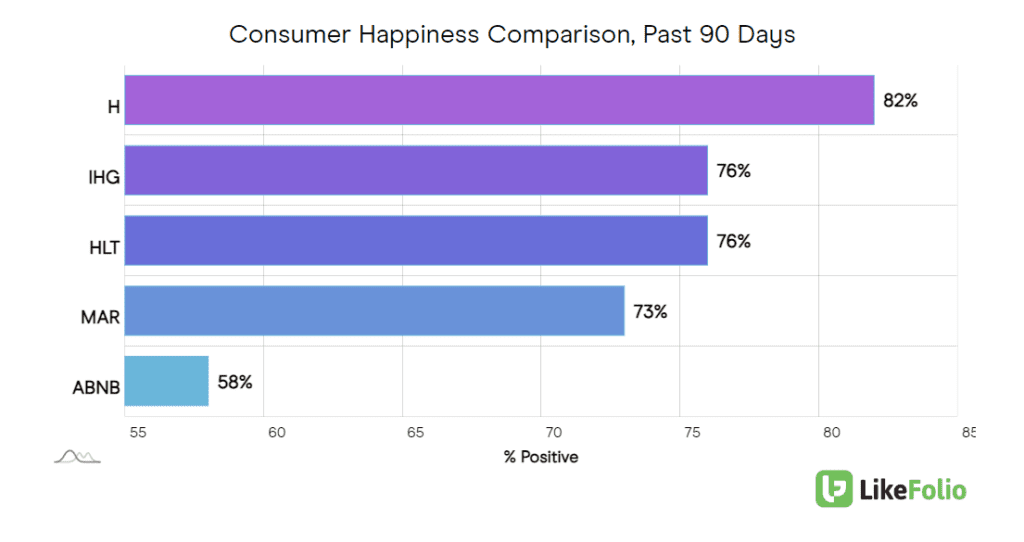

More troubling for a long-term perspective, Airbnb lags behind these traditional competitors in customer happiness levels.

It’s not even close.

Despite reporting an 18% increase in year-over-year revenue to $2.48 billion in its Q2 earnings, surpassing expectations, Airbnb saw a slowdown in nights and experiences booked, growing by almost 11% but not meeting the anticipated 117.6 million. Nevertheless, net income increased notably to $650 million. The company also launched "Rooms" to offer more affordable rentals and improve growth and customer service, partially utilizing AI technologies like OpenAI's GPT-4.

Bottom Line

This booking slowdown, coupled with legislative challenges in various cities (NYC, for instance), is worrisome for Airbnb's long-term prospects.

Although the company has compensated for some weaknesses with higher prices, the strategy appears to be alienating customers.

The combination of low happiness levels and a sharp decline in web traffic are major concerns.

We're bearish on this trend and don't see any stock price drops as buying opportunities. For long-term investments in consumer travel, other options seem more promising.