Expedia (EXPE) Soaring on Investor Optimism Today the online travel […]

Expedia: Worth a Bet?

Expedia's last earnings report revealed several important trends in the travel sector:

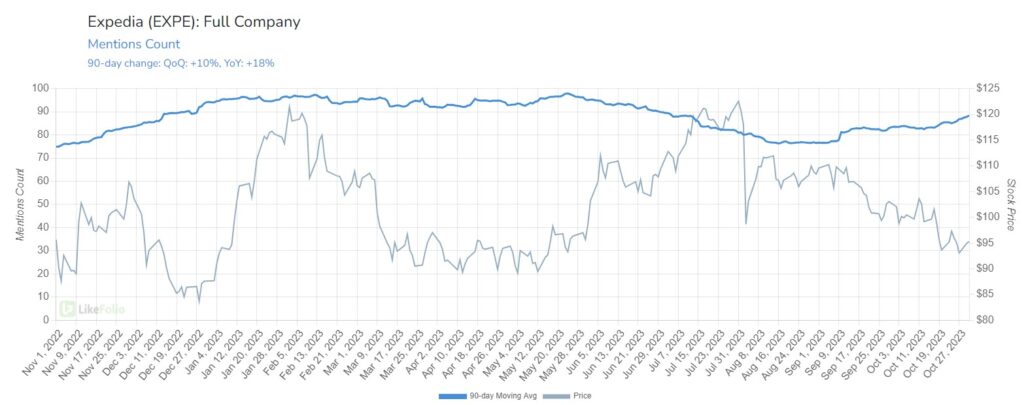

- Strong and Evolving Travel Demand: Travel demand is showing resilience, with significant interest particularly in North America and Europe, and notable growth in APAC and Latin America. LikeFolio's data, indicating an 18% YoY increase in Expedia Mentions, aligns with this trend, highlighting the sector's potential for continued expansion.

- Changing Travel Preferences: There's a shift towards shorter, urban stays rather than the traditional longer vacations in resort destinations. This trend reflects changing consumer behaviors and preferences, influenced by wider social and economic factors.

- Consistent and Responsive Pricing Trends: Expedia is maintaining stable pricing amidst a fluctuating market. Hotel and vacation rental rates remain consistent year-over-year, with a decrease in U.S. domestic airfares due to more available flights. Additionally, rental car rates are dropping as inventory levels normalize, potentially encouraging more travel.

Market Position and Consumer Insights

Despite these positive indicators, Expedia's stock performance is currently behind that of Booking Holdings (BKNG).

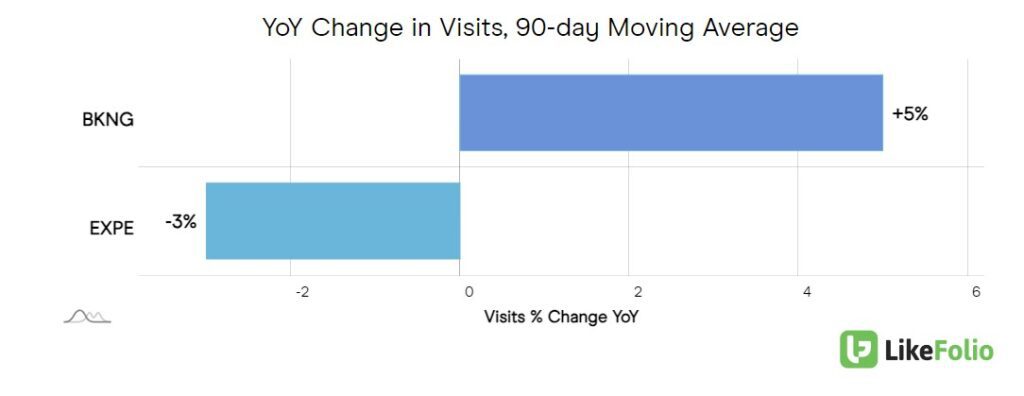

LikeFolio's analysis points to this being a reasonable trend, with Expedia's web traffic…

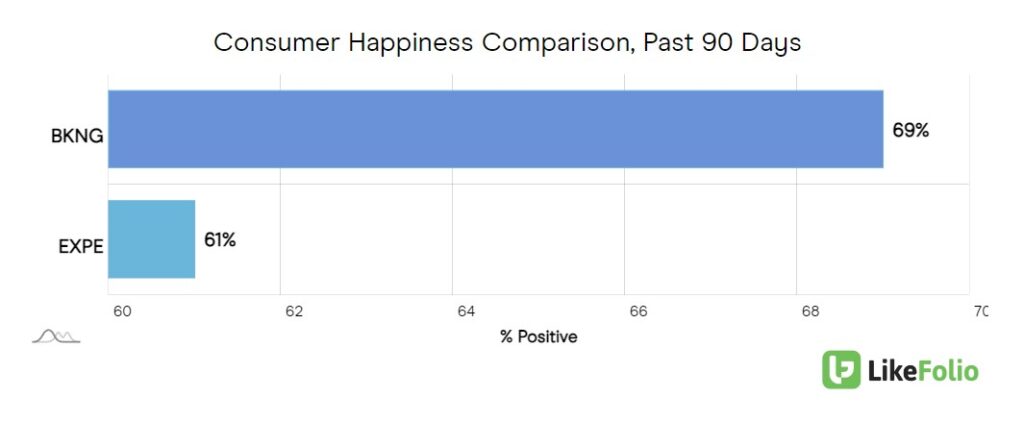

and metrics like customer satisfaction…

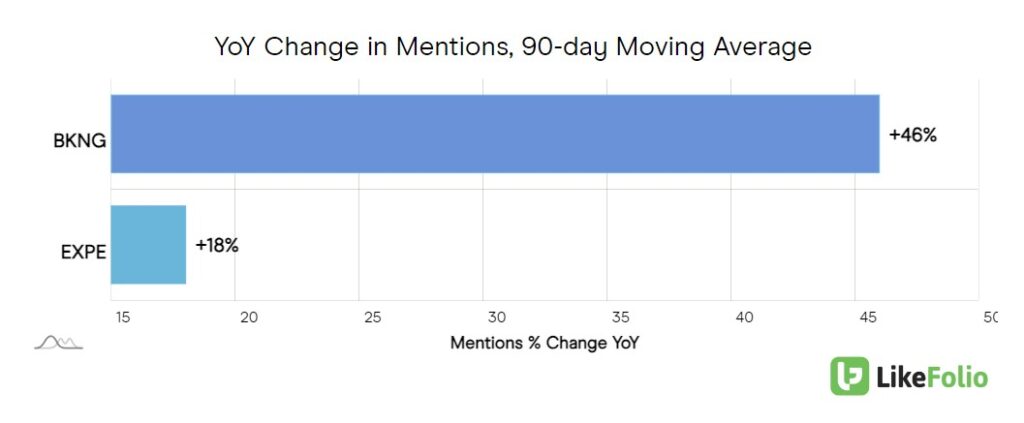

and mention growth falling short of Booking's.

The stock market seems to have already integrated these factors into Expedia's current valuation.

Forward-Looking Strategies for Expedia

Several of Expedia's initiatives could help to drive future growth. For instance:

- Launch of One Key: Expedia's new U.S. loyalty program aims to offer more flexibility and a range of rewards across different travel services, enhancing customer loyalty and potentially differentiating Expedia in a competitive market.

- Advancements in Technology and AI: Expedia is incorporating AI and machine learning to create more personalized customer experiences, with features like conversational trip planning in the Expedia app.

- Expansion in B2B Segment: The B2B area of Expedia is growing quickly, with a 32% year-over-year increase. Partnerships with companies like Mastercard and Walmart, where Expedia provides the technology for their travel booking platforms, are central to this growth. These partnerships help Expedia reach a wider audience and offer specialized services.

- Financial Health and Future Outlook: Expedia's record revenue and EBITDA indicate a focus on long-term growth and profitability. The company's continued stock buybacks demonstrate its confidence in its future performance.

Investment Considerations

While we're observing from the sidelines, Expedia's overall situation suggests potential for growth, especially given its current stock price.

After all, Mentions ARE still growing.

For long-term investors, dips in the stock price might offer accumulation opportunities, considering Expedia's strategic plans and the resilient demand in the travel market.