Airbnb (ABNB) AirbnB is set to report earnings for the […]

Travel Resurgence? ($ABNB, $EXPE, $BKNG)

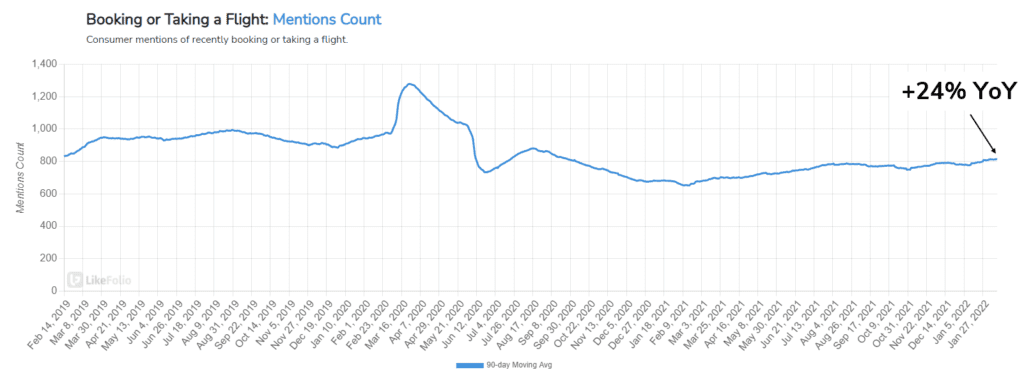

Travel resurgence could be the economic feel-good story of 2022 if early trends hold:

+24% year-over-year is a good start, and we’re expecting pent-up demand to ramp the growth rate through the year as coronavirus fears wane. So, who’s set to benefit the most?

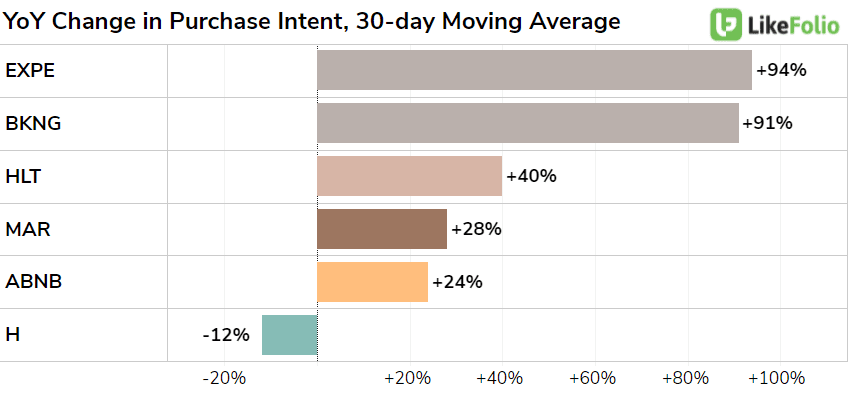

Booking aggregators like Expedia (EXPE) and Booking.com (BKNG) are surging in overall consumer demand mentions – nearly doubling where they were a year ago.

Hotel chains like Hilton (HLT) and Marriott (MAR) are getting a nice bump in early 2022, while Hyatt (H) showing negative growth in demand year over year is concerning, given the overall macro trend.

AirBnB’s (ABNB) 24% year-over-year demand growth is better than it looks considering that the company was a “road trip” solution for many vacationers during the pandemic, making its growth near hotel peers impressive.

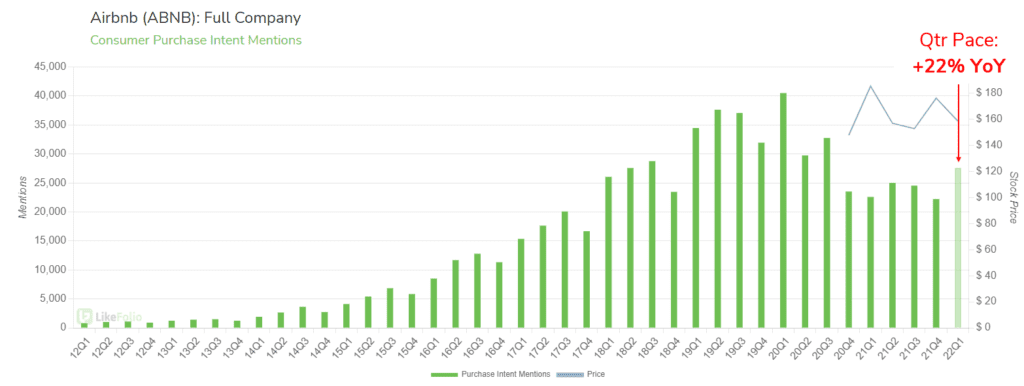

Additionally, LikeFolio consumer demand data suggests that AirBnB’s demand growth rate is holding steady into the current quarter, pacing at +22% YoY.