United Parcel Service (UPS) After two quarters of explosive demand […]

UPS vs. FDX – Which is the better buy from here?

As the business world eagerly anticipates FedEx's (FDX) earnings report, all eyes are on how it stacks up against its long-standing rival, UPS. Despite shared challenges in the logistics sector, recent trends and strategic moves paint a contrasting picture for these two giants.

UPS: Bouncing Back with a Strategic Edge

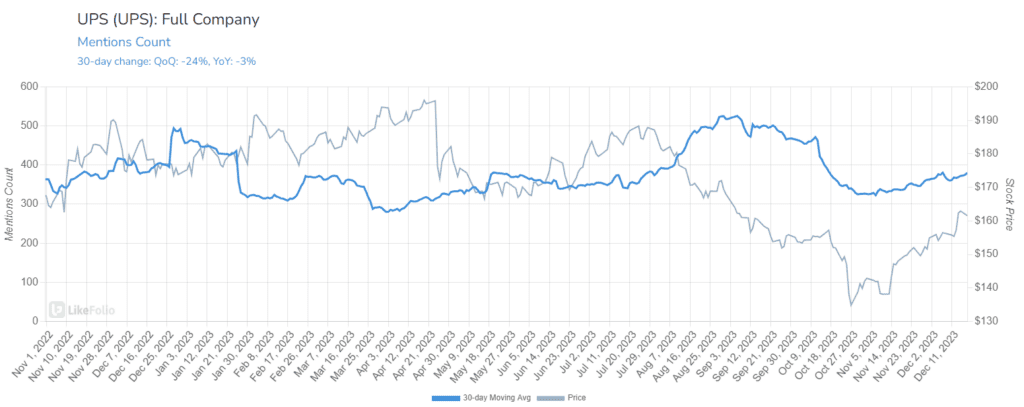

UPS is showing signs of resilience and strategic growth. Data from LikeFolio highlights a promising upswing – its mention volume is down just -3% year-over-year on a 30-day moving average, a significant improvement from the -14% seen on a 90-day moving average. This rebound is crucial as we step into the holiday season, a period traditionally critical for logistics companies.

Web traffic for UPS has increased by +4% year-over-year, indicating a rising customer interest and potentially higher business volumes.

In contrast, FedEx web traffic has dipped by -2% in the same period.

UPS's sentiment remains robust, hovering around 55% positive and in line with FDX.

UPS’s improving metrics are not just a flash in the pan; they have been building for some time, as pointed out in LikeFolio's October Trend Watch report highlighting UPS as a compelling opportunity for long-term investors. UPS shares have traded nearly +20% higher from October lows.

A qualitative review sheds light on a key differentiator for UPS - customer preference.

When given a choice, consumers tend to lean towards UPS, citing a superior shipping experience encompassing customer service, package handling, and delivery speed. This preference has real-world implications for businesses making shipping decisions. For instance, Chewy's reliance on FedEx for package delivery has reportedly impacted its customer satisfaction levels.

Adding to its strategic arsenal, UPS's acquisition of Happy Returns significantly boosts its capabilities in reverse logistics. This move not only enhances package pickup and processing efficiency but also taps into the burgeoning returns market. By leveraging Happy Returns' network of over 10,000 drop-off locations and introducing convenient, box-free, label-free returns at UPS Stores, UPS is streamlining operations and elevating customer service in the e-commerce returns space.

However, it's not all smooth sailing for UPS. The company reported lower-than-expected revenue for the third quarter and adjusted its full-year revenue forecast downwards, from $93 billion to a range of $91.3 billion to $92.3 billion. This decline in revenue, from $24.16 billion to $21.06 billion, reflects the impact of global economic uncertainty on demand. Despite this, UPS CEO Carol Tomé remains optimistic about the company's readiness for the peak holiday season.

Amidst these challenges, UPS adheres to a "better not bigger" approach, willingly accepting reduced volumes to prioritize more profitable deliveries. This strategy, although resulting in short-term revenue declines, is part of a larger plan to enhance revenue quality and operational efficiency, focusing on value over volume.

Looking ahead, the bar is set at very different levels for both names. FDX shares are trading +20% higher over the last 6 months vs. UPS shares dipping -6% lower in the same time frame. This suggests opportunity to the upside for UPS, especially considering LikeFolio's improving consumer metrics. In contrast, we see more risk to the downside for FDX, and are bearish ahead of its earnings event this afternoon.

Later this week, we'll give a high level view on the largest actual player in package delivery -- hint: it's not FDX or UPS, but its changing the delivery game.