Apple (AAPL) iPhone 12 Update Apple delayed (and then staggered) the release of […]

Riding the Shopify Wave $AFRM

As the holiday season unfolds, Affirm (AFRM) emerges as a standout name for investors looking to capitalize on the e-commerce boom.

Why do we say that? Affirm's exclusive Shopify partnership looks to be thriving this holiday season.

This season, Shopify has outperformed its competitors in both in-person and broader e-commerce spending.

Shopify's Success and Affirm's Role

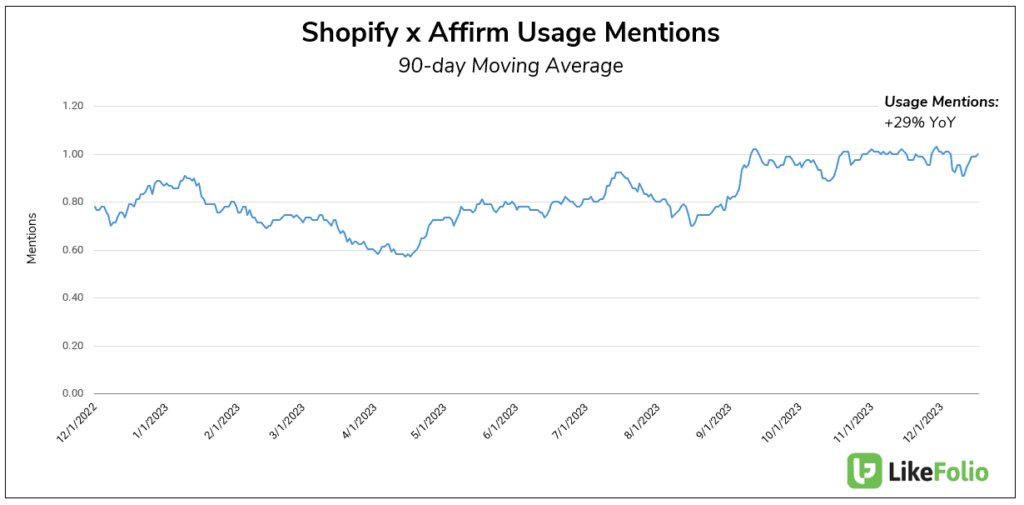

Shopify mentions have surged by 23% year-over-year, indicating a strong consumer preference for the platform. Although Affirm's mentions remain relatively flat, a deeper qualitative analysis reveals a crucial trend: a significant number of Shopify customers are opting for Affirm's financing at checkout.

In fact, consumer mentions of using Affirm within the Shopify ecosystem have jumped by 29% compared to last year.

The Appeal of Buy Now, Pay Later (BNPL)

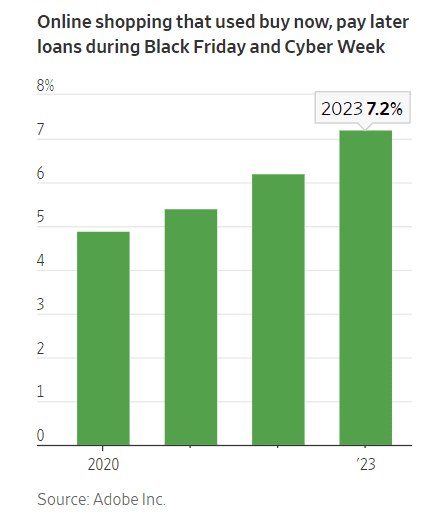

BNPL platforms like Affirm are increasingly popular, partly because they do not report to credit agencies such as Equifax. This feature allows consumers to maintain lower credit card balances and protect their credit scores. Statistically, one in four American adults has utilized BNPL loans.

During key shopping periods like Black Friday and Cyber Week, BNPL loans accounted for 7.2% of all online sales, marking a 25% increase from the previous year. This trend is also contributing to a decline in the use of store credit cards.

Affirm's Competitive Loan Offers

Affirm stands out in the BNPL market by offering loans up to $25,000 with interest rates ranging from 0% to 36%. These rates are tailored based on the borrower's credit status, repayment schedule, and the type of purchase. Retailers, in collaboration with Affirm, often offer attractive terms like 0% interest at checkout, contrasting sharply with the average credit card interest rate of 21.19%.

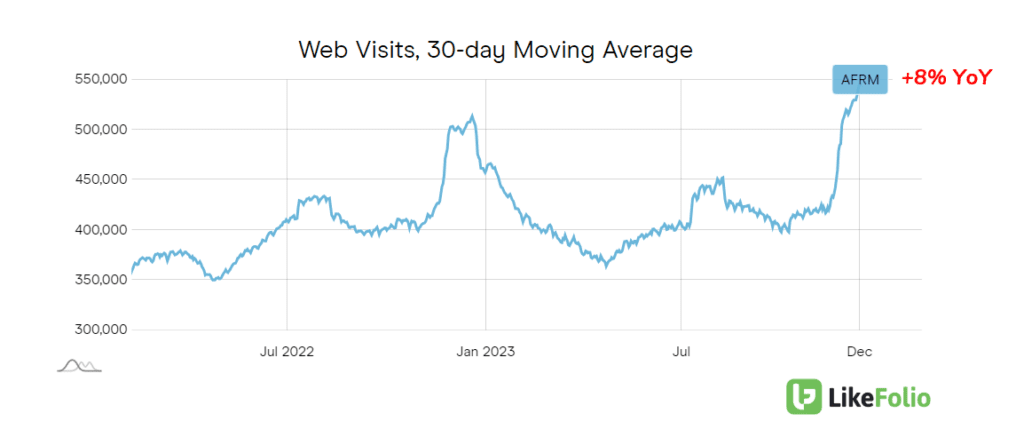

Growing Web Visits and Expanding Partnerships

Affirm more than a Shopify tertiary play; its web visits have accelerated into the holiday season, showing an 8% year-over-year increase indicating growing consumer engagement and utilization.

Additionally, Affirm has expanded its reach by partnering with Amazon to provide BNPL options for small business owners.

These partnerships are pivotal, indicating that Affirm is building a robust and diversified base, moving beyond its previous reliance on single retailers like Peloton.

Contrasting Perspectives: Morgan Stanley Downgrade vs. Data Trends

Despite a recent downgrade by Morgan Stanley, sent shares lower, LikeFolio data trends paint a different picture, especially for this holiday season.

The surge in e-commerce channels like Shopify, coupled with the growing preference for BNPL financing options, positions Affirm as a potentially lucrative way to leverage the e-commerce upswing. As consumers increasingly finance their holiday expenditures, Affirm's role in facilitating this trend may prove to be an opportunity for gains for investors.

In conclusion, Affirm's strategic partnerships, particularly with Shopify and Amazon, and its alignment with current consumer financing trends, make it a compelling option for investors looking to benefit from the e-commerce sector's growth. As the holiday season progresses, Affirm's role in this domain is likely to become even more pronounced.