Netflix (NFLX) Last quarter, Netflix shares fell more than 6% after missing EPS and adding fewer […]

Logitech (LOGI) Demand is Cooling Off

Logitech (LOGI) Demand is Cooling Off

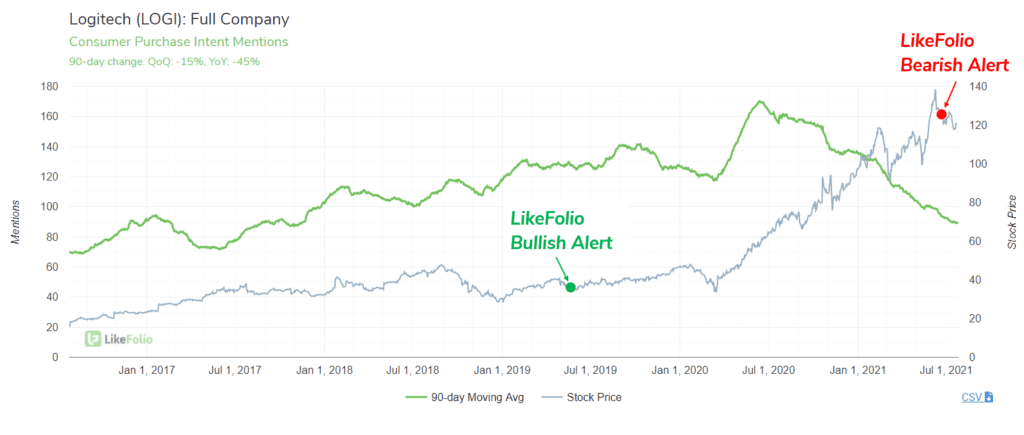

We've been Bullish on LOGI for years.

LikeFolio issued a Bullish Opportunity Alert in May 2019 when shares were trading under $37. Shares surged by more than 280% through early June.

Then we noticed something...consumer demand for Logitech products was dropping off significantly.

We issued a Bearish LOGI in June...and since then LOGI share price has cooled, currently trading ~4% lower.

The company has smashed earnings expectations in recent quarters, as evident by recent stock performance. But now, LikeFolio data suggests things are normalizing for Logitech.

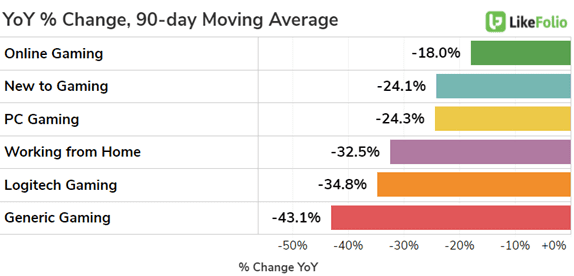

A massive shift to working from home supplied an unexpected boost in 2020. In addition, PC gamers clamored for gaming accessories.

Mentions of PC Gaming and Working from Home have dropped significantly vs. 2020 (though both remain higher vs. pre-Covid levels).

The concerning note is that Logitech demand growth has fallen below 2019 levels... suggesting consumers haven't upgraded setups yet.

LOGI Demand in 22Q1 was -28% lower vs. 2019 levels, and is currently pacing -45% YoY.

Logitech has some of the highest levels of Consumer Happiness in our coverage universe at 83% positive. But near-term, it may not be enough to boost sales over a very high bar.