United Parcel Service (UPS) After two quarters of explosive demand […]

A Closer Look at the Silver Shortage

A Closer Look at the Silver Shortage

Yesterday, we highlighted rising demand for silver bullion products, but that's only one aspect of the mounting silver supply shortage.

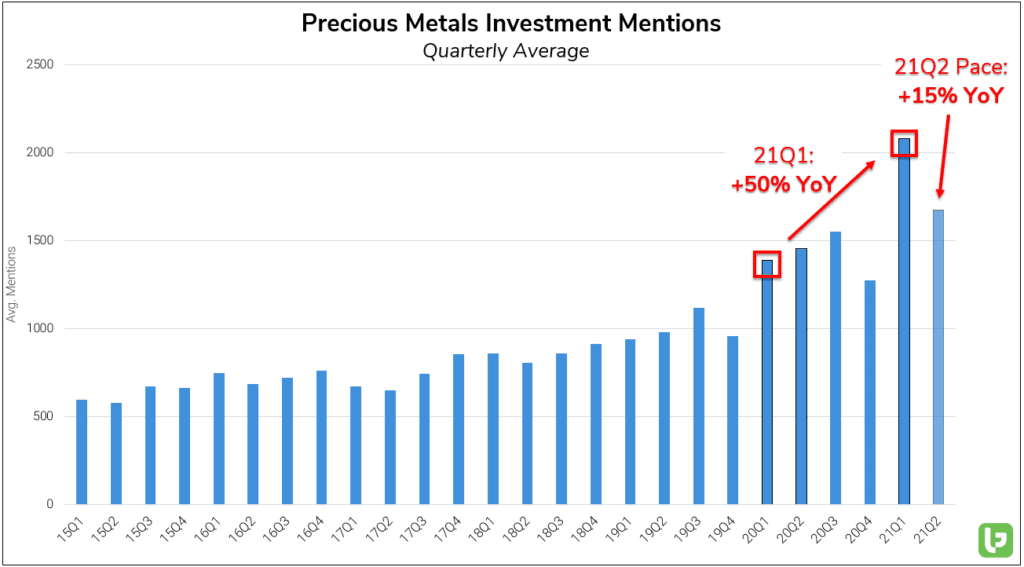

Consumer Mentions of purchasing or investing in precious metals are still showing immense strength, trending +15% YoY in the current quarter (ending 6/30).

It's important to note that the YoY period of comparison (20Q2) saw a massive increase in the price of both silver and gold, driven by record-high delivery demand on the COMEX.

While many consumers prefer to invest in physical silver (coins, bars, etc.), there's been an equally large influx in demand for a new silver investment vehicle:

Physical Silver Trust ($PSLV).

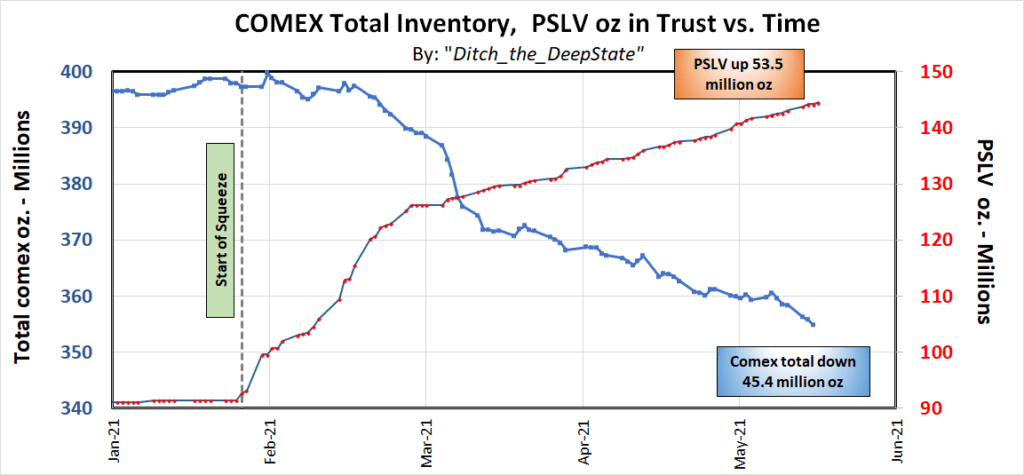

Since the start of the "Silver Squeeze" in late January of 2021, PSLV has added ~53M ounces of silver to its holdings, while total inventories on the COMEX have fallen ~45M.

Why is this significant? Because COMEX's silver futures have served as the generally accepted price discovery mechanism for more than 50 years. COMEX sets the rules, and only the largest players can participate in a meaningful way.

If silver continues to leave the COMEX warehouse and enter the hands of individual investors at the current pace, we could see a shift in the status quo regarding this highly demanded precious metal.