Last September we used Purchase Intent data to predict that […]

AAPL: Sometimes the best place to be is the sidelines.

Last quarter LikeFolio made a bold prediction: Apple demand looked muted. Our earnings signal supported this thesis, coming in at -58 due to significant weakness in demand growth.

But we were right. Shares fell -3% after Apple reported Q4 sales that missed expectations, weighed down significantly by supply chain constraints. While we're sidelined for this event, here's what is top of mind for us heading into this report:

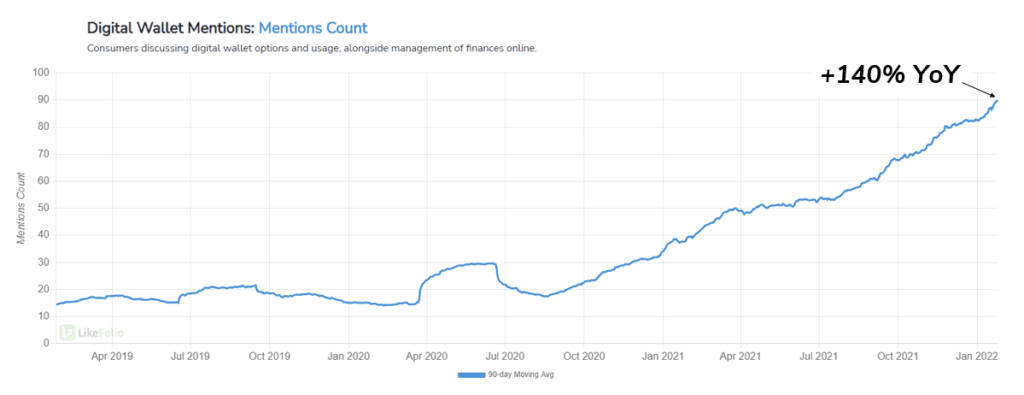

1. Apple Pay is well-positioned to thrive. Digital wallet usage mentions are rocketing as consumers use their phone vs. physical cards to complete transactions.

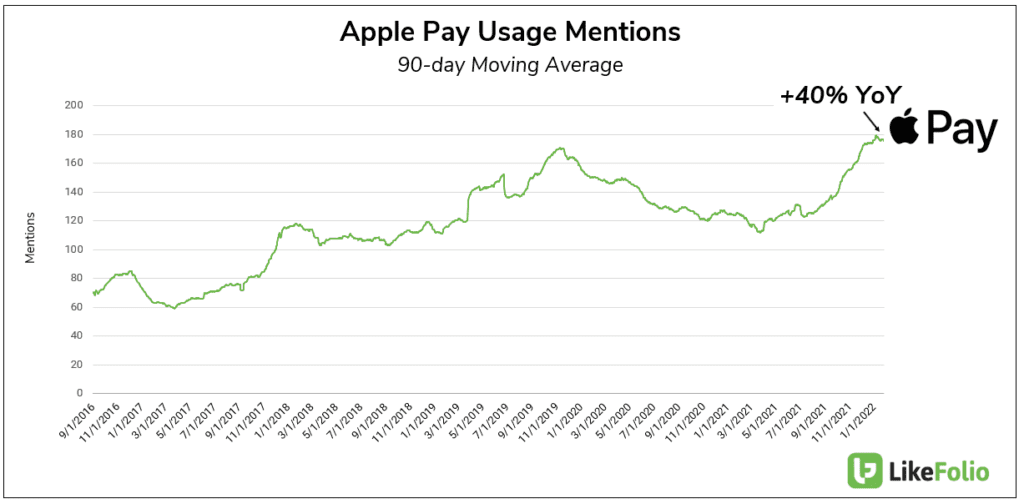

Apple Pay usage mentions are at an all-time high, +40% higher vs. the same time last year.

Nice traction.

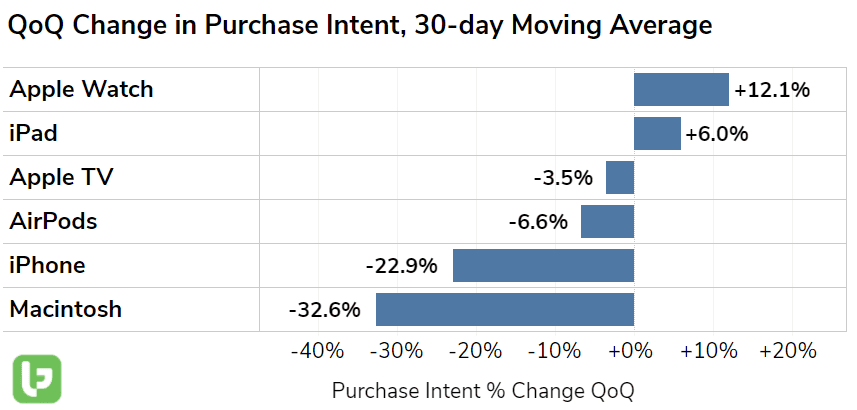

2. Apple Watch and iPad had a nice Holiday season, but product demand for larger items (ahem, iPhone) remains muted.

You can see a seasonal ramp for Apple's very giftable wearable watch and tablet. However, iPhone demand looks lackluster. If investors are looking for a surprise resurgence in phone sales, they may be out of luck.

3. Services growth is still critical moving forward. Apple Pay is a key component of these service offerings referenced, along with cloud storage, Apple TV, Apple Music, the App Store, and all corresponding advertising spend. LikeFolio data shows service usage mentions remain +24% higher on a 2-year comparison. Last quarter, the services segment was Apple's second-largest revenue driver, trailing only the iPhone.

4. Apple users aren't deserting the brand. We analyzed mentions from consumers jumping ship -- either joining or leaving the Apple iPhone team. And data shows this user flow is tipping in favor of Apple...just not enough to move the needle when it comes to iPhone sales on a larger scale. Apple reports earnings after the bell. Stay tuned.