Last September we used Purchase Intent data to predict that […]

Apple Demand Looks Muted...for Apple

Apple Demand Looks Muted...for Apple

Hear us out...

Apple is a monster.

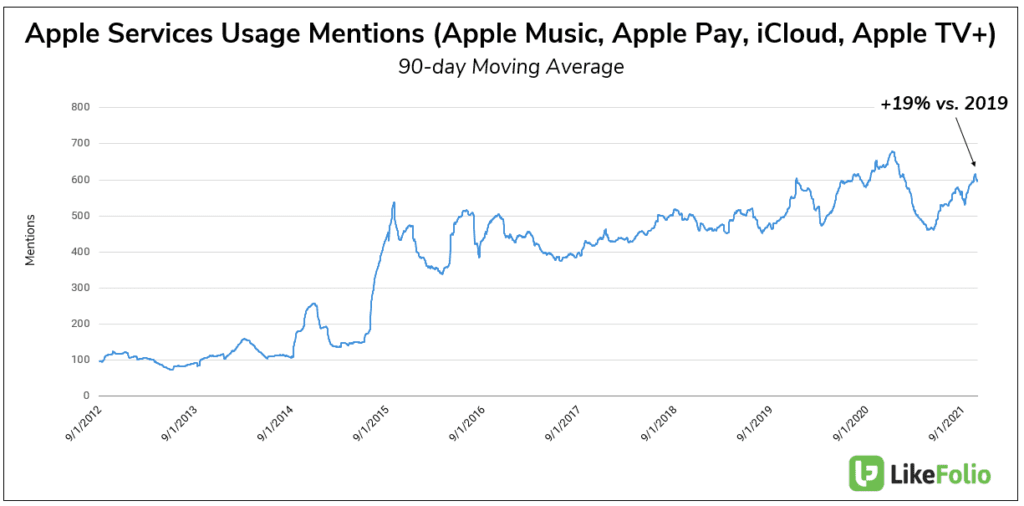

Last quarter, the company generated more than $81 billion in revenue, a June quarter record. Its services segment grew by +33% YoY, now comprising more than 20% of the company's revenue.

At LikeFolio, we've been keyed in to tremendous demand growth in devices like iPads and Macs, the workhorses of the working-and-learning-from-home shift we witnessed over the last year and a half.

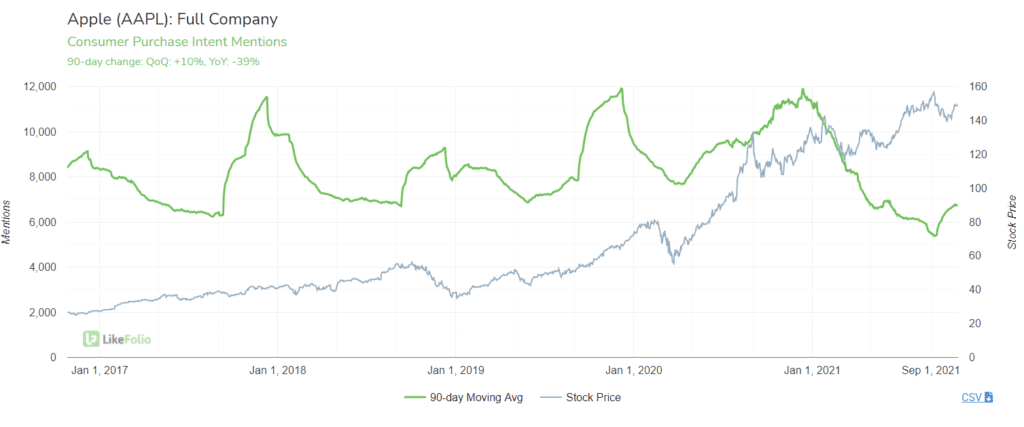

But now, things are slowing down for Apple, at least when it comes to demand growth. You can see this on the chart below.

We've broken critical Apple segments down ahead of Apple 21Q4 earnings. Here's what we've found...

The Bad News...

- Consumer demand for the iPhone 13 lineup lags 2020 levels: -19% YoY.

- Overall demand for AAPL products shows short-term slack.

The Good News...

- Apple is gaining more loyalists: upgrade mentions remain consistent, and more consumers report switching to an iPhone device vs. 2020: +5% YoY. Meanwhile, "switching to an Android" mentions are falling.

- For Apple consumers who DID purchase a new iPhone device, the majority opted for the most expensive version.

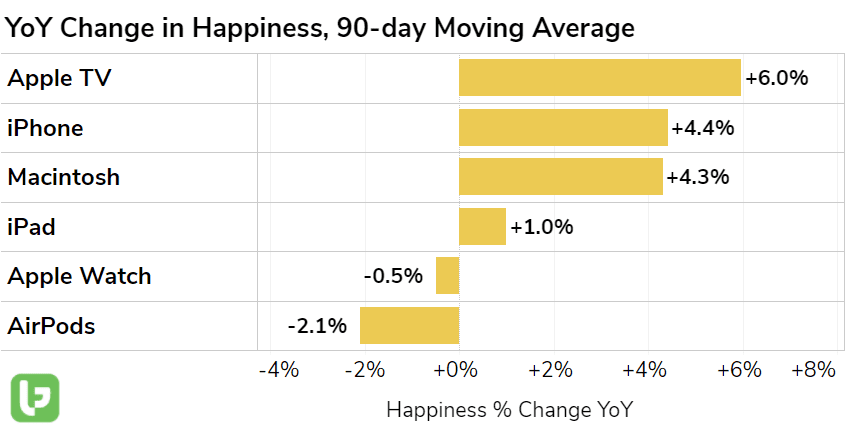

- Happiness is rising for key Apple Products, namely the iPhone, Mac, and iPad.

Looking Ahead…

- While Apple service usage mentions remain above 2019 levels, these mentions have tempered vs. 2020. Will these gain steam as more devices land in consumer hands?

- Recommend monitoring demand for popular gift items, including AirPods, Apple Watch, and Apple TV.

- The new MacBook Pro received significantly more buzz YoY (+14%) and happiness has jumped +6 points since launch. Watch for continued traction.

What does this all mean?

Apple may have a tough time clearing an extremely high bar today.

But this quarter likely isn't the "big one" for the company. Keep an eye on demand in the coming months to understand how consumers are shopping during the Holiday season. We certainly will be...