Activision Blizzard (ATVI), Take-Two Interactive (TTWO) Gaming is gaining steam […]

Activision (ATVI) is on Fire

October 5, 2022

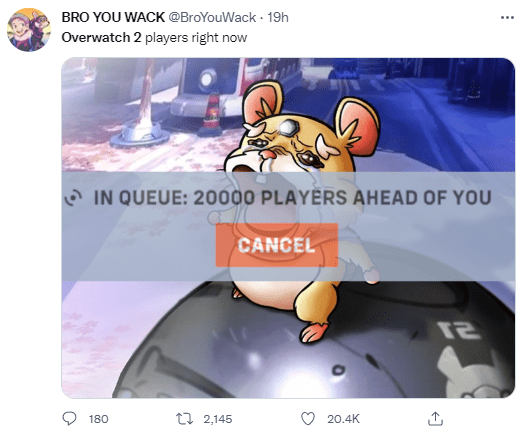

| Early data from LikeFolio reveals Activision Blizzard (ATVI) has a winner on its hands…that is if consumers can play the game. |

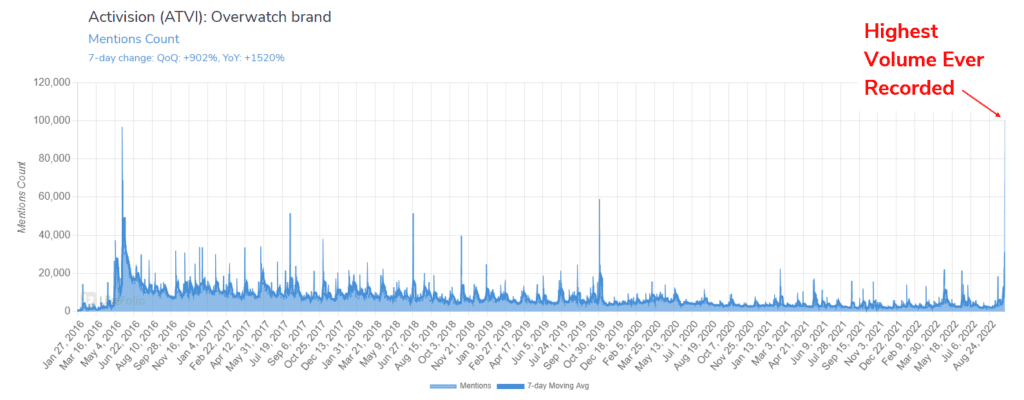

| Earlier this week Activision launched the highly anticipated Overwatch 2 -- a (now) free-to-play game that allows players to duke it out against each other, regardless of the platform they are using. Gamers were buzzing. The Overwatch brand received more than 100,000 consumer mentions on launch day, the highest volume ever recorded for the game, including its initial launch in 2016. |

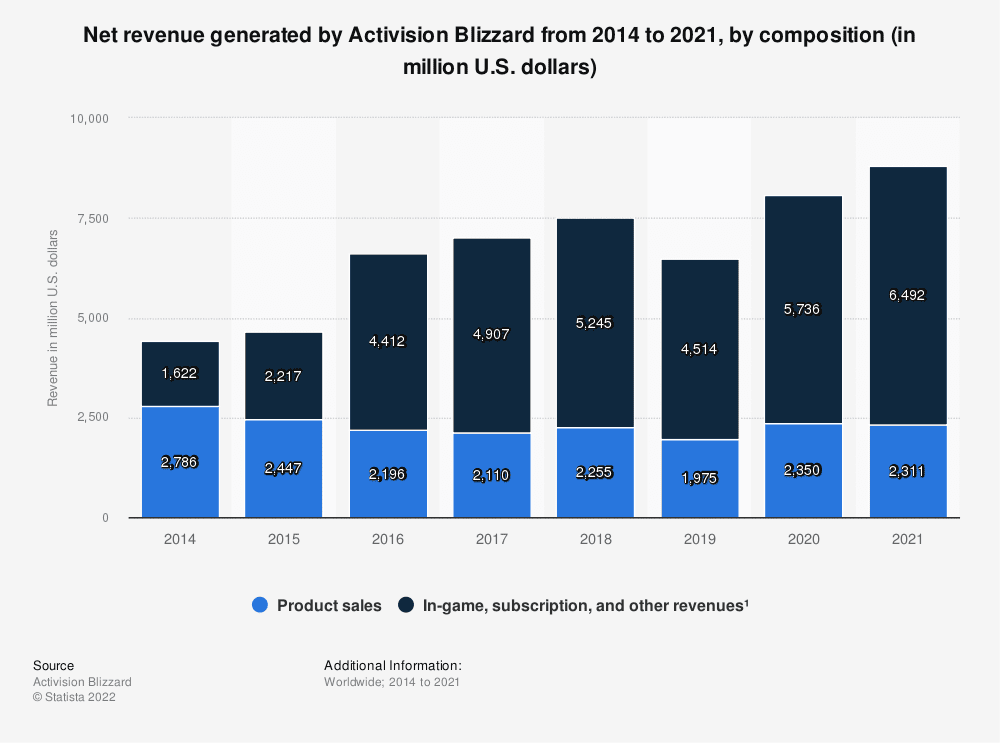

| While the company certainly had kinks to work through (it was hit with a DDoS attack, or denial of service, that prevented successful matchmaking for players) – sentiment leading up to the launch was extremely positive. More importantly, this game launch also features updates that should pique investor interest: In-game add-ons…or microtransactions. Microtransactions and in-game add-ons accounted for nearly 80% of Activision's revenue in 2021. These purchases include things like special premium levels, skins, and weapons players can utilize to personalize and enhance the gaming experience. |

| Translation: don’t be spooked by the “free-to-play” nature of this game, or any of the games under Activision’s umbrella. It’s not about product sales, anyway. The Overwatch 2 launch includes multiple points of microtransaction generation and extended playing time. Activision’s monetization strategy is outlined below: |

- Staggering the game release with a seasonal model, ensuring new content every 9 weeks, and keeping users engaged

- Launching a new in-game shop that facilitates purchases with “Overwatch Coins” -- a new virtual currency that costs real dollars

- Adding a Premium version of the Battle Pass available for purchase that features a premium skin and ability boost

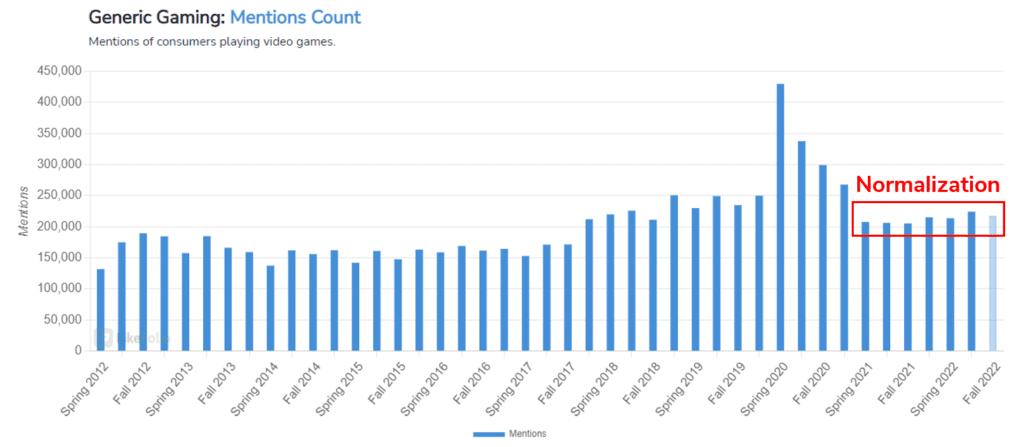

| Looking ahead, Activision has other highly anticipated game launches on its docket for the remainder of the year, including Call of Duty: Modern Warfare II at the end of October. These launches are critical for future growth, especially as overall gaming trends normalize from pandemic highs. |

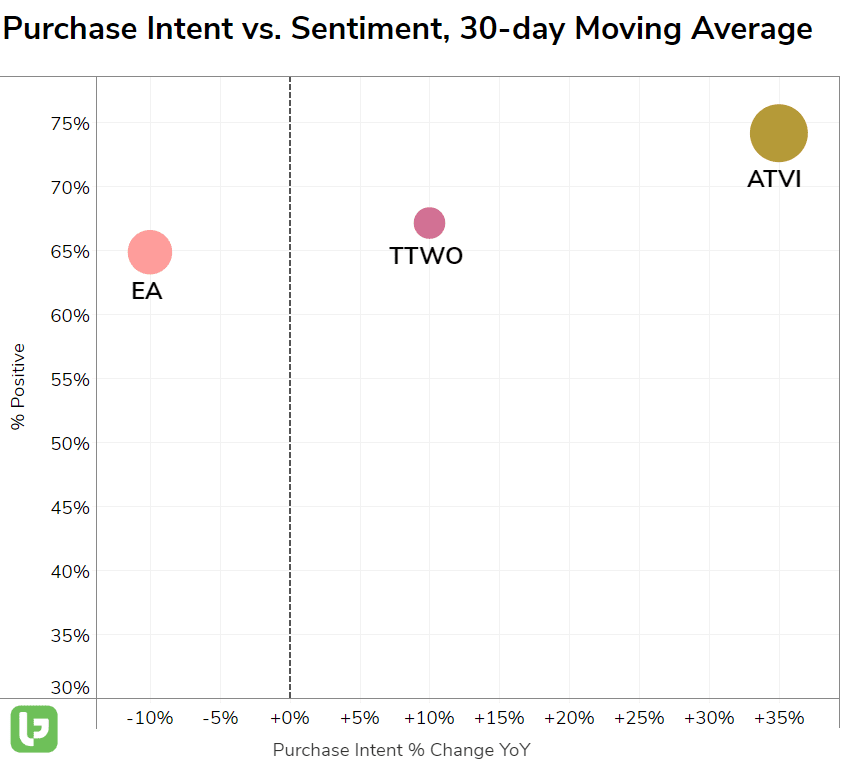

| The good news: for now, Activision’s new content and monetization strategy is giving the game maker a serious leg up on competition. |

This certainly helps to explain why Microsoft is adamant about making its case to acquire the company…to the tune of $70 billion.

This deal is pending regulatory approval. But in the meantime, it looks like Activision (and thus, potentially Microsoft) is well positioned for future growth and market share steal.

Want FULL Access? Click Here for LikeFolio Pro

Tags: