When we look at Adobe's consumer purchase intent (PI) mentions […]

Adobe is Still Growing its Subscribers in 2021

Adobe is Still Growing its Subscribers in 2021

Adobe (ADBE), with its subscription-based suite of software products ‘Creative Cloud’, has emerged from the pandemic stronger than ever before.

The entire American economy has undergone a major shift over the past 2 years, and some of the biggest beneficiaries have been software-as-a-service (SAAS) providers -- Adobe stands as one of the premiere names in the SaaS industry.

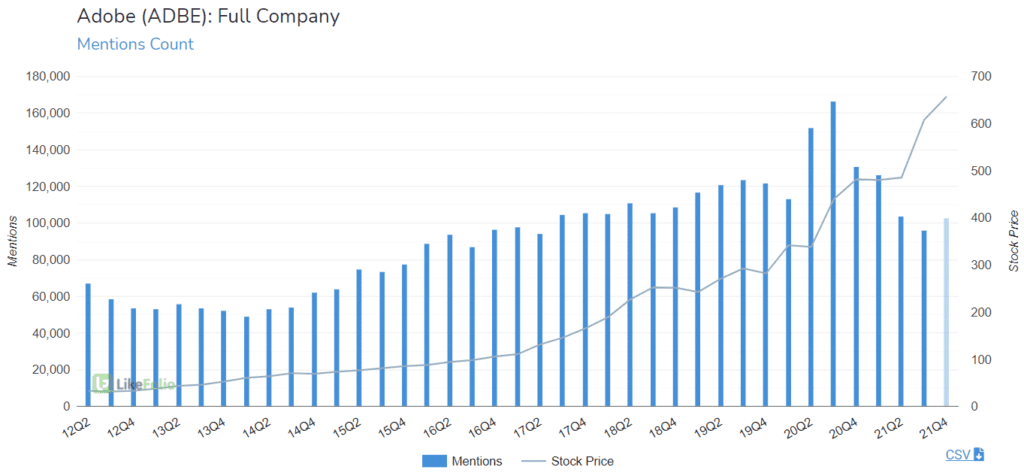

From LikeFolio’s consumer-facing perspective, ADBE’s most-mentioned brands include some of its wildly popular creative software applications, such as Photoshop, Lightroom, and Illustrator. Adobe's total combined brand Mentions pushed to new ATHs last year but have since pulled back, trending roughly -15% vs. 2019 in the ongoing 21Q4 (ending Dec 3).

Although Total Mention volume has declined vs. the 2020 highs, Adobe’s subscription-focused business model has continued to generate impressive revenue growth.

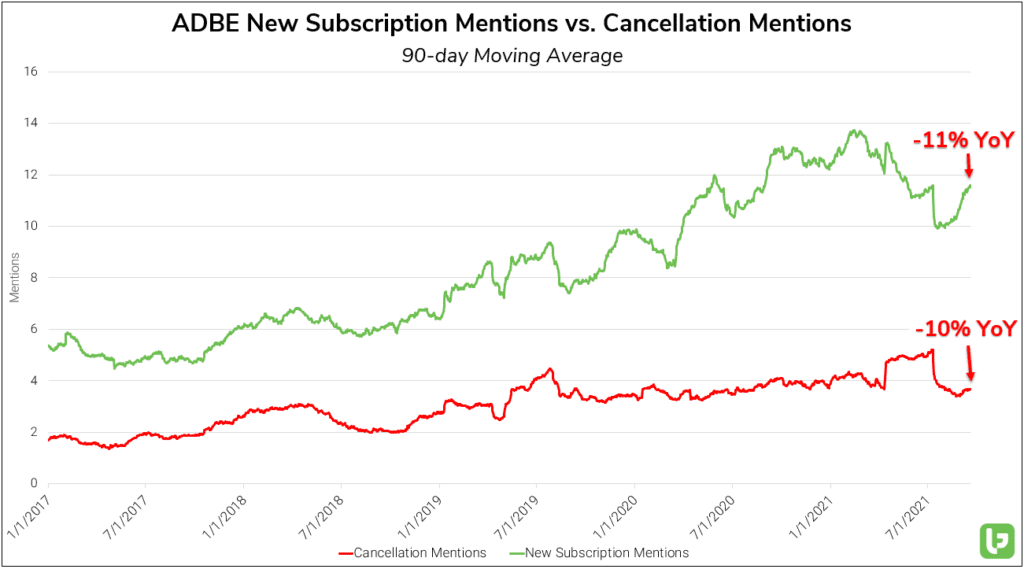

Last quarter, ADBE reported better-than-expected revenue, up +23% YoY --Subscription revenues led the way with a gain of +24% YoY, accounting for 92% of total sales for the quarter. A comparison of subscription-specific Mentions helps to contextualize the company’s true growth trajectory:

Mentions of consumers subscribing to ADBE's Creative Cloud have fallen -11% YoY -- Mentions of consumers canceling a Creative Cloud subscription have also fallen -10% YoY. Despite the equivalent year-over-year slowdown, the volume of New Subscriptions Mentions remains more than 3x higher than that of Cancellation Mentions.

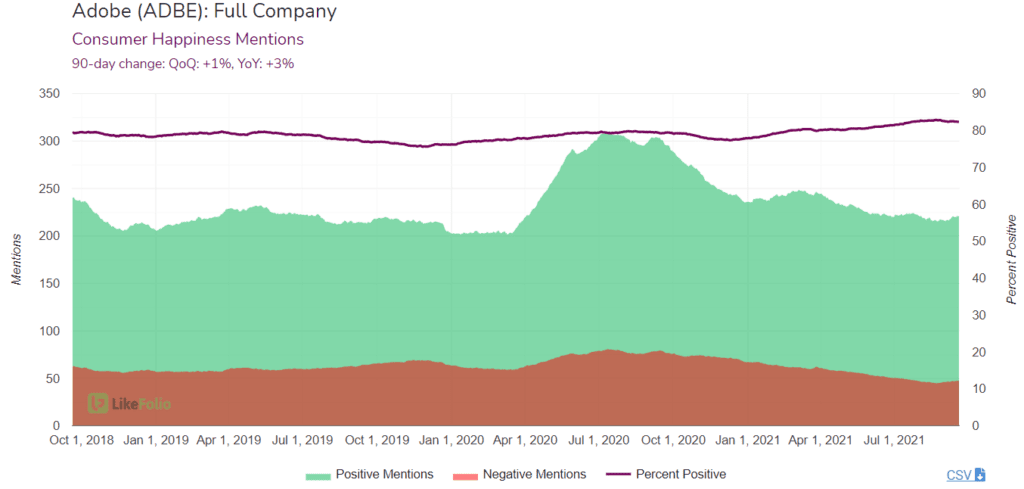

Additionally, Adobe maintains a phenomenally high and consistent level of Consumer Happiness (>80% Positive).