Airbnb (ABNB) AirbnB is set to report earnings for the […]

AirBnB Comeback Attempt Is Underway

In an industry grappling with tightening consumer budgets and macroeconomic uncertainty, Airbnb (ABNB) continues to stand out. While the broader travel sector faces significant challenges, Airbnb’s performance is a bright spot in terms of both traffic growth and consumer sentiment.

Let’s break down the key elements influencing Airbnb’s recent performance and what investors should be watching for in the quarters ahead.

Traffic Tells the Story

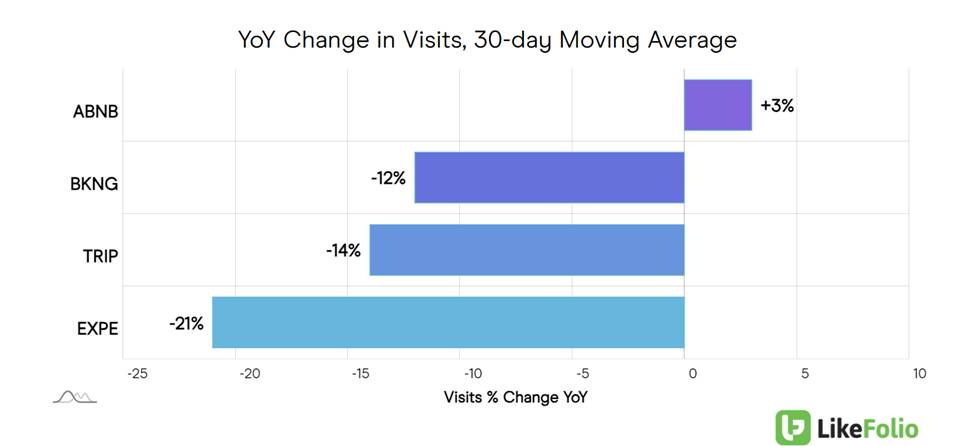

One of the most telling indicators of Airbnb’s relative strength is its year-over-year (YoY) web traffic growth. While Expedia (EXPE), Booking Holdings (BKNG), and TripAdvisor (TRIP) have all seen double-digit YoY declines in visits, Airbnb stands alone with a 3% increase. This is a clear sign that Airbnb’s platform continues to attract users, even as competitors struggle.

However, it’s not all positive. Quarter-over-quarter (QoQ), Airbnb’s web traffic has dropped 17%. This decline could be attributed to seasonal shifts in travel behavior or broader consumer caution. Despite this drop, Airbnb’s YoY growth demonstrates resilience in an industry where others are faltering.

Consumer Sentiment: A Mixed Bag

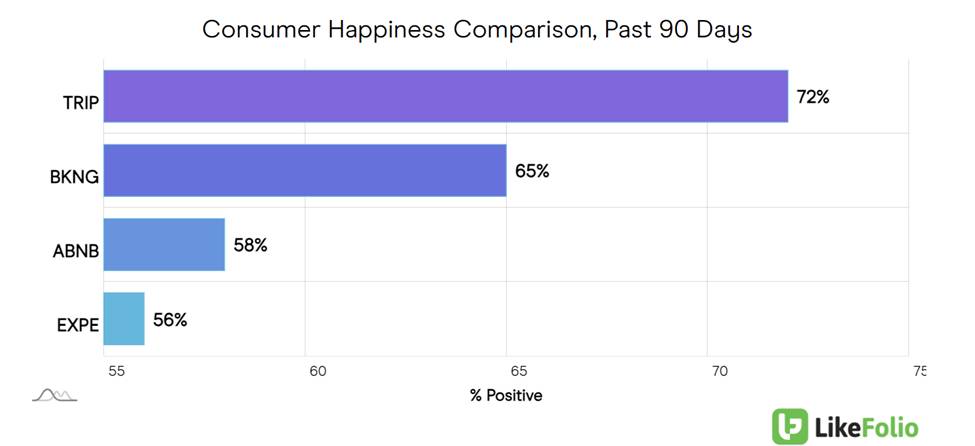

When it comes to consumer happiness, Airbnb has shown some improvement, but it still lags behind competitors. The company's efforts to improve the overall guest experience—through initiatives like Guest Favorites, Top Property badges, and Icon Experiences—have helped boost consumer sentiment by 4 percentage points in the last month. Currently, Airbnb’s consumer happiness score sits at 61%.

Still, this score is notably lower than TripAdvisor, which leads with a 72% happiness rating, and Booking.com, which boasts a 65% positive rating. The competition is fierce in this space, and Airbnb’s consumer satisfaction needs to continue improving to remain competitive.

The Impact of Operational Changes

One of the key factors contributing to Airbnb’s improved consumer sentiment is its decision to remove 200,000 underperforming listings that failed to meet guest expectations. This strategic move has led to a more consistent and reliable experience for travelers, which should help the company continue its upward trend in consumer happiness over time.

Additionally, Airbnb’s increased focus on international expansion—especially in less mature markets—offers potential for further growth. The company is leveraging its strong brand reputation to tap into new regions, creating opportunities that can offset some of the pricing pressures and margin constraints it's facing in established markets.

Financials: A Balancing Act

Airbnb's revenue growth remains a positive story. The company reported an 11% YoY increase in revenue in Q2, although earnings per share (EPS) missed estimates by $0.06. Looking forward to Q3, analysts expect revenue to rise another 9% YoY, but EPS is projected to decline by 7% as Airbnb continues to face pricing pressures and rising costs.

This decline in profitability is something to watch closely. While revenue growth is encouraging, Airbnb’s bottom line may continue to be squeezed by competition and macroeconomic headwinds. Shorter booking windows and an increase in last-minute bookings highlight the current consumer mindset—cautious spending and more price sensitivity, which could continue into the holiday season.

Stock Performance: A Mixed Picture

From a stock perspective, Airbnb shares have been volatile. Year-to-date (YTD), shares are flat, but they are down 12% over the past three months. The recent trend, however, has been more positive, with shares climbing 17% in the last month. Despite this upward momentum, Airbnb’s stock is still trading at a P/E ratio of 18.04, much lower than its three-year average of 39.7, suggesting potential value if the company can improve profitability moving forward.

Conclusion

Airbnb is navigating a challenging landscape better than most of its competitors. Its ability to grow web traffic and improve consumer sentiment amid sector-wide headwinds speaks to the strength of its brand and platform. However, short-term profitability concerns and heightened competition from major players like Expedia and Booking.com remain key risks.

Investors should keep an eye on Airbnb’s Q3 earnings report next month, as it will provide more insight into how the company is managing these challenges. In the meantime, Airbnb’s focus on international growth and commitment to improving the guest experience will be crucial drivers for long-term success.