LikeFolio's Consumer Happiness data on Papa John's has been incredible […]

AI’s Next Big Winner: Pizza? $DPZ

As Domino's Pizza (DPZ) gears up to announce its earnings on Thursday, October 12 before the bell, LikeFolio's earnings score is neutral.

Boring, you say.

However, we think investors have a few solid reasons to start leaning Bullish on this name, which seems to be a leader in tech…oh, wait, we mean pizza!

Here's why:

- Delivery Diversification Driving Sales: Last quarter, Domino's made a strategic move to counter the slowdown in its delivery business. How? By expanding its delivery horizons with a partnership with Uber's delivery arms, Uber Eats and Postmates. This decision wasn't just about meeting customer needs; it was about tapping into new sales avenues, with projections of adding $1 billion in new sales. The market's response? A hearty +11% leap in Domino's stock. With the service kicking off in four U.S. test markets and plans for a wider rollout (think national and in 27 international markets by the end of 2023), Domino's is baking some big plans.

- A Tech-Forward Approach with AI: Domino's recent partnership with Microsoft is a testament to its continuous drive to infuse technology into its operations. This collaboration aims to integrate AI and cloud computing, courtesy of Microsoft's Azure OpenAI Service, into its ordering system and store operations. But it's not just about tech; it's about enhancing experiences across the board — for customers, franchisees, and employees — while keeping a tight lid on data security and privacy. Plus, with an Innovation Lab on the horizon, Domino's is kneading its future tech strategies today.

- Historical Tech Innovations Setting the Stage: This isn't Domino's first rodeo with technology. The company has been a trailblazer, introducing industry-firsts like the Pizza Tracker and a proprietary ordering app. These innovations didn't just boost customer service; they revolutionized it. And with its platform compatibility stretching across Apple CarPlay to Amazon Alexa, Domino's has not just participated in the digital era; it has helped shape it.

Now, what does the data tell us?

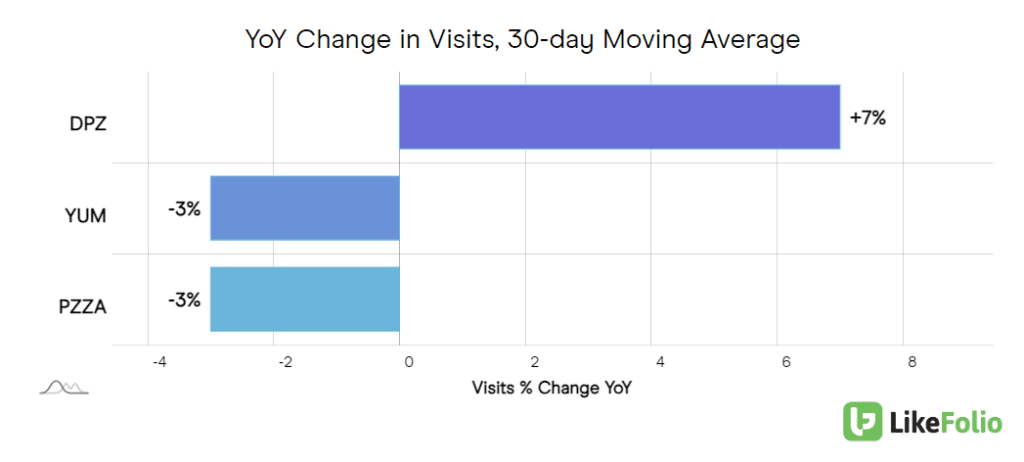

LikeFolio's web traffic data is showing some promising trends for Domino's.

The company's online visits have seen a +7% uptick YoY, a stark contrast to its peers like Papa Johns (PZZA) and Pizza Hut parent, YUM! Brands, both landing in negative territories.

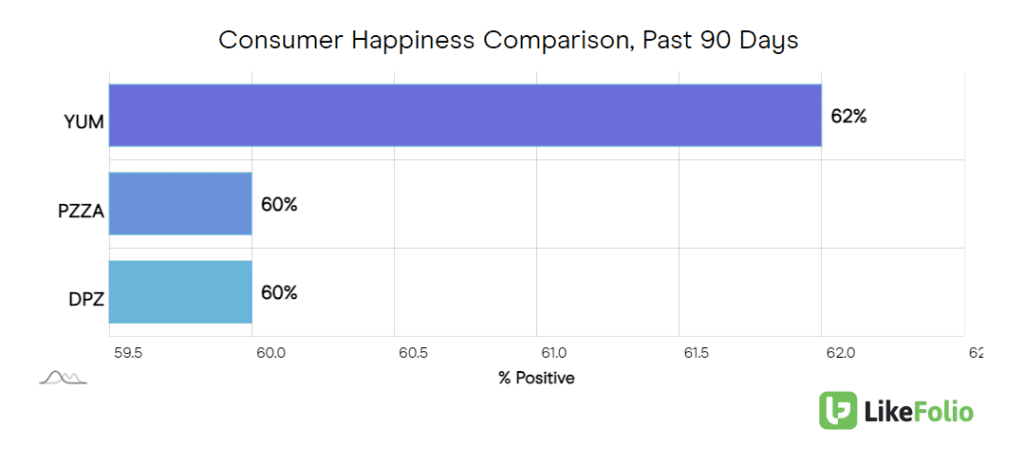

In terms of consumer happiness, DPZ is toe-to-toe with PZZA, both clocking a 60% positive sentiment, just a smidge behind YUM.

DPZ’s mentions have seen a bit of a cool down on a YoY basis, and the stock has slid by -8% over the past three months, eroding some of the gains following the delivery app announcement.

But this could prove to be an ideal setup.

Bottom Line:

Domino's didn't become a leader in pizza by accident. Its consistent, forward-thinking investments in technology played a big part. And it seems like history is repeating itself.

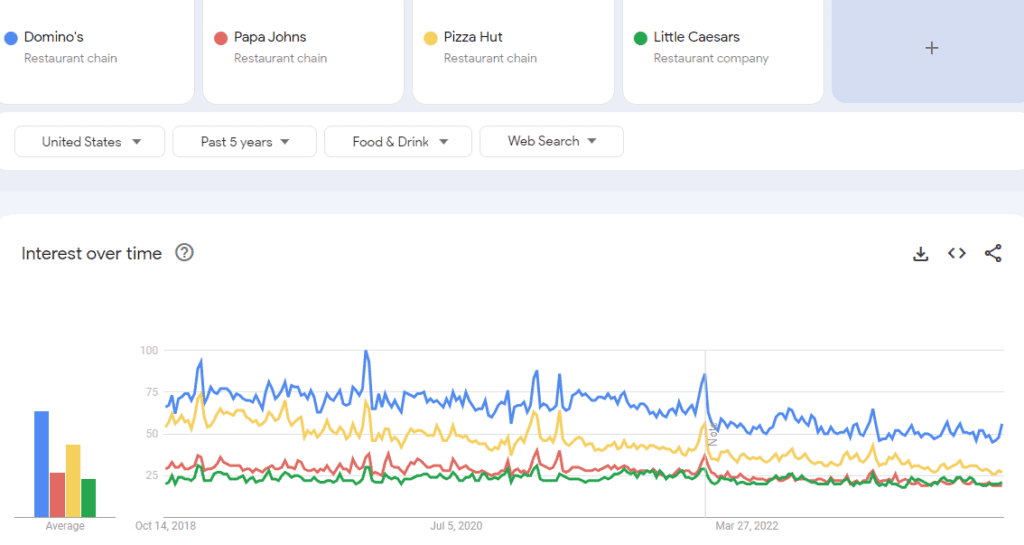

Despite a general cooling in consumer interest in pizza amidst the broader food delivery landscape, Domino's is snagging consumer attention and gaining momentum comparatively.

The third-party delivery app partnership? A game-changer. We're staying neutral as we head into this report, but we've got an eye out for long-term opportunities, especially as the shares continue to trade lower. Domino's might just have the right toppings to continue its tech...err, pizza dominance.