Tesla reports earnings after the bell on Wednesday. After last […]

Tesla’s Plans for Total Domination

Tesla's Bullish Path Forward: Price Parity, Tech Convergence, and Strong Metrics

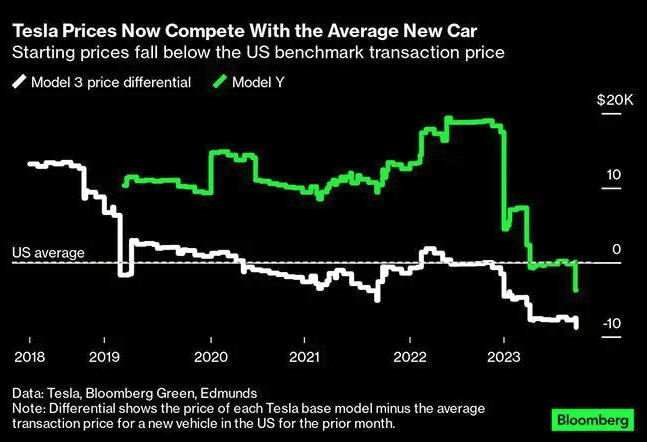

1.Achieving Price Parity: A Game-Changer for Tesla

Tesla's recent strategic price cuts have positioned its vehicles to compete head-to-head with traditional internal combustion engine (ICE) vehicles. The Model 3 sedan, now priced at a competitive $38,990, is not just undercutting the average car price in the US but also giving traditional ICE vehicles a run for their money.

To make this feel more real: When you factor in the federal tax credits, the cost of a Model 3 is in the same price range as the 2024 Toyota Corolla.

While some analysts express concerns about the potential $1.2 billion annual cost to Tesla, we see this as a strategic move.

Given Tesla's significant margins (even with price cuts, TSLA core margins remain above 18%) compared to traditional automakers and other EV competitors, this aggressive pricing strategy further solidifies Tesla's dominant position in the market.

2. The Future of Tesla: A Convergence with Mobile Tech?

The lines between cars and smartphones are blurring. As vehicles transition to be more software-centric, Tesla, with its advanced vehicle software, is perfectly positioned to lead this transformation. The rumors of a potential "Tesla Phone" might have been just that - rumors, but Tesla's introduction of a $300 Cybertruck-inspired wireless charger compatible with devices like Apple's iPhone is a testament to the merging worlds of automotive and mobile tech. This move hints at potential competitions between tech behemoths like Apple and automotive innovators like Tesla.

To be frank, we’re betting on TSLA here.

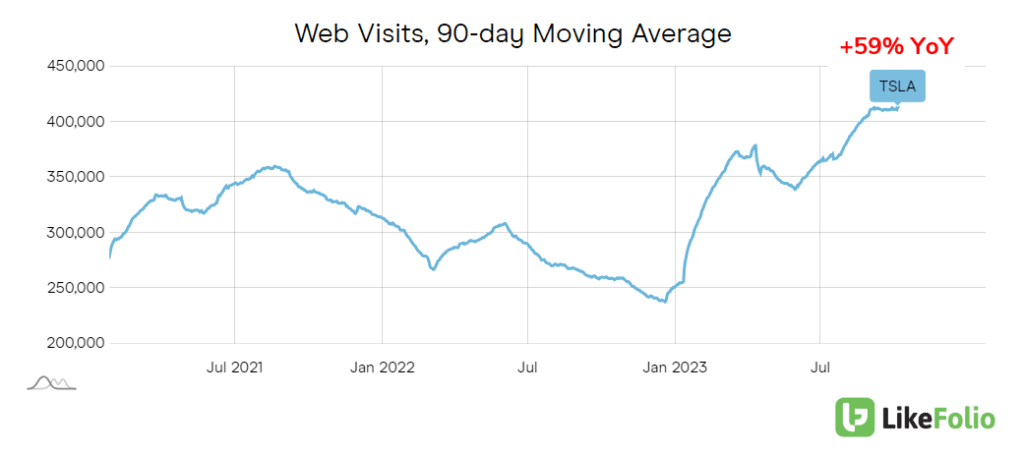

3. LikeFolio Metrics: Tesla's Momentum Continues

Web visits to Tesla have surged by a whopping +59% YoY, hitting multi-year highs.

This uptick is a clear indication that the price cuts are generating demand and making Tesla vehicles more accessible to a broader consumer base.

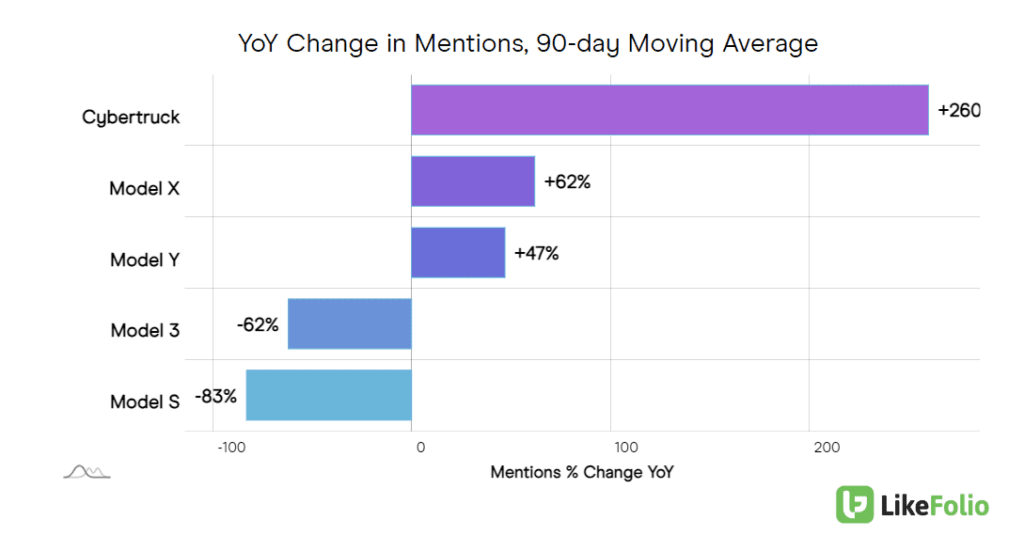

The buzz around Tesla's Models X, Y, and the much-anticipated Cybertruck is palpable.

Speaking of the Cybertruck, the first 2024 model was reportedly auctioned at the Petersen Auto Museum for a reported staggering $400,000. Just imagine the excitement when this futuristic truck becomes a common sight on the roads!

From a broader perspective, the demand for EVs continues to rise, especially with increasing gas prices (as we have previously touched on).

Final Thoughts

We've consistently been bullish on Tesla, and our stance remains unchanged.

Any sell-offs due to price cuts should be viewed as accumulation opportunities for long-term investors. With Q3 earnings around the corner on Oct. 18, there are expectations of weakness in China and a potential 30% hit to Tesla's bottom line.

Despite these short-term challenges, we're in for the long haul with Tesla.