PepsiCo (PEP) The quarantine 15 didn't materialize out of thin […]

Will Ozempic kill Doritos? $PEP $MCD

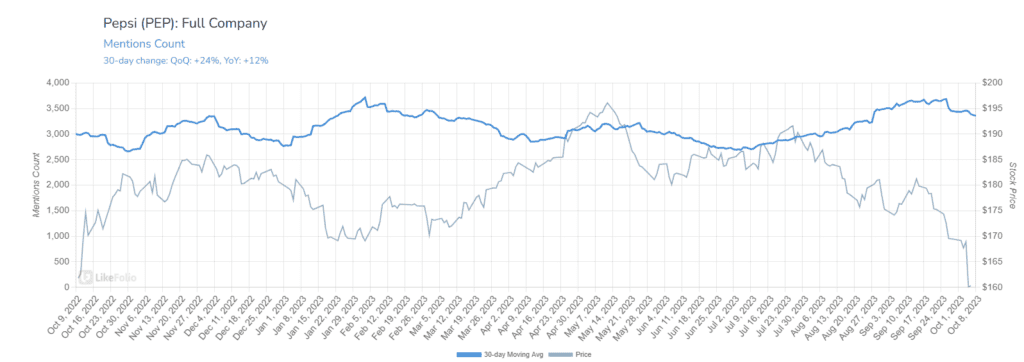

Check out this PepsiCo (PEP) chart.

Shares for the snacking giant have shed more than -16% in value since the end of July.

Did something happen? A bad earnings release? A scandalous company event?

Nope.

This time, it’s a combination of macro factors, investor caution, and a perhaps hyperbolic report.

Here’s what’s going on, and why at LikeFolio we think a Bullish opportunity (or 2) may be brewing…

Investor Fear Weighing on PEP, MCD

The stock market is currently adjusting to a stronger than expected September Employment Report and an upward movement in the 10-year Treasury yield. Despite positive indicators like McDonald's dividend increase and encouraging comments from analysts on PepsiCo shares, both McDonald's and PepsiCo, along with other entities in the snacking and restaurant sectors, are facing backlash.

These concerns are primarily driven by reports that suggest weight loss drugs could potentially decrease the demand for their products.

So – what does demand look like for names like PepsiCo and McDonald’s right now?

Not so bad.

Consumer mentions of PepsiCo products have increased by +12% YoY, and consumer sentiment has jumped by +4 points in the same time frame.

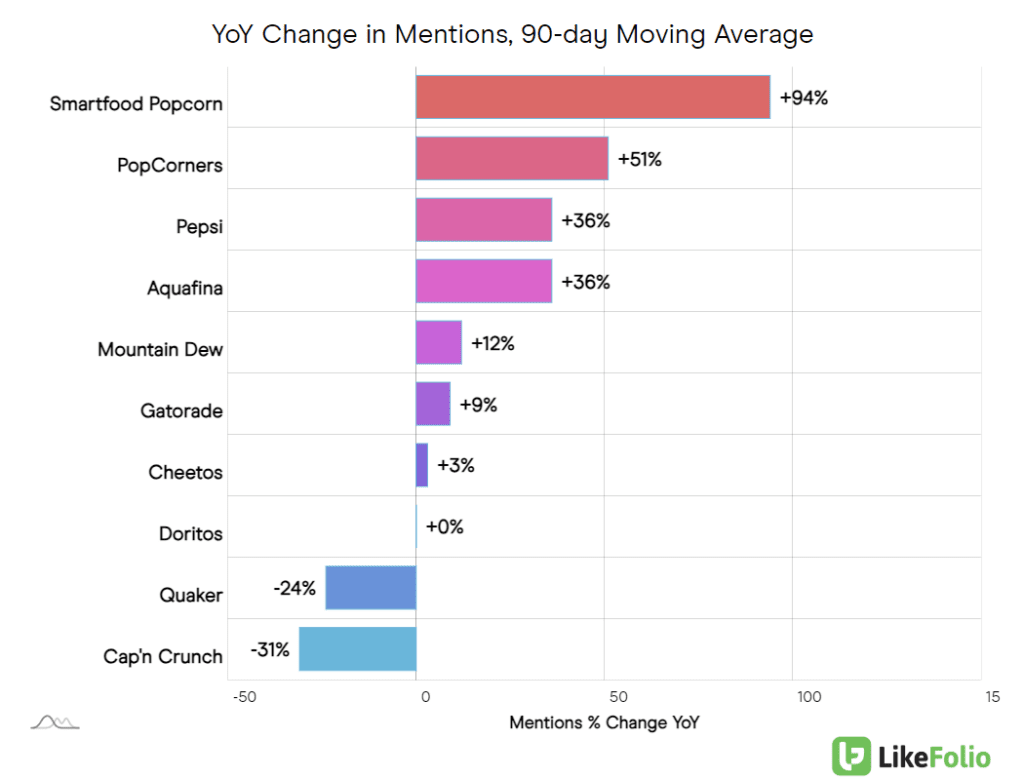

A brand breakdown reveals another interesting takeaway.

PepsiCo isn’t tied to just its “eeto” brands.

It has other healthy alternatives that consumers can grab to snack on instead – like PopCorners, Smartfood Popcorn, and even Aquafina.

McDonald’s is hanging in there too.

Landon talked about McDonald’s alongside other key fast food players like Chipotle and even Starbucks on Friday on the Schwab Network (watch for yourself here).

Bottom Line

This isn’t not-so-good-for-you-food’s first rodeo.

McDonald's and PepsiCo have weathered various diet trends and health movements. In the 1970s and 1980s, the low-fat craze prompted many to shun fast foods and sugary sodas, leading these companies to introduce healthier options and diet sodas.

The Atkins and low-carb movements of the early 2000s saw a shift away from bread and high-carb foods, yet both companies adapted by diversifying their product lines.

More recently, the rise of organic, non-GMO, and clean-eating trends have posed challenges, but McDonald's and PepsiCo have demonstrated resilience by innovating and aligning with changing consumer preferences, ensuring their enduring presence in the global market.

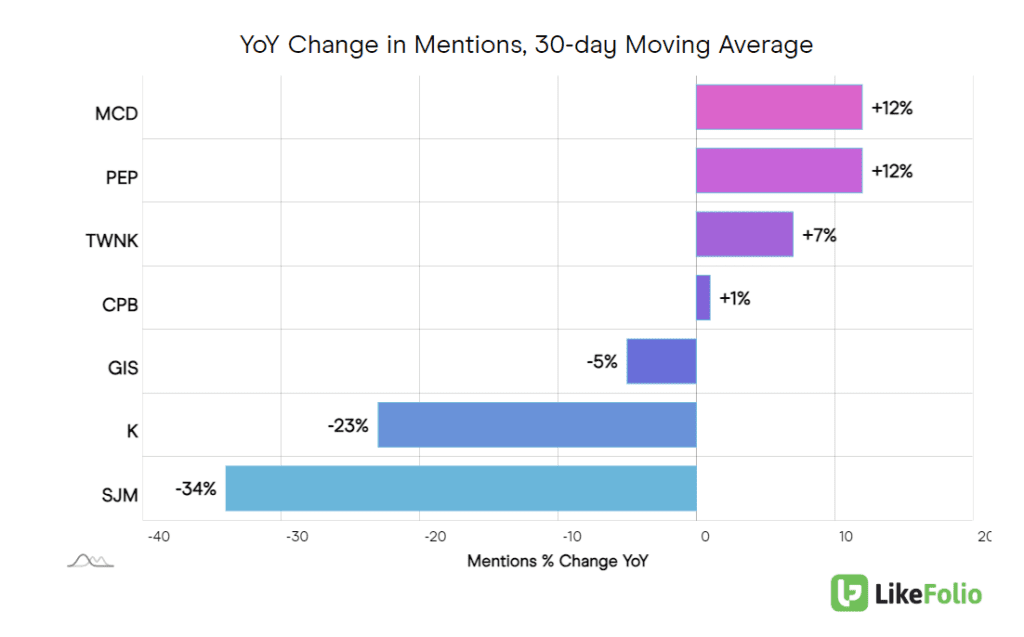

In fact, names like PEP and MCD appear to be more responsive to changes in consumer behavior vs. peers, as evidenced by the chart below.

Long-term investors may take a second look at both of these consumer favorites – with shares trading down, negative news may already be baked in.