Dunkin' Donuts is superior to Starbucks. There is really no […]

Fast Food Deep Dive: $MCD $CMG $SBUX

If you’re hungry, you’re in luck.

Chances are you have a fast food restaurant within a few miles of your house.

And fast food isn’t like it used to be – consumers now have high-quality food options, ready nearly immediately and for less than it costs to sit down at a restaurant.

3 of the companies we’ll discuss today are giants in the fast-food landscape…and featured in the image below (generated by Chat GPT – for real – based on the article below)…

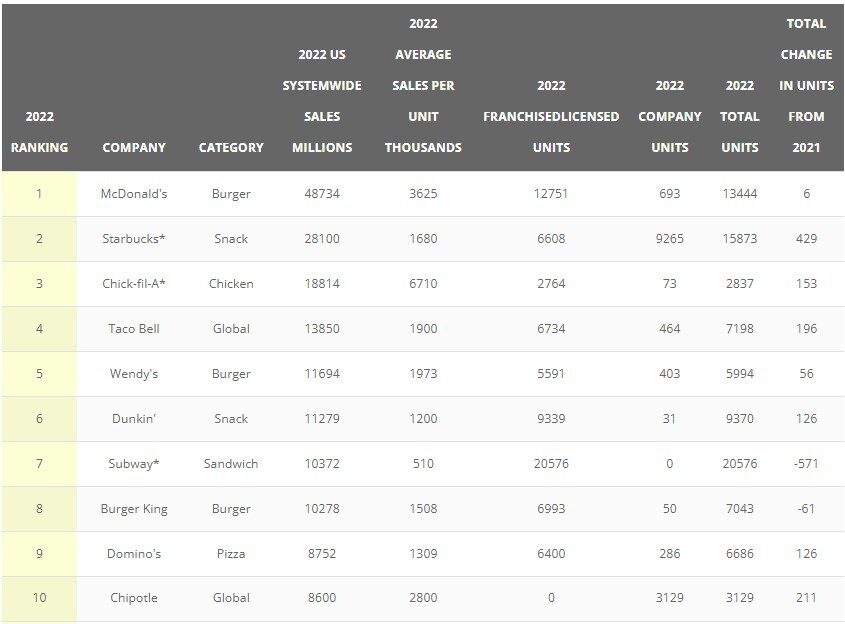

McDonald's (MCD), Starbucks (SBUX), and Chipotle (CMG) – all in the top 10 when it comes to US sales last year.

These companies have seamlessly integrated digital accessibility, drive-thru convenience, and compelling loyalty programs.

It’s no wonder fast food is having a heyday.

Let's delve into the key factors driving this industry's growth in 2023:

- Economic Factors and Affordability: With grocery prices rising significantly (e.g., cereal and baked goods up 29% since 2020), fast food offers a competitive alternative. The average check at fast-food chains is often comparable to or cheaper than making a meal at home, and loyalty programs, like McDonald’s app with 127 million global downloads, enhance affordability.

- Convenience and Changing Dining Habits: As on-premises dining decreased by 14% from February 2020 to April 2023, off-premises dining, especially drive-throughs, surged (+14% in the same time frame). The return-to-work movement further propelled fast food's popularity, with a 10% increase in fast-food business openings in recent months.

- Technological Advancements and Automation: The fast-food industry is leveraging the three D’s: digital, delivery, and drive-through, with a notable shift towards automation and AI. For instance, Wingstop's 16.8% growth in Q2 was driven by 65.2% of transactions being digital, and many chains are integrating robotics into their operations. For example, Chipotle is already using robots for chip-making and is testing robotic salad and bowl mixing, Jack in the Box and White Castle employing robots at deep fryers, and Panera integrating robots for coffee preparation. This shift toward robotics and AI is streamlining operations and enhancing efficiency.

So, how do CMG, MCD, and SBUX stack up vs. each other?

Take a look…

Chipotle (CMG)

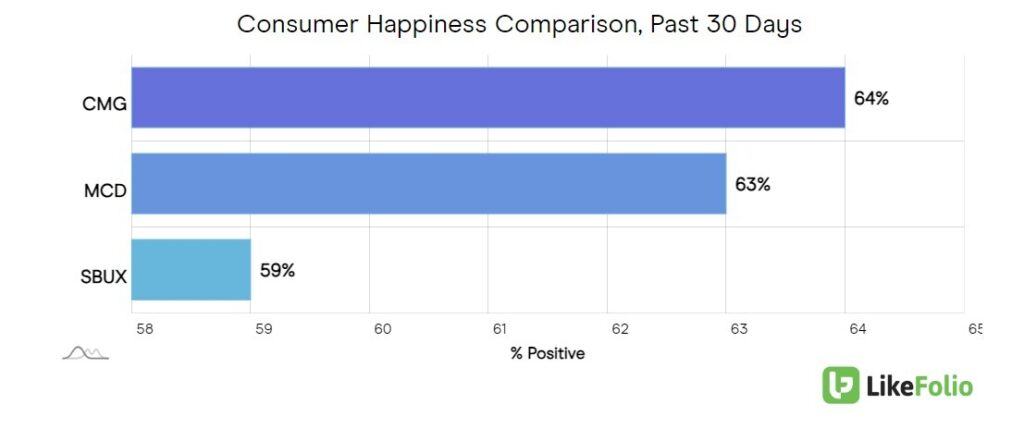

Chipotle is leading the pack when it comes to consumer happiness and digital traffic.

Chipotle reported a robust 14% sales growth in the second quarter, reaching $2.5 billion, with digital sales accounting for 38% of total sales. The introduction of Chicken al Pastor was met with significant acclaim, contributing notably to the sales momentum. The company expanded its footprint by opening 47 new restaurants during the period, with 40 of these featuring Chipotlanes, underscoring their commitment to enhancing customer convenience and accessibility.

McDonalds (MCD)

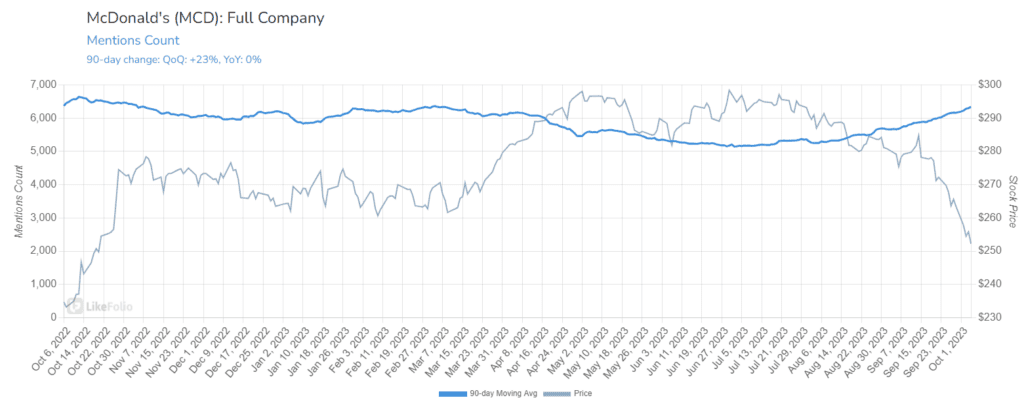

McDonald's has significantly improved its happiness over time, partially by leaning into nostalgia (Grimmace!) and higher quality ingredients. The company only trails Chipotle by 1 point in happiness, which is impressive for the chain once synonymous with frozen beef. Sentiment levels have been boosted +11 points vs. last month alone. While digital traffic does appear to be trailing peers, this company likely has higher app activity vs. pure web visits.

McDonald's demonstrated robust sales (same-store sales +11.7%) and operational performance last quarter, driven by effective brand engagement campaigns such as Grimace and the FIFA Men's World Cup. The introduction of the McCrispy Chicken Sandwich in over 10 major markets has significantly boosted their chicken share gains. Despite economic challenges, the company maintains its value proposition with affordable meal initiatives like Germany's McSmart menu and the UK's Saver Meal deals. Furthermore, its digital strategy is thriving, with digital sales accounting for nearly 40% of system-wide sales in their top markets, supported by a strong base of over 52 million active loyalty members.

Starbucks (SBUX)

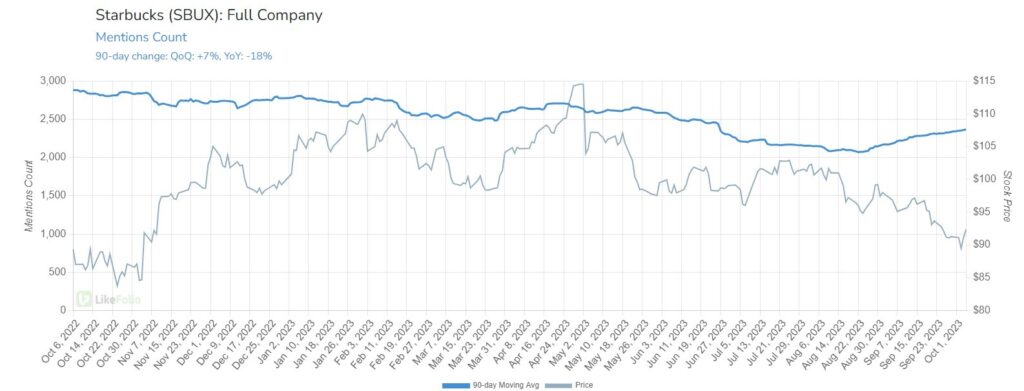

Starbucks trails in overall consumer happiness, with rising costs most significantly impacting overall sentiment.

Starbucks reported a 12% increase in net sales to $9.17 billion for its fiscal third quarter, although it slightly missed revenue expectations. Cold beverages now dominate U.S. beverage orders, accounting for three-quarters of the total, indicating a shift from traditional hot coffee. Despite the growth, the 7% rise in North American same-store sales suggests a cautious consumer spending pattern, potentially reflecting broader economic concerns.

Playing it from Here

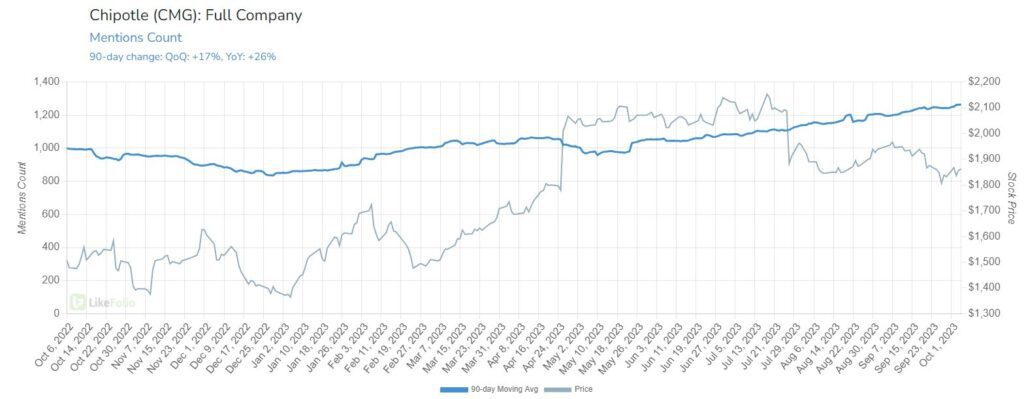

- From a stock perspective, Chipotle has outperformed peers, with shares rising +30% over the last 9 months.

- In contrast, MCD and SBUX shares have dropped by 8% and 13% respectively in the same time frame.

- Data suggests McDonald's may prove to be the best long-term growth play here, as consumers trade down and happiness rises.

- Metrics also support continued upward trajectory for Chipotle.

- In contrast, Starbucks metrics appear comparatively weak. With low happiness, this name gives us the most pause.