Roku makes streaming devices that allow its customers to stream […]

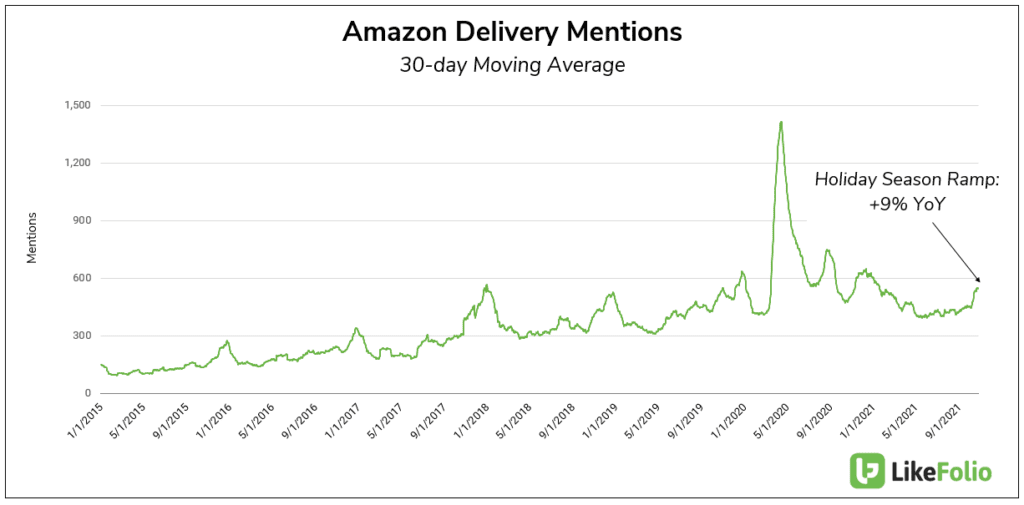

Amazon Delivery Mentions are Rising into a Critical Holiday Quarter

Amazon Delivery Mentions are Rising into a Critical Holiday Quarter

Amazon shocked investors last quarter when it posted a revenue miss and guided for slower sales growth in 21Q3, sending the stock down more than 7% and shaving off ~$120 billion of market value overnight. And AMZN shares are still trading near that level.

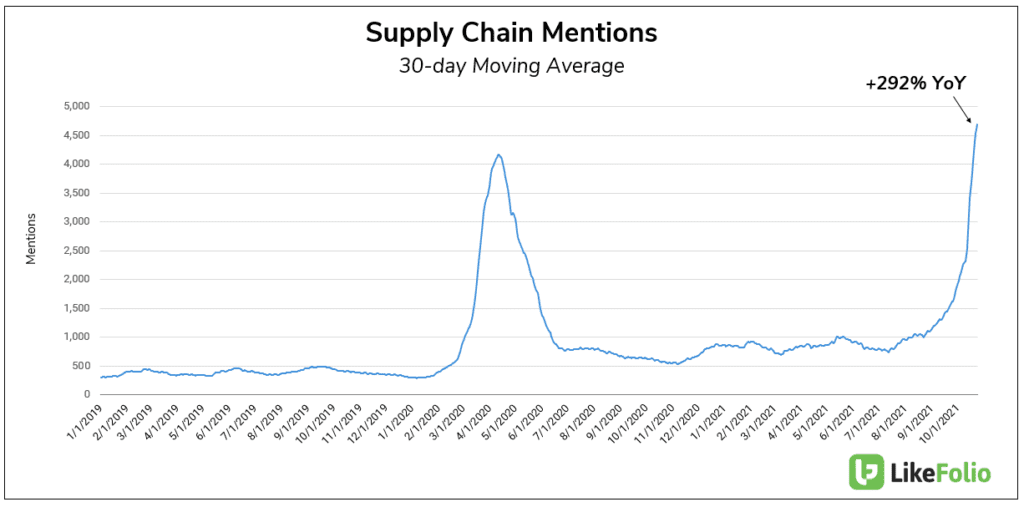

Since then, Amazon is doing its best to assure shoppers (and investors) that it's prepared for the upcoming Holiday Season, even as supply chain fears dominate conversations.

Amazon says it's ready for holiday demand -- think plane, trains, and automobiles style, plus pre-planning at critical ports.

But this will cost the company in the near term.

Amazon is projecting a drop in operating income in Q3 due to increased costs of operation: $2.5-$6 billion vs. $6.2 billion in 2020.

The company is spending more on hiring (and retaining) staff and expanding its fulfillment center capacity.

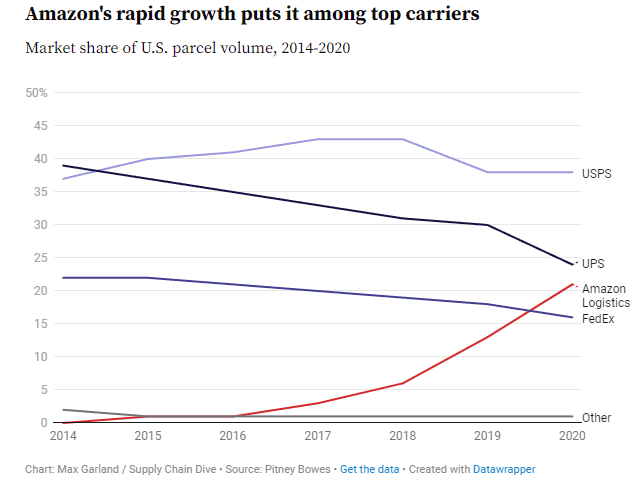

Long-term, the company's investments in its own logistics, like delivery, will likely pay off.

Analysts say Amazon's U.S. parcel volume has surpassed that of FedEx, and its rate of growth continues to outpace all other major players in this field, including USPS and UPS.

LikeFolio data suggests Amazon deliveries are already ramping ahead of the Holiday season.

Consumer mentions of receiving a delivery from Amazon have increased +9% YoY.