Roku makes streaming devices that allow its customers to stream […]

Amazon is a Beast, but Competent Peers are Rising

Amazon is a Beast, but Competent Peers are Rising

Last quarter Amazon reported a banger: Sales increased 44% YoY propelling revenue over $100 billion in a single quarter for the first time. The company also announced Jeff Bezos was stepping down as CEO, and guided for a slow down in rev growth in Q1 (33% to 40%).

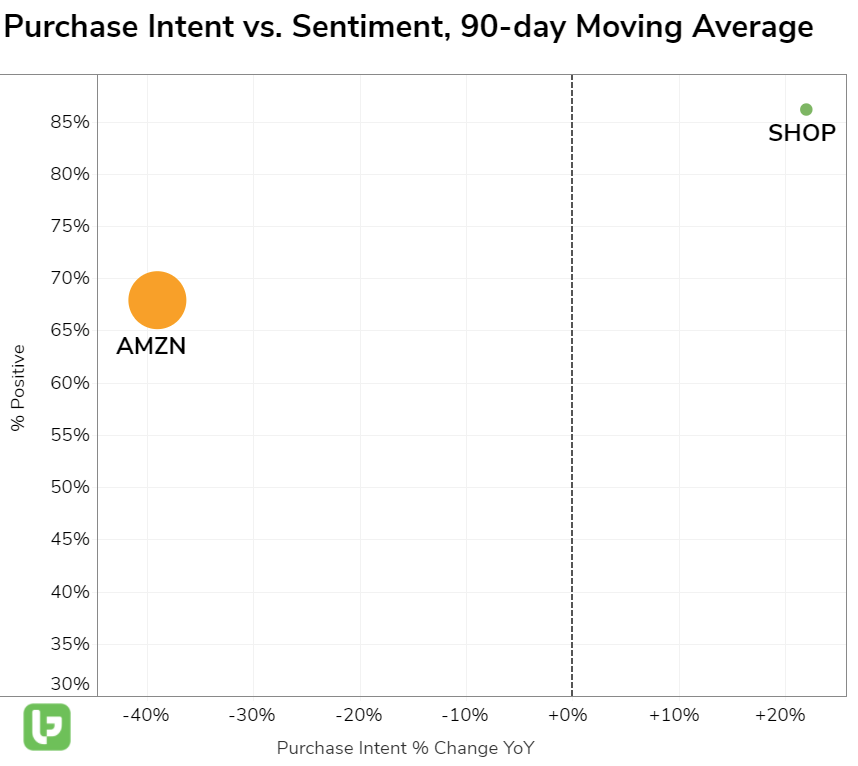

LikeFolio data confirms this slow down in growth. You can see YoY weakness on the chart below, and this is to be expected considering Amazon's massive demand surge reported during lockdown last year.

While Amazon certainly commands volume (represented by the size of the circle), Shopify's trajectory looks bright. Not only is demand growing, but customers are happier.

Both companies are taking drastically different approaches in the eCommerce space:

- Amazon is serving as a central hub, asking users to come to it to complete a purchase. In the past decade, this mindset has served Amazon well. It has allowed Amazon to charge a membership for its digital fulfillment services, exert control over participating merchants, and become a one-stop-shop for most retail needs.

- Shopify is empowering merchants via its payment and fulfillment network, to enable customers to shop directly with the brand. Instead of serving as the doorway to usher customers in, it serves as the eCommerce arm for a range of businesses, allowing for the swipe of a credit card and logistics backend that many smaller companies may not be able to support on their own.

What does all of this mean? There's no denying Amazon is a GREAT company. And we are expecting a great report. But data suggests competent competition is building, and consumers are getting accustomed to going straight to the horse's mouth.

AMZN reports 21Q1 results April 29 after the bell.