Lowe's (LOW) Home Depot is trading ~3% lower today after […]

An economic double whammy could sink this stock

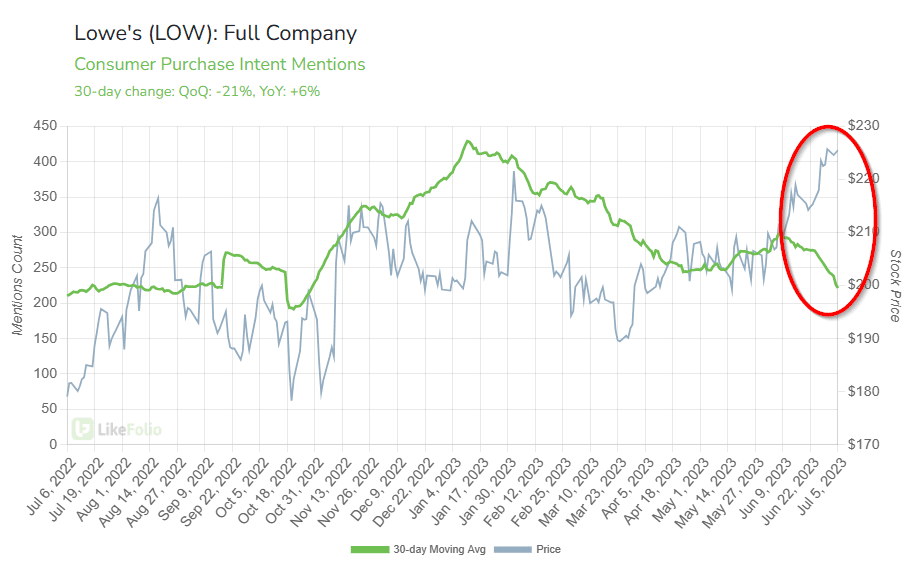

As the summer sun shines, traditionally a season for DIY home improvement, Lowe's (LOW) finds itself in a precarious position.

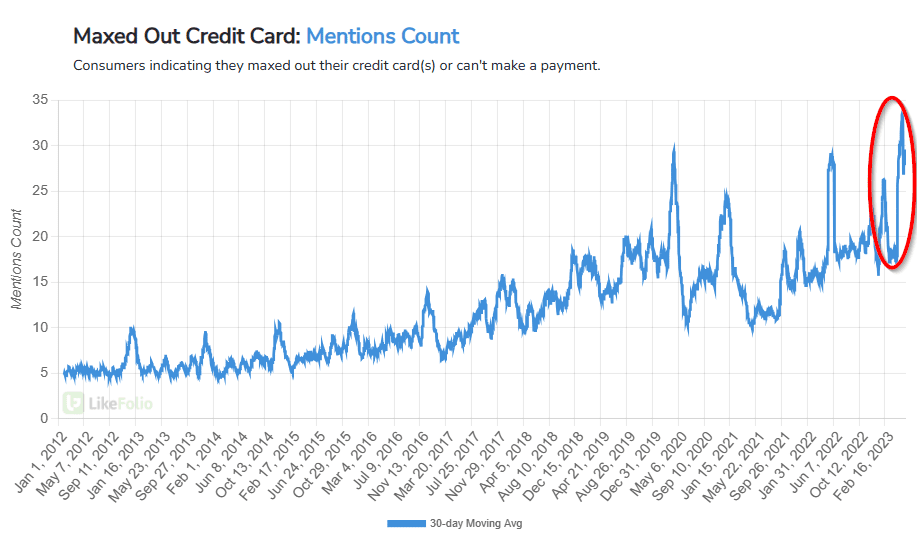

LikeFolio data uncovers a worrying trend: chatter about maxed-out credit cards has nearly doubled over the past year, hitting record highs.

Meanwhile, the consumer demand for Lowe's, as indicated by purchase intent mentions, has taken a 17% hit year over year and a whopping 30% in the past quarter.

Rising Interest Rates and Resuming Student Loan Payments: A Double Whammy

The American economy is wrestling with high inflation and interest rates.

Add to this the resumption of student loan payments, and we're looking at a potential reduction in consumer spending that could hit various industries, including major retailers like Lowe's.

Credit Card Debt: A Ticking Time Bomb

Americans are drowning in credit card debt, with the total balance inching dangerously close to $1 trillion.

More than a third of U.S. adults now have more credit card debt than emergency savings. This financial strain on consumers could further dampen their spending on home improvement projects.

Cooling Housing Market: Bad News for Home Improvement Retailers

The housing market, which has been a beacon during the pandemic, is showing signs of cooling. Experts are predicting a significant drop by the second or third quarter of 2023.

This could be the largest housing correction in the post-World War II era. A cooling housing market could lead to a decrease in home improvement projects, affecting companies like Lowe's.

Conclusion: A Storm Brewing for Lowe's?

The convergence of rising interest rates, a cooling housing market, and financially strained consumers could pose significant challenges for Lowe's and its stock.

As consumers tighten their belts, discretionary spending on home improvement projects may take a hit.