When social-data and stock price are moving sharply in opposite […]

Are Consumers Axing Streaming Subscriptions? DIS NFLX AAPL

Last quarter, Disney earnings were bolstered by droves of consumers returning to Disney Parks, boosting this experience segment back to profitability.

In addition, Disney beat subscriber estimates, recording 116 million Disney+ subscribers and 174 million subscribers across its network of streaming services including Disney+, ESPN+, and Hulu.

Can Disney continue to expand its streaming audience?

LikeFolio dissected the major players in the streaming game. This is what we found:

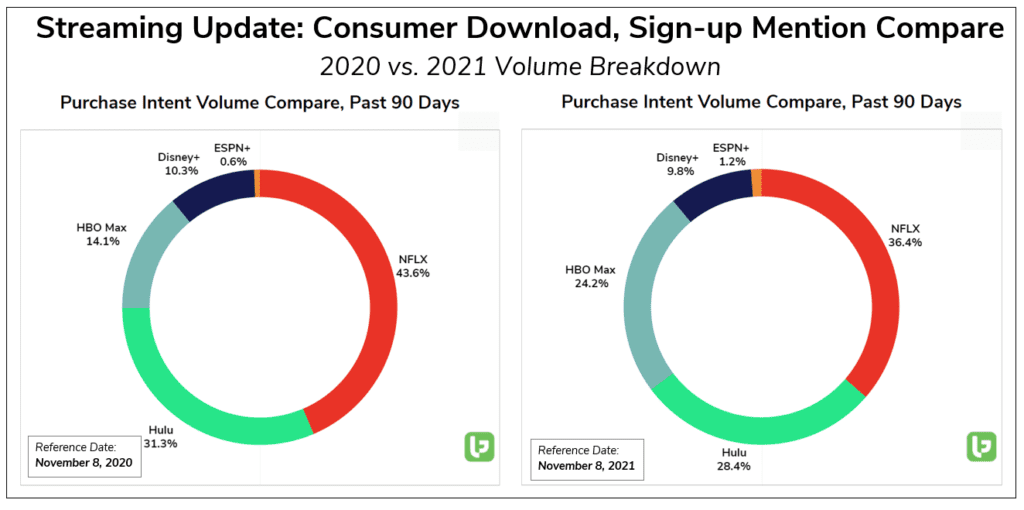

1. Netflix is the dominant player, but it's getting crowded. In regard to new user growth, HBO Max is actually making the most ground. Disney's ESPN+ also showing strength, but volume is low comparatively.

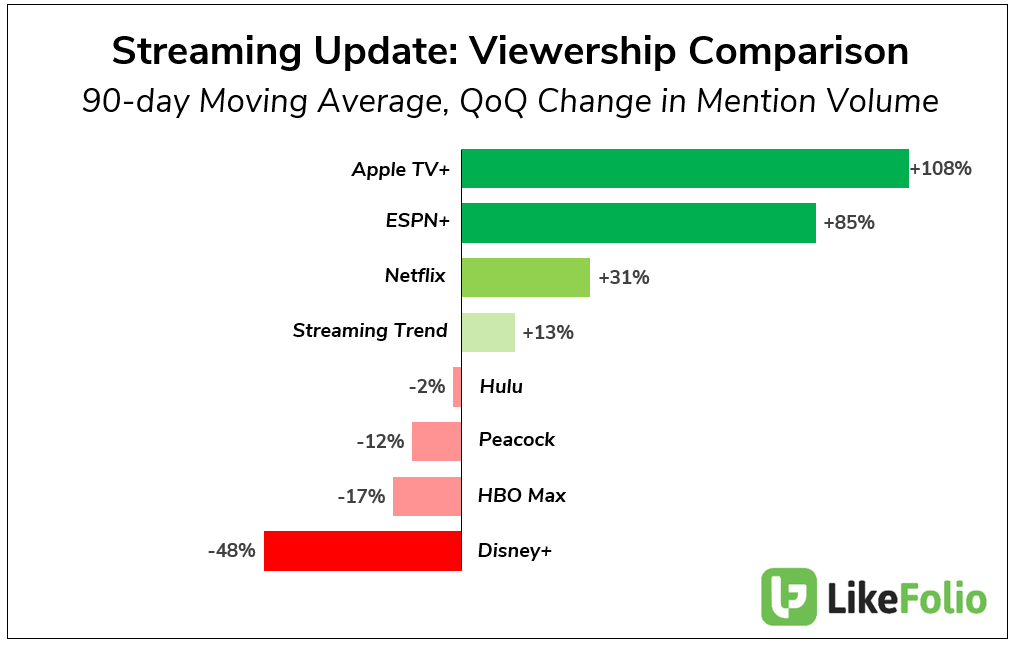

2. As the weather cools down, streaming is recording a seasonal uptick. We plotted the rates of platform viewership to showcase how major players are performing vs. the base trend and each other. AppleTV+ shows continued signs of expansion. Netflix's new content is moving the needle for the giant vs. the other streaming peers.

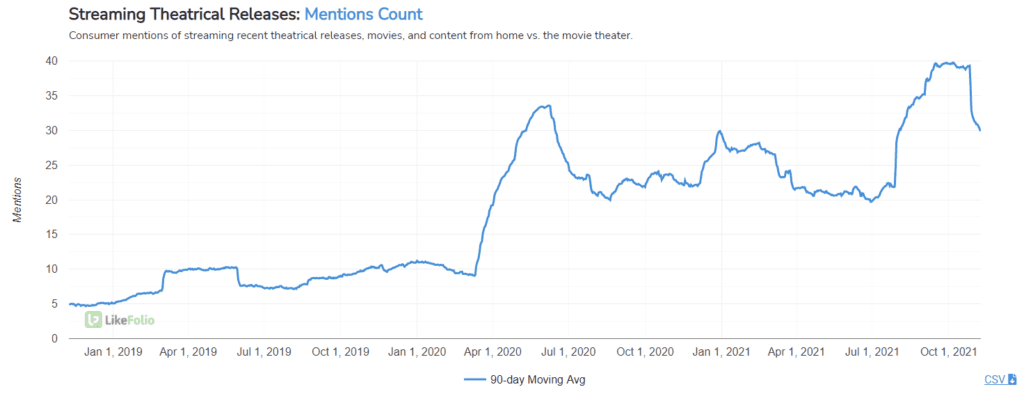

3. Disney+ and HBO Max benefitted greatly last quarter from some direct-to-streaming theatrical releases, but viewership and user growth mentions have since tempered for both companies.

4. Subscription fatigue mentions show consumers aren't tapped yet. These mentions have dropped -37% YoY, almost directly in line with Cancel Netflix mentions (-34% YoY) and Cancel Disney+ Mentions (-32% YoY). 5. ESPN+ is likely to be a bright spot on Disney's streaming update, driven by sustained consumer interest in live sports. Disney reports 21Q4 earnings after the bell.