Travel Update: Airline Earnings It's time for the airline industry to report […]

Are Consumers Scared to Travel?

Are Consumers Scared to Travel?

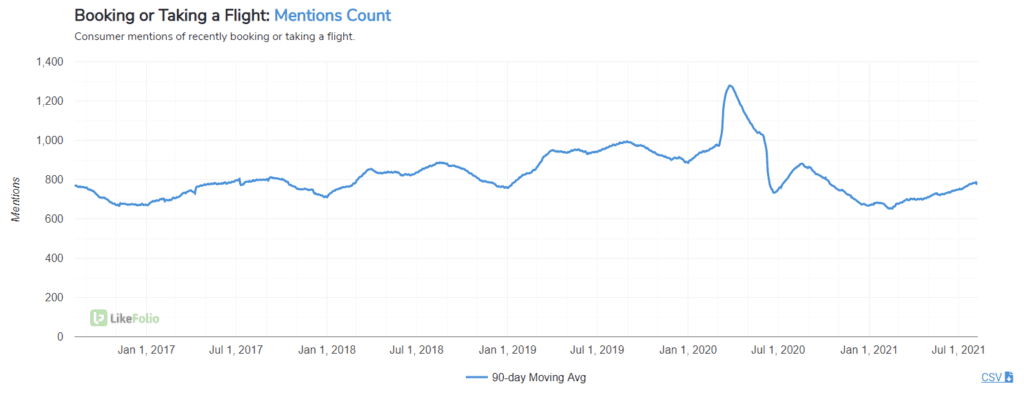

According to LikeFolio booking mentions and TSA throughput data, nope.

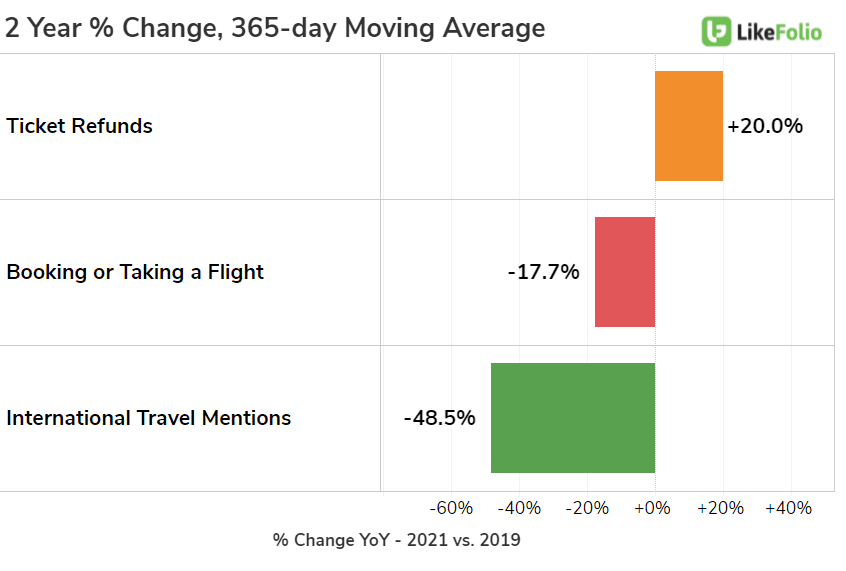

Mentions of consumers booking or taking a flight are still improving, but these do remain below pre-pandemic levels with International Travel stunted more severely vs. domestic.

While cancellation mentions look relatively stable vs. 2019, mentions of consumers experiencing flight delays have increased +400% YoY, and consumers aren't happy. It's no surprise to see the number of consumers seeking ticket refunds elevated vs. 2019: +20%. When we break down the 4 major airline players (LUV, DAL, UAL, AAL) data reveals three main takeaways.

- Southwest Airlines (LUV) is somewhat insulated thanks to resiliency in leisure travel demand. LUV Purchase Intent Mentions have increased +64% YoY, leading the pack. Flying for leisure mentions continue to gain steam: +39% QoQ.

- Delta (DAL) demand is being bolstered by signs of business travel resumption. Traveling for work mentions have increased +39% YoY, but do remain below pre-pandemic levels. Delta Consumer Happiness is the strongest of the group at 52% positive.

- American Airlines (AAL) is executing the worst. Purchase Intent Mentions haven't gained momentum at the rate of LUV or DAL, and Consumer Happiness is the lowest (30% positive) due to flight delays, cancelations, and overall poor customer service experiences.

We've got our eyes on booking mentions moving forward, especially when it comes to corporate travel. This could prove to be a major tailwind for Delta if the trend continues to gain traction.