A new sport is taking the heart of the country […]

‘Big Game’ Big Winners!

We all have our own take on the Super Bowl.

How we watch, who we’re rooting for, what we eat, what commercials we like, if we’re placing bets (more on that tomorrow), and whether or not we stay tuned for the halftime performance.

But at LikeFolio, we’re listening to the masses to spot the BIG winners, according to the chatter on social media.

Here are the highlights:

Rihanna stole the show – and brought Fenty (LVMH) with her to the top

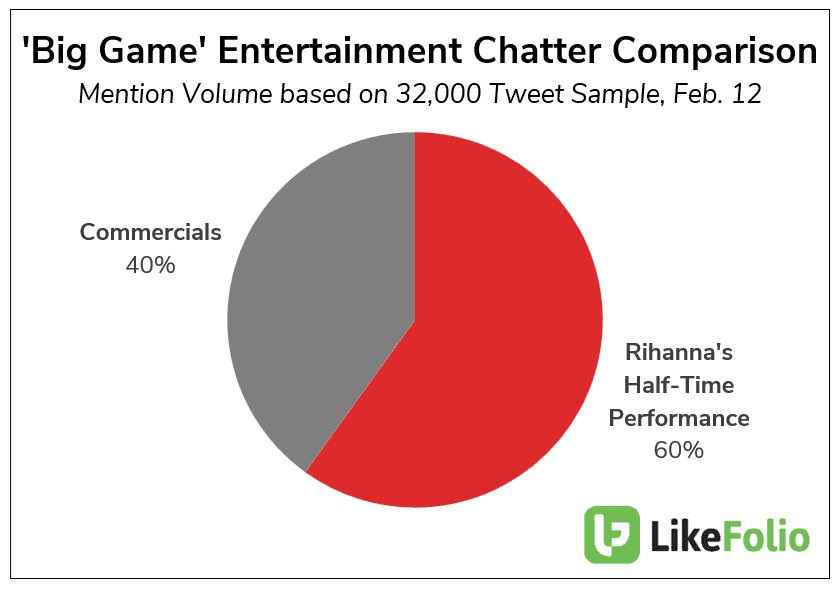

We analyzed more than 32,000 mentions of the Super Bowl that were solely focused on the entertainment components (ads and the halftime show) vs. the game itself.

And the breakdown shocked us.

Rihanna and her well-choreographed performance snagged more organic mentions vs. all Super Bowl ad spots combined (even including generic mentions of “commercials”).

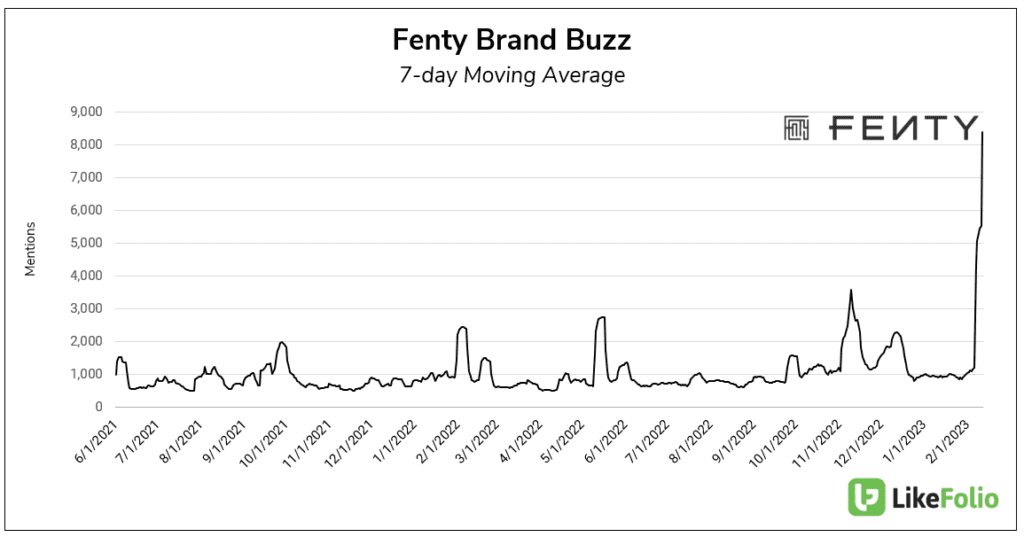

Naturally, the performer threw in a mid-performance nod to her beauty brand, Fenty.

Fenty brand mentions rocketed, nearly +800% higher vs. the prior month’s average.

How is this relevant for traders?

Fenty was launched as a joint venture between the artist herself and LVMH-owned KENDO, a beauty brand incubator. The skincare and cosmetic products are available online and in LVMH-owned Sephora beauty shops.

Consumer demand for Louis Vuitton (LVMH) has risen significantly across the board YoY, bolstered by sustained consumer preference for luxury (Fenty included).

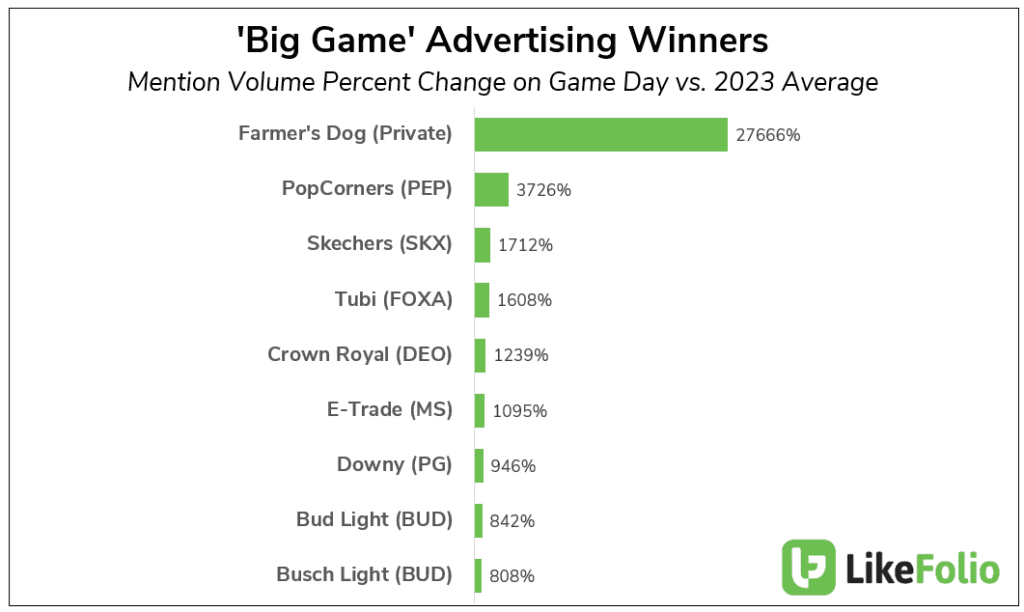

Farmer’s Dog, PepsiCo (PEP), Skechers (SKX) Take Top Ad Spots

Aside from Rihanna’s domination, LikeFolio data reveals the 10 brands generating the most brand buzz.

Consumer response to The Farmer’s Dog was overwhelmingly positive…despite the emotional journey.

Turns out consumers just want to feel something. (You can watch the extended version of the commercial here.)

The brand itself sells human-grade dog food and is privately owned.

However, the brand does pose serious competition vs. other major players in pet care, including Bark (BARK), Hill’s Pet Nutrition (CL), Petco (WOOF), and Chewy (CHWY). Keep an eye out here for potential acquisition, IPO, and market share steal.

Other major winners included PEP (PopCorners) featuring a nod to Breaking Bad and Skechers (SKX) featuring Snoop Dog and Martha Stewart.\

GrubHub, Papa John’s (PZZA) Continue to Boost Brand Positioning

Last but not least, we all know the Super Bowl is all about the food.

From a Pizza perspective, Papa John’s shows signs of serious brand improvement.

Papa John’s mentions have increased by +18% YoY and sentiment has increased by +4 points in the same time frame.

In contrast, DPZ and Pizza Hut mentions have dropped by -12% and -5% respectively.

On the food delivery side of things, GrubHub continues to make traction, bolstered by its relationship with Amazon.

- GrubHub mentions increased +29% on Super Bowl Sunday vs. the prior year.

- DoorDash dominated from a food delivery volume perspective, raking in 38% more mentions vs. GrubHub (though this number was flat vs. last year).

Bottom line: brands and companies had a lot to win (and lose) over the weekend.

But the real edge comes from authentic consumer analysis on a massive scale.

We’ll continue to monitor the big winners long-term to see if momentum holds long-term.

To gain more insight, watch Landon discuss the major Super Bowl 2023 commercial winners on the TD Ameritrade Network