For trend Tuesday, we’re breaking down the top trends popping […]

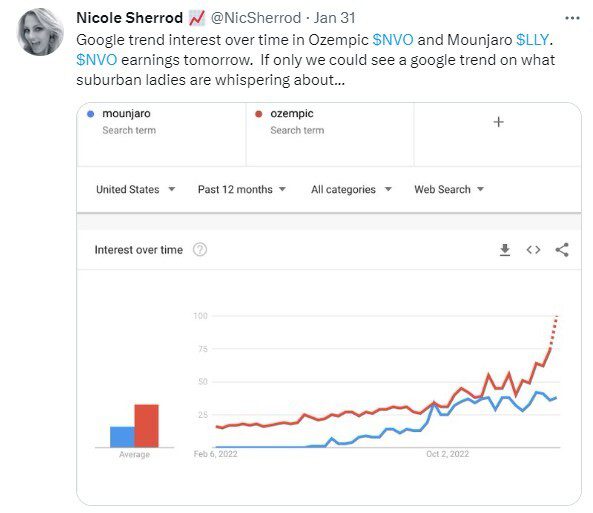

New Trend Addition: Prescription Drugs for Weight Loss $NVO $LLY

It’s human nature to search for an easy switch. Or in the case of weight, a magic pill.

Of late, this concept appears well within consumer grasp, thanks to a unique application of drugs originally designed to treat different forms of diabetes.

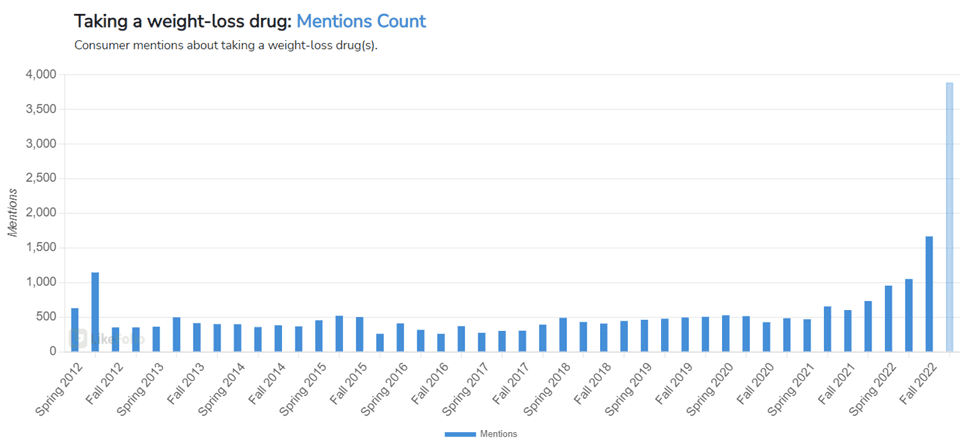

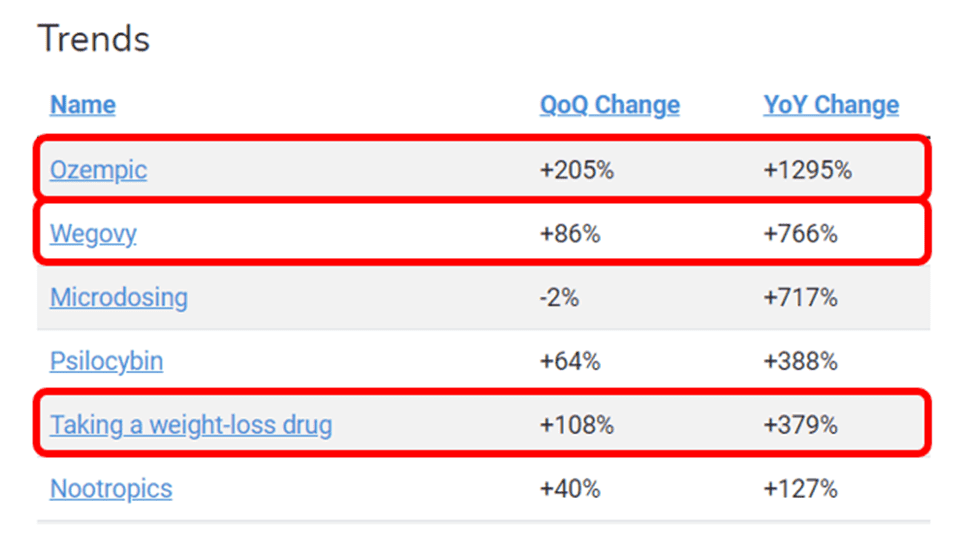

Consumer demand for weight loss drugs has exploded over the last year, currently pacing +379% higher YoY.

And we’re tracking the major players in this game:

Novo Nordisk (NVO) and Eli Lilly (LLY).

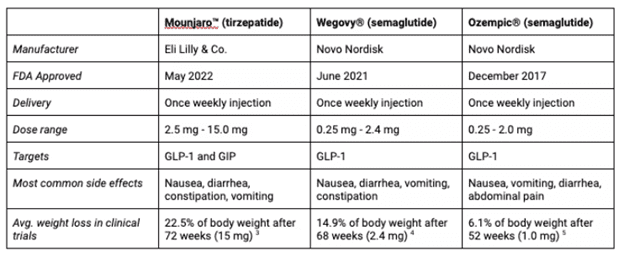

The first drug in question is Semaglutide, better known under the brand names Ozempic and Wegovy. Both brands are owned by pharmaceutical maker Novo Nordisk (NVO).

The prescription injection is meant to regulate blood sugar levels by acting on GLP-1 receptors in patients – but in layman’s terms: the drug also regulates hunger, therefore making it easier to lose weight.

- Ozempic is targeted to type 2 diabetics, and Wegovy is aimed to treat overweight and obese people.

- Wegovy has a higher concentration of Semaglutide than Ozempic.

LikeFolio data reveals that consumer demand is soaring for both brands – overtaking the prior wellness trend leader “microdosing”.

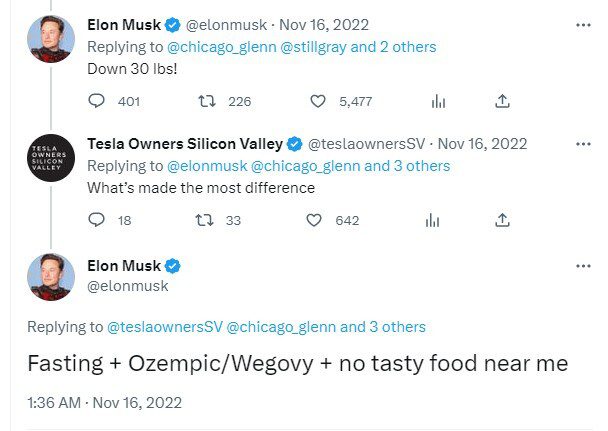

Both (Ozempic and Wegovy) have taken over headlines in the past few months due to celebrities -- most notably Elon Musk -- claiming they’ve lost weight after taking the drugs.

The start of the uptick in demand for both products eerily correlates to tweets from Elon back in November:

Another weight loss drug on our radar: Mounjaro

Eli Lilly’s (LLY) Mounjaro has also gained some buzz in recent months.

Mounjaro is tirzepatide acting on both GIP and GLP-1 receptors, differing from Ozempic and Wegovy which act solely on GLP-1 receptors.

According to Eli Lilly, “GIP is a hormone that may complement the effects of GLP-1 receptor agonists. In preclinical models, GIP has been shown to decrease food intake and increase energy expenditure therefore resulting in weight reductions, and when combined with GLP-1 receptor agonism, may result in greater effects on markers of metabolic dysregulation such as body weight, glucose and lipids.”

Back in May of 2022, the drug was approved by the FDA for type-2 diabetics, but still awaits approval for obese and overweight patients.

Regardless of approval status, consumers have touted significant weight loss results:

Rising concerns accompanying popularity

While these drugs appear to be revolutionary for weight loss, their success and rapid adoption are coming at a cost literally and figuratively for diabetic patients.

The exploding interest for these drugs in the name of shedding a few pounds is creating disdain toward some users.

LikeFolio is tracking this trend in real-time and will be adding supporting trends as this situation unfolds.

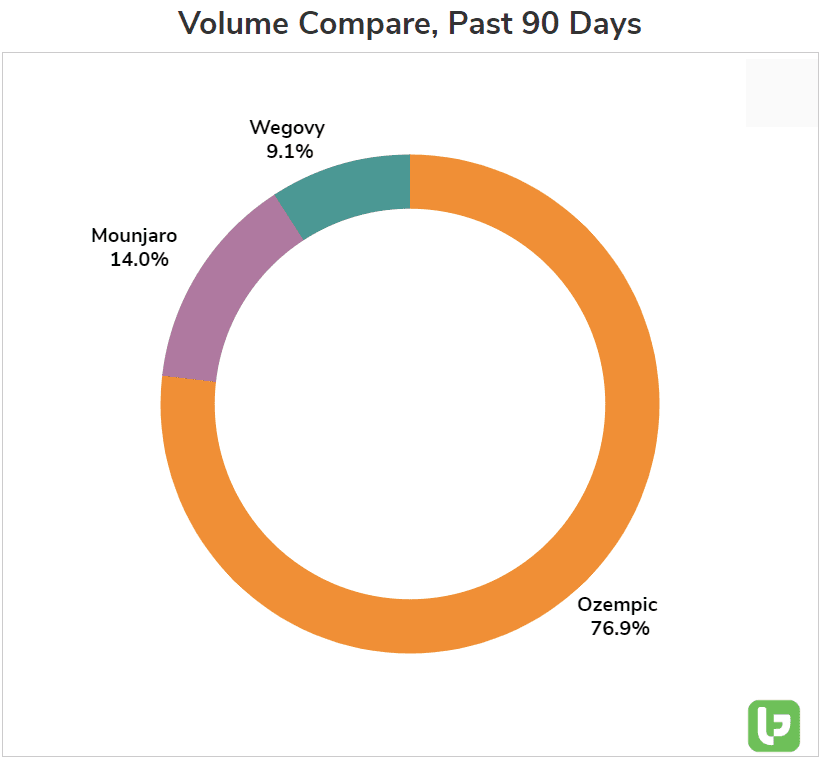

For now, it looks like Ozempic is the preferred brand leader among consumers from a mention volume and growth perspective.

Demand is likely to be a considerable tailwind for parent Novo Nordisk (NVO).