Inflation Fears are Rising Today the Labor Department released its Consumer […]

Boiling Point: How much more can consumers take?

You know prices are getting up there when a bag of BBQ mesquite beef jerky and a soda cost almost as much as a T-bone dinner with a glass of Cabernet. Yeah, I was a bit rattled too when the gas station attendant rang up a small mortgage for my afternoon snack.

Like me, consumers across the U.S. are increasingly facing sticker shock on just about everything. From expensive groceries and gas to soaring rents and home prices, the greenback simply doesn’t go as far these days.

We wonder, are people really getting squeezed like a family pack of Charmin? How are shoppers’ spending habits being affected?

Let’s take a step back and see what the LikeFolio data tells us about the current inflation pressures.

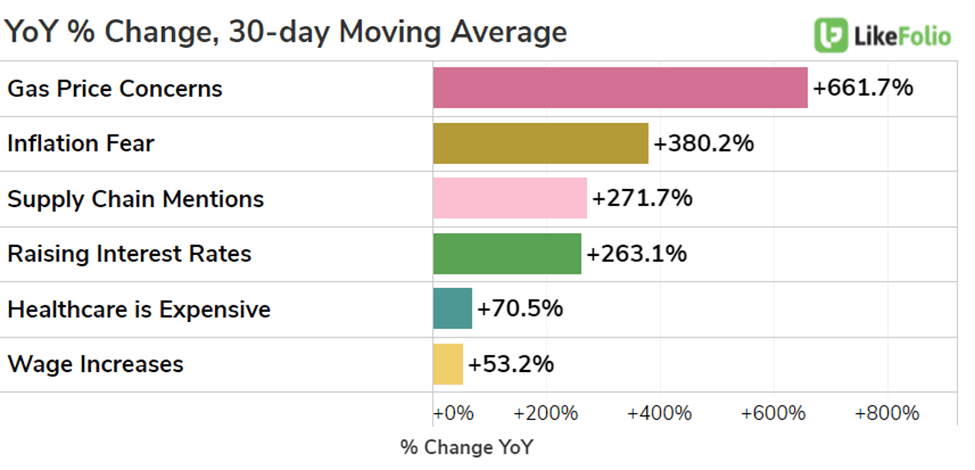

Data confirms: Inflation related concerns, from gas prices to healthcare are dominating consumer thoughts.

This shouldn’t be a surprise, especially as consumers shell out ~$4.24 on average for a gallon of gas.

Even historically low mortgage rates are joining the inflation party. The average 30-year fixed rate has snuck above 4% for the first time since 2019.

Despite these mounting pressures, the consumer spending environment remains healthy. At least that’s what recent retail sales figures have shown. Although they reflect easy year-over-year comps when lockdowns were still a thing.

Consumer confidence readings tell a different story. Yes, higher heating, electricity, and Internet bills do seem to be weighing on our collective psyche.

But is this shaky sentiment translating to a slowdown in discretionary spending? And what about spending on the essentials?

This is where LikeFolio data comes into play.

Here’s how:

To Spend or Not to Spend

Let’s divide things into big-ticket items, discretionary purchases, and essentials to learn if consumers are feeling the burn.

1. Big Ticket Items

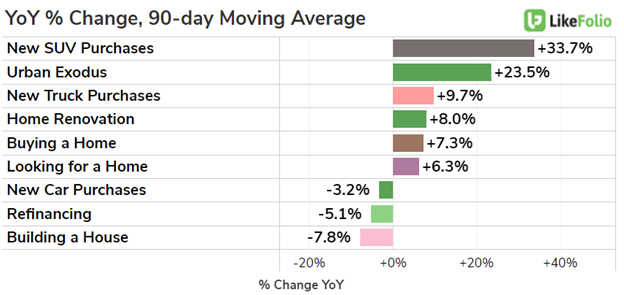

Traditionally, large ticket items are the first purchases to go as consumers tighten wallets.

For example, buying a home or a new car. Or renovating their existing home.

While refinancing and new home building mentions are tempering, other trends remain positive. This tells us that consumers haven’t reached their breaking point…yet.

However, this could change. Very quickly.

2. Discretionary Purchases

The next level of consumer spending to get cut is discretionary purchases.

Consumers recognize that they’re paying a lot more than they are used to…but coming off a pandemic, are putting their burning need for getting out and recreation at the controls.

Data suggests consumers are still splurging on things they’ve missed out on. Booking trips. Going out to eat. Attending that music festival. And upgrading their wardrobes.

The big question: is this pent-up demand that will shortly fizzle?

We’ll be watching these trends (and related companies) very closely so we know exactly if and when this euphoric boon begins tapering.

3. Essentials

Finally, the last area where consumers may tighten their belts is related to consumer staples.

Reduced spending on food, toiletries, and cleaning supplies may be the final sign of an impending breaking point. After all, tough economic times can cause consumers to hit the supermarket less frequently, rotate to generic brands, or find other ways to stretch the dollar.

Tracking mentions for companies like General Mills, Campbell’s Soup, Kraft Heinz, Clorox, Kimberly Clark, and Colgate-Palmolive are great staples to keep an eye on – to see if demand begins slipping.

We’ve also got a close eye on discount retailers. So far, stores like DG and DLTR are not experiencing a major traffic influx. Granted, even discount retailers have raised prices, but since they remain the safety net for many strapped consumers, we’ll be monitoring developments there...