Travel Update: Airline Earnings It's time for the airline industry to report […]

Business Travel is Resuming, but not as fast as Leisure

Business Travel is Resuming, but not as fast as Leisure

TSA checkpoint data confirms air travel is resuming. The 14-day avg. of passenger throughput is more than 1,000% higher in 2021 vs. 2020. However, it remains -38% lower vs. the same two week average in 2019.

LikeFolio data displays a divide in the reason for travel: consumers are resuming travel for leisure at a faster clip than travel for work:

Flying for Leisure: +23% QoQ

Taking a Roadtrip: +12% QoQ

Work Travel: +4% QoQ

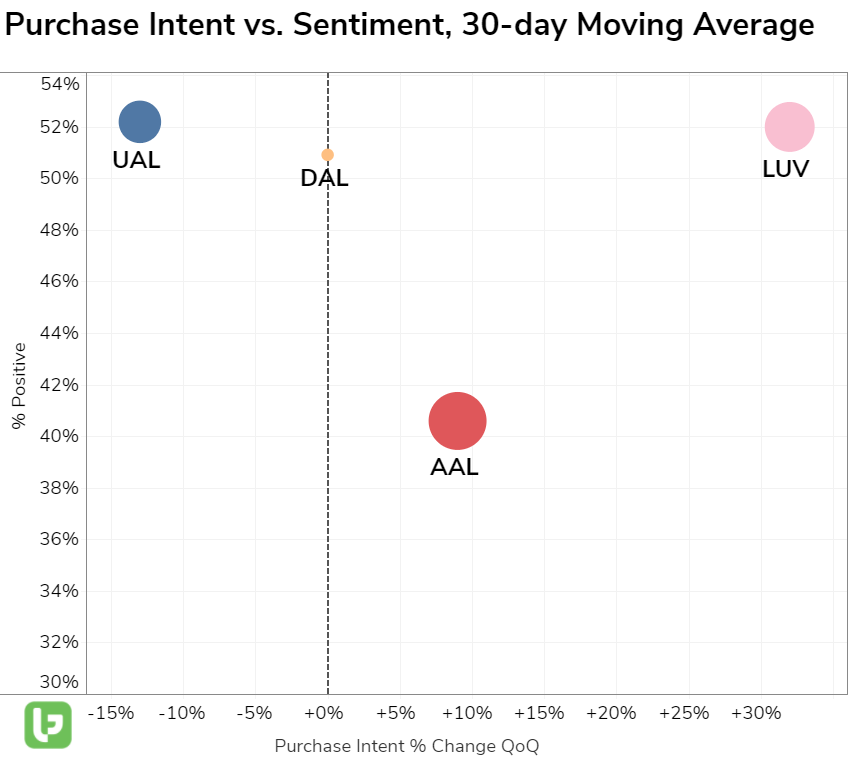

This has resulted in a disparity in booking demand across major airlines. The scatterplot below showcases how Southwest's focus on leisure is bolstering it vs. peers who have greater business travel exposure.

While Delta (DAL) has a sentiment edge vs. American (AAL), and a booking edge vs. United (UAL), it trails Southwest (LUV) in both metrics.

But DAL booking mentions don't support complete normalization. Purchase Intent mentions remain 62% lower vs. 2019. Heading into earnings Thursday before the bell, DAL shares are trading ~17% lower than pre-covid levels posted in February 2020. We've got our eyes on guidance.