United Parcel Service (UPS) After two quarters of explosive demand […]

Can FedEx Fight Through the Headwinds? ($FDX, $UPS)

The COVID-19 pandemic affected a shift in consumer behavior — one that’s shown stickiness — an increased preference for online shopping. As a result, the leading delivery/logistics services, FedEx ($FDX) and UPS ($UPS), have experienced a lasting uptick in domestic shipping demand.

A rising tide lifts all ships, right? Not in 2021. UPS has handily outperformed FDX over the past year:

- UPS Stock -- Up +18% YoY, currently trading -6% below its 52-week high

- FDX Stock -- Down -13% YoY, currently trading -25% below its 52-week high

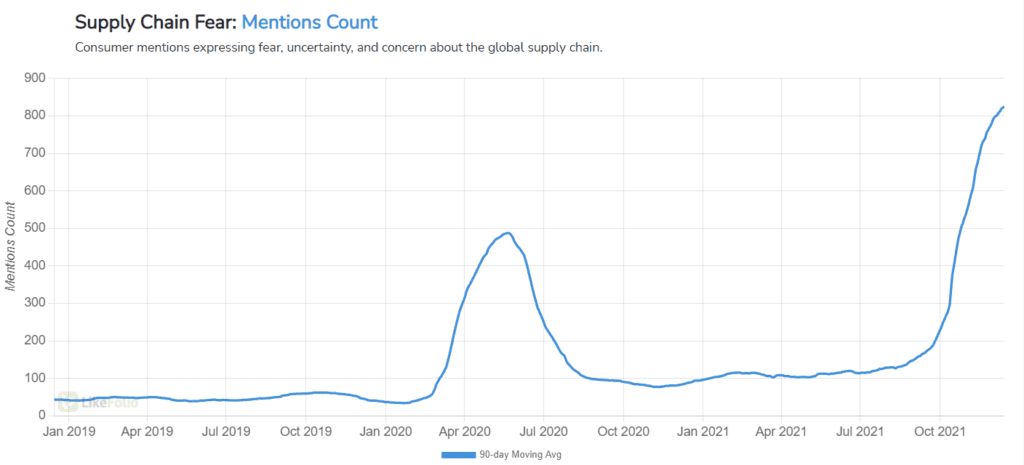

Both companies have enjoyed healthy revenue growth, so what’s causing the disparate outcomes? Profitability. Last quarter, FedEx missed earnings expectations and cut FY ’22 guidance, citing labor and supply chain woes. This news couldn’t have come at a worse time. LikeFolio data shows that fears about the supply chain are at an all-time high level, with underlying consumer Mentions trending +382% QoQ (90d MA).

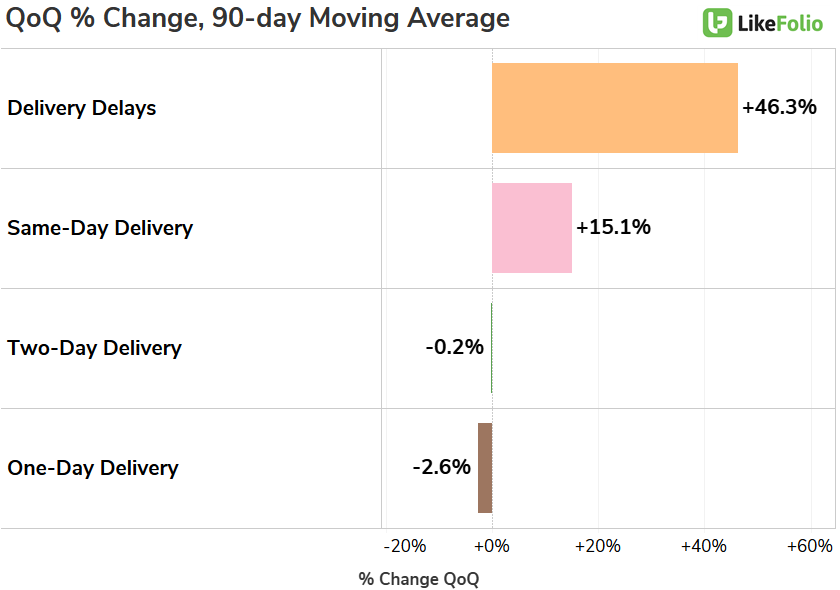

These fears will likely serve as a headwind for both companies into 2022…And that's not the only unfavorable trend for shipping providers. Mentions of Delivery Delays & Same-Day Delivery are both showing significant near-term growth.

Consumers are greedier than ever and they’re not having their expectations met.

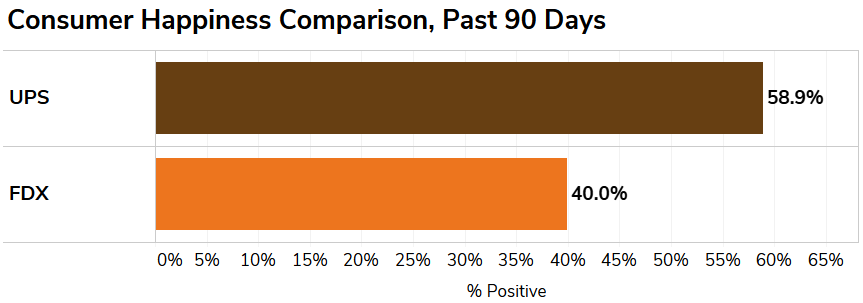

Despite the troubling macro trends, Consumer Happiness has stabilized for both companies — FDX remains significantly lower @ 40% positive vs. 59% for UPS (90d MA).

FedEx reports earnings after the bell, and its outlook isn't all doom and gloom.

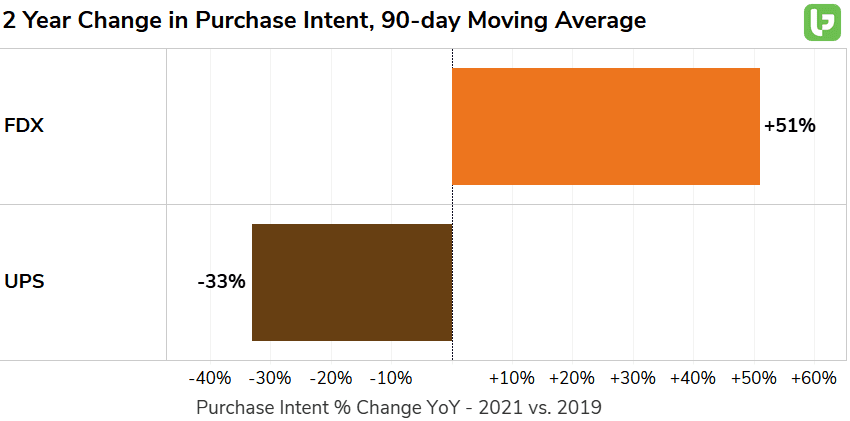

FDX's Consumer Demand growth is outperforming that of UPS, both near-term and relative to pre-COVID levels, trending +51% vs. 2019 on a 90-day moving average.

FedEx reported higher sales for all segments last quarter, and strong underlying PI growth suggests they can continue to outperform on the top line.